Platform Perfectly Suited to Prop Trading

Start your own proprietary trading business using our award-winning Match-Trader trading platform. Enhance your capabilities with turnkey, cutting-edge solutions developed in collaboration with top prop trading technology experts

Key Features

Harness the power of prop-trading technology

High Capacity Server

The Match-Trader platform is based on a high-performance server in order to guarantee the best efficiency available for the trading environment. It is possible to have 200k accounts without any performance loss.

API connectivity

Match-Trader provides access to various APIs in order to enable the easy integration and smooth operation of prop trading companies’ systems. Our APIs provide the flexibility to tailor trading systems according to your requirements.

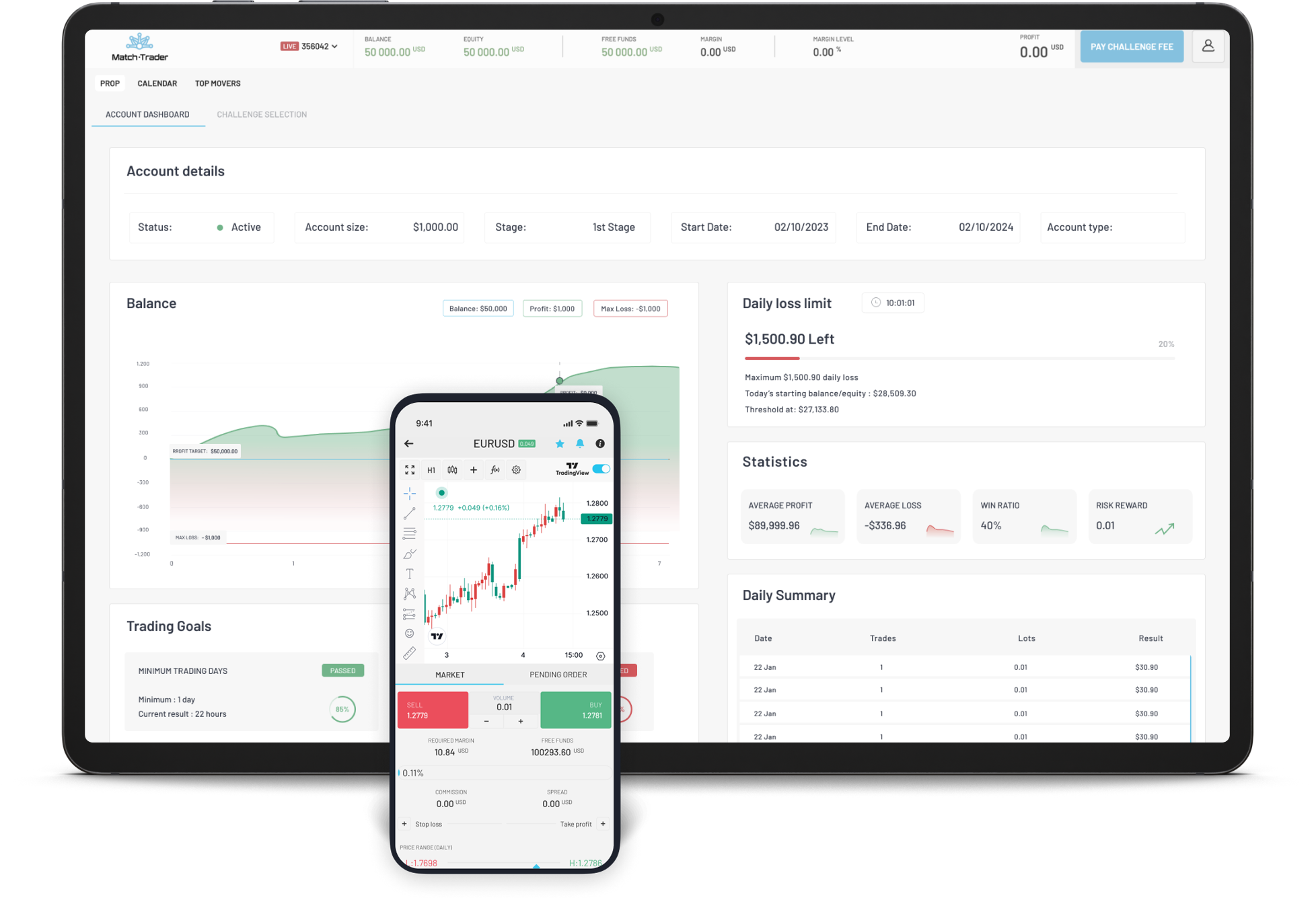

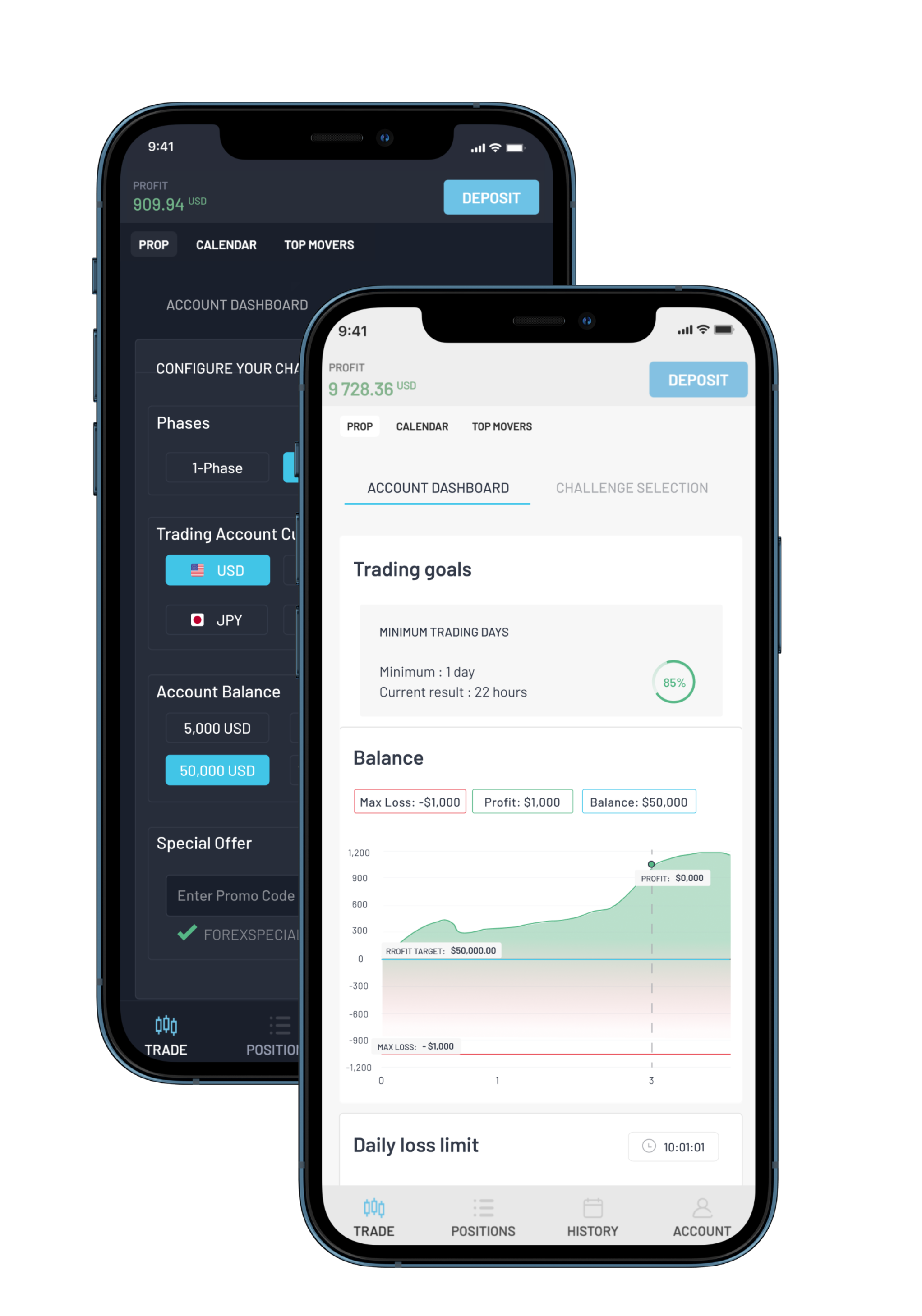

Prop Trading Management

Match-Trader provides various tools which help to manage the funded accounts (also, set evaluations, challenges, and rules to fit your exact specifications). Benefit from real-time account monitoring through tailored trader dashboards.

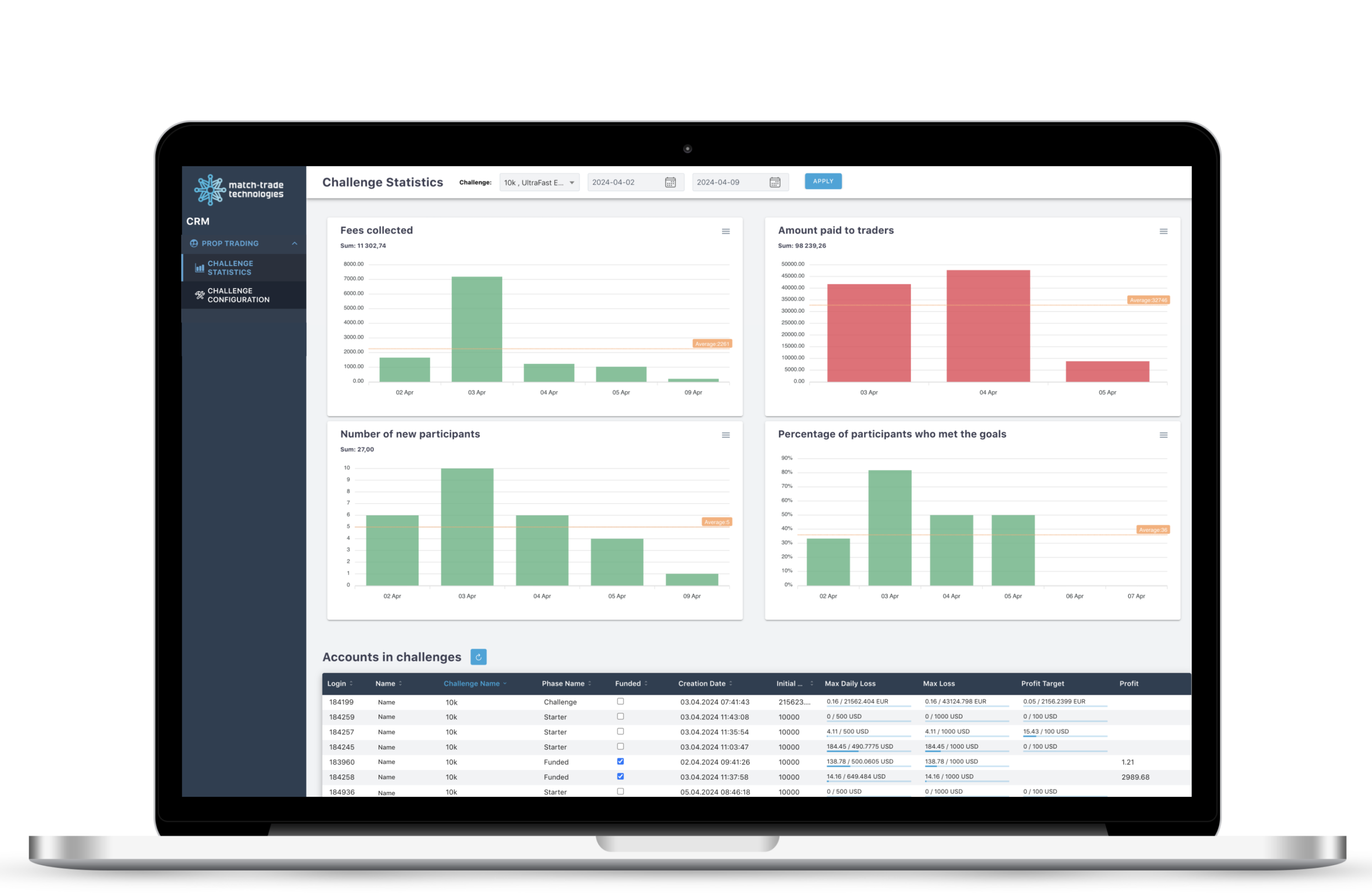

Analytics

Take advantage of multiple reporting options, such as tracking comprehensive transaction history and personalised statistical insights in order to support optimisation for profitability and secure the business from potential abusers.

Branding

Provide your proprietary trading platform with all the necessary elements of brand identity. Logotypes as well as information about the company can be added in the mobile and web version of the platform.

Advanced CRM System

The CRM system seamlessly integrates with the Match-Trader, creating a powerful solution designed for prop trading firms. It allows scalable customisation of client portals within the trading platform.

Trusted By

Prop Trading firms using our platform

Match Trader Prop Trading

Download our Match Trader Prop Trading brochure presenting the ultimate solution to manage your brokerage business. Contact us to get more details!

Know-How

Frequently asked questions

What is Prop Trading?

From a broker’s perspective, prop trading involves allocating the firm’s capital to traders who operate under set risk management rules, aiming to generate profits that the firm shares in

How Does Prop Trading Differ from Retail Trading?

In prop trading, the broker provides capital and shares profits with traders, while in retail trading, the broker earns through spreads and commissions

How Do Prop Firms Make Money?

Prop firms make money through profit-sharing agreements and subscription fees for premium trading tools

Why is Prop Trading Popular among Brokers?

Prop trading is popular among brokers because it maximises profits through investment earnings and diversifies revenue streams beyond commissions

How Does the Funded Trader Journey Means for Brokers?

For brokers, the funded trader journey starts with evaluating trader performance and risk management. Successful traders are then allocated more capital, increasing trading volumes and, consequently, broker commissions and profit shares

How to Start a Prop Trading Company?

For brokers, the funded trader journey starts with evaluating trader performance and risk management. Successful traders are then allocated more capital, increasing trading volumes and, consequently, broker commissions and profit shares

What are the Risk Management Rules in Prop Trading?

Rules usually relate to maximum daily loss, maximum percentage risk, and minimum trading days

What is the Technological Side of Prop Trading?

Prop trading companies use cutting-edge CRMs and trading platforms to ensure the best experience for traders

How to choose a trading platform for a prop firm?

Proprietary trading has different requirements regarding CRMs, so the platform with the most feasible API should be chosen

How should the rules of trading phases be set?

Trading rules and stages should be constructed in a way so the traders can proof themselves as consistent and profitable traders

How does a prop firm manage its risk?

Prop firms, in order to ensure safety or their well-being and safety of traders’ capital, should hedge their funded traders

How can prop firms verify their traders?

Prop firms should perform a KYC procedure on their side. It can be done manually by the team, although here come handy automated solutions for online verifications, like Sumsub

How can a prop firm collect subscription payments?

As proprietary trading is based on a subscription model, a company can have a choice from many PSPs, not necessarily dedicated for financial markets

How should a prop trading company choose a liquidity provider?

The liquidity provider that is chosen should have competitive spreads on offered symbols and fair commission on turnover per million

Contact us

Please fill out the contact form below if you would like to learn more about our technology and services