More than three years after the cryptocurrency boom and bust of 2017, crypto is still alive and kicking. Crypto is also just as polarizing as ever: while more people are excitedly jumping onto the crypto train than ever before, the voices speaking out against the cryptocurrency industry are imbued with escalating fervour.

Indeed, the growth of the crypto industry over the course of the past year has been impressive, to say the least. At the beginning of 2020, crypto’s total market cap was roughly $200 billion. As of March 8th, 2021,, that figure has surpassed $1.5 trillion. For some, the fact that the rate of crypto’s growth has continued at such a rapid pace is a sign of its promise; for others, the rapid growth is a sign of a bubble.

Either way, crypto is getting more attention than ever before. What’s behind all the hype? Here are five of the most important factors impacting cryptocurrency markets today.

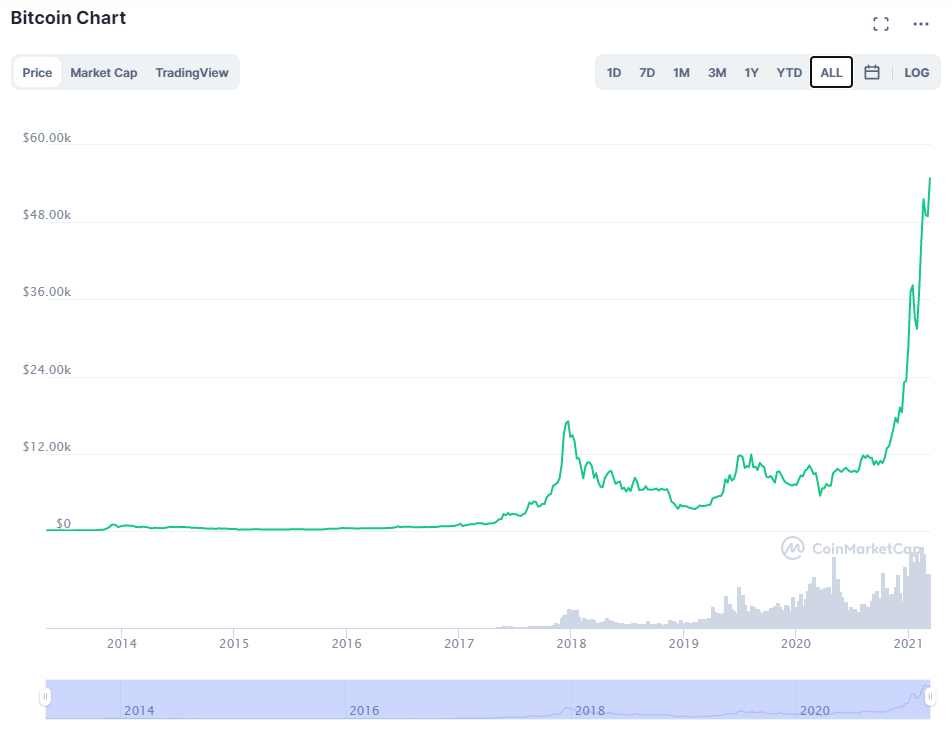

#1: Bitcoin’s astronomical rise

The massive increase in crypto’s collective market cap has been led by the “flagship” cryptocurrency, Bitcoin (BTC). In January of 2020, Bitcoin was worth roughly $7,200. In the first several months of 2021, Bitcoin rose to levels past $50,000. For most of February and early March, Bitcoin held support lines above $45K fairly consistently.

Many analysts agree that Bitcoin’s eye-popping price increase has much to do with the COVID-related stimulus efforts that have been initiated across the globe. In the United States, the Federal Reserve added roughly $1 trillion USD to the country’s balance sheet.

This ignited concerns of inflation, which, in turn, caused some investors to see Bitcoin as a “hedge against inflation” or “store of value.” As such, a growing number of large institutions–including MicroStrategy, Square, Tesla, and others–have added Bitcoin to their balance sheets.

As the demand for BTC has continued to increase, so too have the number of ways that investors can indirectly own or profit from Bitcoin. Bitcoin futures markets have seen spikes in activity in the early months of 2021; Goldman Sachs announced that it would be resuming its Bitcoin futures trading offerings in mid-March of 2021.

Additionally, Canada-based Purpose Investments announced in February that it would be launching the first-ever North American Bitcoin exchange-traded fund (ETF). Within the ETF’s first 24 hours, investors had purchased more than $165 million worth of shares.

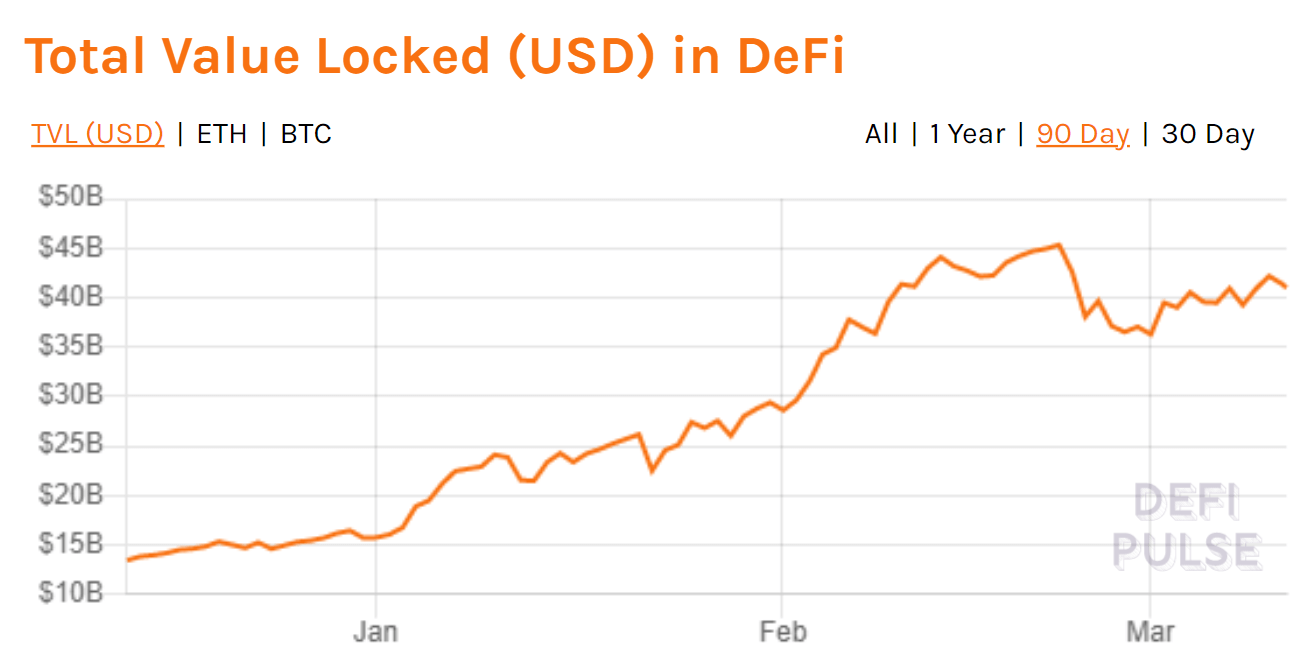

#2: The dawn of DeFi

While the concept of decentralized finance (DeFi) has existed in crypto for several years, many analysts agree that 2020 was the year that DeFi really came to life. During the “DeFi Summer” of 2020, a number of tokens associated with DeFi protocols caught headlines for massive price increases in a matter of weeks. Notably, while a lot of cash was flowing into the DeFi space, the number of DeFi users was happening at a much slower pace.

However, after the DeFi Summer of Q2 and Q3 2020, the start of Q4 brought a “DeFi Fall”–quite literally. The same tokens that had performed so well throughout the summer months began to see red. As such, DeFi markets shed billions.

As it happened, however, the DeFi drop was short-lived. Bitcoin’s astronomical rise at the beginning of 2021 seemed to pump new life into DeFi markets. Cash began to flow into DeFi once again–this time, bringing more new users along with it.

#3: DeFi brought alternative earning opportunities to the crypto space

As DeFi has continued to grow, so have the number of earning opportunities in the cryptocurrency sphere.

Within the DeFi sector, there are two particularly popular ways of earning passive income (besides buying tokens and hoping that they’ll increase in value.) These include staking and yield farming.

Staking is the process of “locking” your cryptocurrency in a crypto network in order to assist with transaction confirmation on the network. In exchange for keeping your assets “locked” in the network, you will receive financial incentives. Staking is possible on crypto networks that are run by Proof-of-Stake (PoS) algorithms. This includes Eth2.0, the updated version of the Ethereum network that is currently in the process of launching.

Like staking, Yield Farming also involves “locking” your assets into a protocol for an extended period of time in exchange for a financial incentive. However, unlike staking, Yield Farming involves the process of lending assets to others through a system of smart contracts. The practice of Yield Farming is said to have been originally popularized by Compound Finance, but has since spread to many other DeFi platforms.

#4: Beyond DeFi, centralized platforms have also offered alternative ways to earn with crypto

In addition to the staking and yield farming earning opportunities in the DeFi world, a host of other earning opportunities have sprung up in the crypto space.

For example, companies like Celsius, BlockFi, and Crypto.com have all begun offering interest-bearing cryptocurrency accounts that offer considerable returns on crypto assets. Like staking and yield farming, these centralized platforms offer financial incentives for users to deposit crypto into their services for extended periods of time. In addition to any earnings that users may make based on the increasing value of their crypto assets, these companies also offer earned interest rates as high as ~13% per year.

#5: Public companies investing in crypto provide an avenue into cryptocurrency for risk-averse investors

Risk-averse investors who may not be interested in directly owning crypto at all also have more options than ever before to get a piece of the crypto pie. Publicly-traded companies like Square, MicroStrategy, and Tesla have added Bitcoin (BTC) to their balance sheets. Similarly, Argo is a publicly-traded company with the primary function of mining and holding Bitcoin.

Investors who may be interested in crypto but do not want to deal with the risks associated with holding it directly have the option to invest in these companies and more companies that will add crypto to their balance sheets in the future. Coinbase, which is known to hold cryptocurrency on its balance sheet, is slated to launch its own IPO in Q1 of 2021.

#6: Regulation is on its way; crypto critics speak out

As the cryptocurrency industry continues to expand, lawmakers are taking the regulation of the cryptocurrency space more seriously than ever–for better or for worse.

Some analysts within the space are particularly concerned about comments made by Janet Yellen, President Joe Biden’s pick for the United States Secretary of the Treasury position. So far this year, Yellen has said (among other things) that Bitcoin is an “extremely inefficient way of conducting transactions” that is used “often for illicit finance.”

However, cryptocurrency has been around for long enough that it is no longer a totally foreign concept for many lawmakers. As such, many analysts believe that cryptocurrency regulations coming out of most major economies will not seriously curtail the industry.

On the other hand, lawmakers in India are considering the passage of a crypto ban that could effectively end the private cryptocurrency industry in India, while simultaneously sponsoring the creation of a “digital rupee.” Some analysts believe that this kind of harsh regulation against crypto, which originated in China in 2017, could continue to spread. This could have serious consequences for crypto.

In conclusion…

With the number of opportunities that are currently available in the world of cryptocurrency, this may be the most exciting time in the history of the space. At the same time, though, the fact that crypto is still in the early stages of its development means that changes can come hard and fast for crypto. Alway do your due diligence, and ever invest more than you can comfortably afford to lose.