Currently, there are many turnkey White Label brokerage solutions on the market, which makes almost everyone able to become a Forex broker. Of course, this requires some knowledge and financial investment to get started, but the platforms available on the market are becoming more affordable. However, this does not mean that the number of brokers will constantly grow. Research indicates that the majority of FX brokers fail within the first year, and the main reason is poor customer service and bad (or even lack of) relationships management. So how to make the startup Forex broker attract many loyal traders who will stay for years? If you want your brokerage business to grow and bring more and more profits, here are the applications that will help you manage key aspects of Forex brokerage business more effectively.

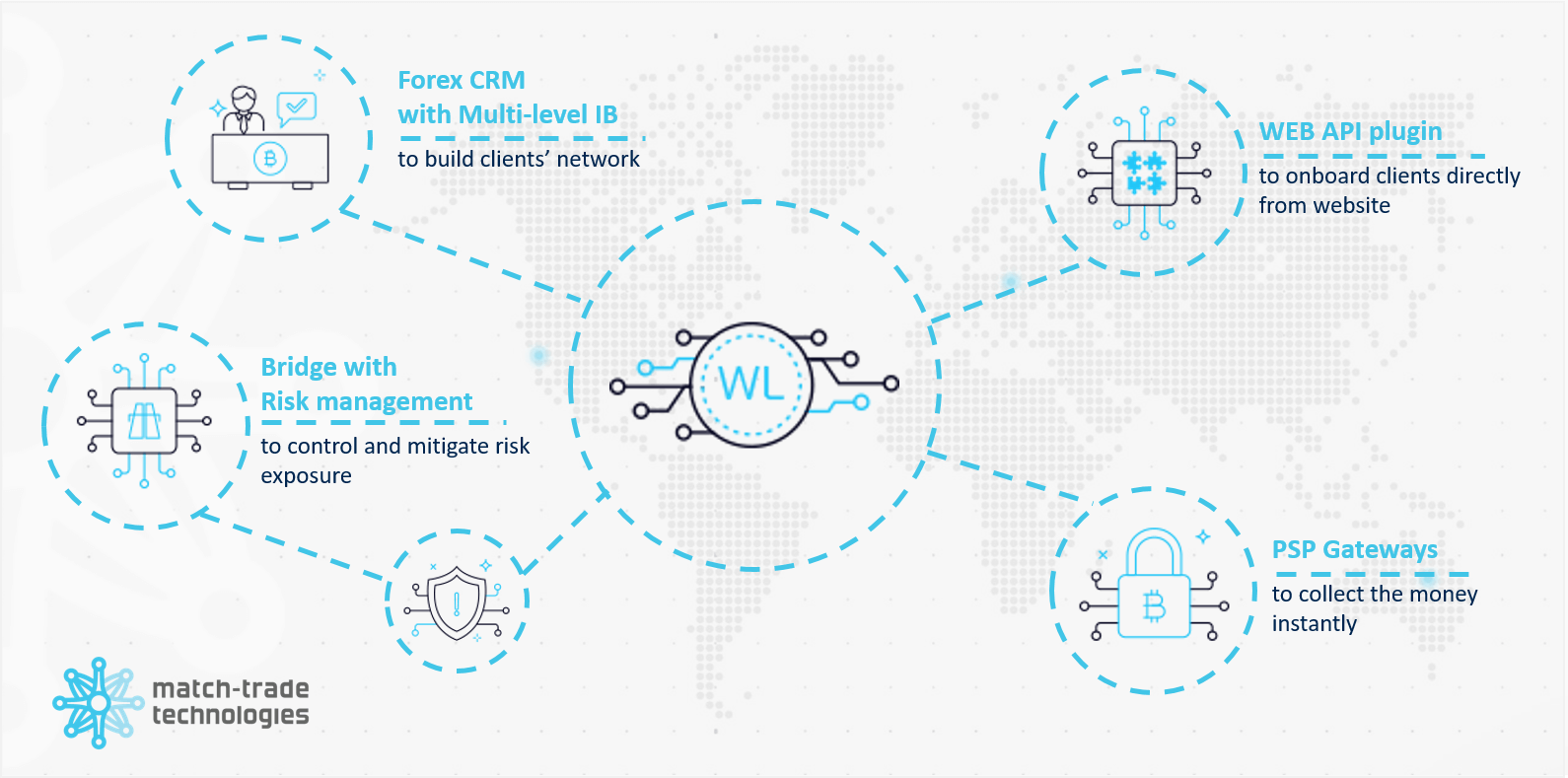

Forex CRM with Multi-level IB for building your clients’ network

The vast majority of brokers choose an offshore license to start with. It’s easier to obtain and much cheaper than, e.g. the EU license. However, there are also disadvantages. offshore brokers have very limited options to conduct digital marketing such as lead generating campaigns on social media or search engines because their ads are being blocked. So how to acquire customers in this digital business? One of the most effective ways is to create a network of partners so-called introducing brokers (IB). Many experienced traders and financial market experts have traders and people interested in trading among their followers. Such Forex influencers can provide brokers with many valuable clients. The big advantage for the broker is the fact that he pays the commission only for the onboarded client. To remunerate your partners automatically a startup broker can use simple Multi-level IB plugin for MT4 or MT5 before investing in a full Forex CRM solution. The plugin allows to calculate commissions for IB and book them on the transaction platform.

However, if the broker wants to do it on a larger scale, investing in Forex CRM application (often called Trader’s Room or Client Office) will be a better option. It will allow automating clients’ onboarding process but also to build multi-level IB structures. Through the IB portal, each IB or Sub IB can monitor all their clients’ performance and commissions which were generated. As a result, the broker can control how many commissions are paid to each IB or what IBs are most effective in building multi-level structures that increase the broker’s reach among potential clients. Also, thanks to the IB Portal – each of them has a full overview of their clients’ performance and can conveniently connect new clients via dedicated referral links (generated automatically. Each partner can share such links on portals or online media in which he is most active.

WEB API plugin to onboard your clients directly from your website

The more complicated the procedure of setting up a trading account, the more customers will give up. The most effective way to acquire a trader is an automatic registration using the website form. A registration form can be connected directly with MT4 or MT5 server through web API plugin, which allows opening a trading account automatically for the client after submitting the form. Client in such case will receive credentials to his account directly on his email or he will see it on a website. It is the simplest method, that has many limitations, but it provides basic functionality which can be used at low cost.

In case you require more advanced solution you should think about Forex CRM application, which will cover the whole onboarding process and it will assure full back office for your support. Apart from the functions mentioned above, Forex CRM will handle payments management, IB affiliate network, client retention and other business aspects crucial for you and your clients.

PSP Gateways to collect the money instantly

Each broker needs channels to effectively collect and withdraw money from their clients. That is why – when choosing Forex CRM – it is crucial to check how many different Payment Service Providers (PSP) it supports. This is especially important for novice brokers who do not have a payment history, which can make opening a merchant account difficult. Therefore, the more PSPs the selected CRM supports, the greater the chance of success.

However, if the broker has failed to open a standard merchant account to collect money in USD, EUR or other FIAT currency, he may choose to accept payments in Bitcoins and other cryptocurrencies. Forex CRM from Match-Trade Technologies has an integrated Crypto Payment Gateway with Exchanger which is a complete solution for buying, exchanging and collecting cryptocurrencies. Thanks to this, the whole process is quick, easy and cheap for both brokers and their clients.

Bridge with RMS – a tool to control and manage your risk

Depending on the business model, each broker is exposed to some market risk that should be controlled and mitigated. If the broker uses a pure market maker model, there will always be some profitable clients who can generate significant losses for the broker. That is why it is important to have the right tools to monitor the performance of the broker’s clients. Usually, brokers can use RMS applications which are often integrated with the bridge, so it is possible to monitor and manage the risk from one app. Among Bridge providers, it is worth highlighting those who offer A-Book simulation reports that can compare the profits generated in the B-Book with the simulated profit that could be achieved if the client was fully hedged. It is also important to have flexible hedging and coverage options which will allow hedging, for example, specific clients, instruments or set specific percentage ratio.

If the broker operates a standard agency model (STP / ECN), it is important to choose a reliable liquidity provider that will ensure good spreads and performance for clients. Most bridges on the market also support aggregation of multiple LPs, but sometimes it is better to have only one trusted LP due to exposure management, margin control problems and higher costs. Every A-Book broker, who uses a bridge application, should have access to extensive reporting to control how much profit is earned daily. Additionally, it is good if a broker can control its exposure on clients and hedge account directly in the bridge together with account balance and other LP account parameters

These are just a few of the many different business aspects that a broker must take care of to stay on the difficult Forex market. If you’re just taking your first steps as an FX broker, take advantage of the business advice of Match-Trade Technologies’ experts. However, if you have been on the market for some time and are looking for ways to optimize your business, let us know what solutions you use and what are your monthly costs. Our experts will estimate your possible savings if you choose Match-Trade’s solutions.