El texto original en español se puede leer aquí: https://www.fxstreet.es/education/cosas-a-tener-en-cuenta-al-iniciar-un-broker-de-forex-en-latam-202305181330

The Forex market continues to evolve, and the experiences of the past few years, when the pandemic triggered a global economic crisis, show that the Forex market can be profitable in practically any conditions. Therefore, it’s not surprising that Forex trading is becoming increasingly popular among both individuals taking their first steps in investing and more experienced traders who want to develop their own Forex business.

Theoretically, anyone can become a Forex broker, but the nature and unpredictability of the market require brokers to navigate multiple aspects of the business, including financial market regulations, trading technologies, and risk management. While there are specialised firms in the market that provide support in these areas, nothing can replace one’s own experience. That’s why the individuals who often decide to take their Forex business to the next level are those who conduct investment training, often acting as Introducing Brokers. They possess a deep understanding of the market, trading technologies, risk management, and, most importantly, they have the know-how to acquire and manage clients, which is crucial when starting a brokerage business.

You need a Forex company to start operating as a broker

First and foremost, to become a Forex broker, you need to register a company. However, in many cases, simple business registration is not enough. As a Forex broker, you are essentially providing investment services, which are heavily regulated in most countries. Therefore, licenses issued in the United States (NFA), the United Kingdom (FCA), or Cyprus (CYSEC) are unattainable for many starting brokers due to the significant financial investment required and the numerous legal requirements. While having a similar license makes it easier to conduct business by allowing direct promotion of services and establishing a corporate account in a chosen bank, it is not necessary for running a brokerage business. There are other categories of licenses available on the market, recognised as low to moderate regulatory environments (e.g., Seychelles, Vanuatu, Belize) and non-regulated jurisdictions (SVG and Marshall Islands) that most Forex brokers start with. However, low or no regulation does not mean that no requirements need to be met. To protect the market from scams and enhance trader safety, registering a Forex broker requires the submission of notarised documents and the possession of a corporate bank account. Therefore, regardless of the chosen license, it is advisable to seek the assistance of a specialised entity that can ensure a smooth registration process. Match-Trade Technologies, as a renowned provider of comprehensive solutions for brokers, offers consulting services in the field of company registration through our network of specialised partners.

Forex trading platform is much more than just technology

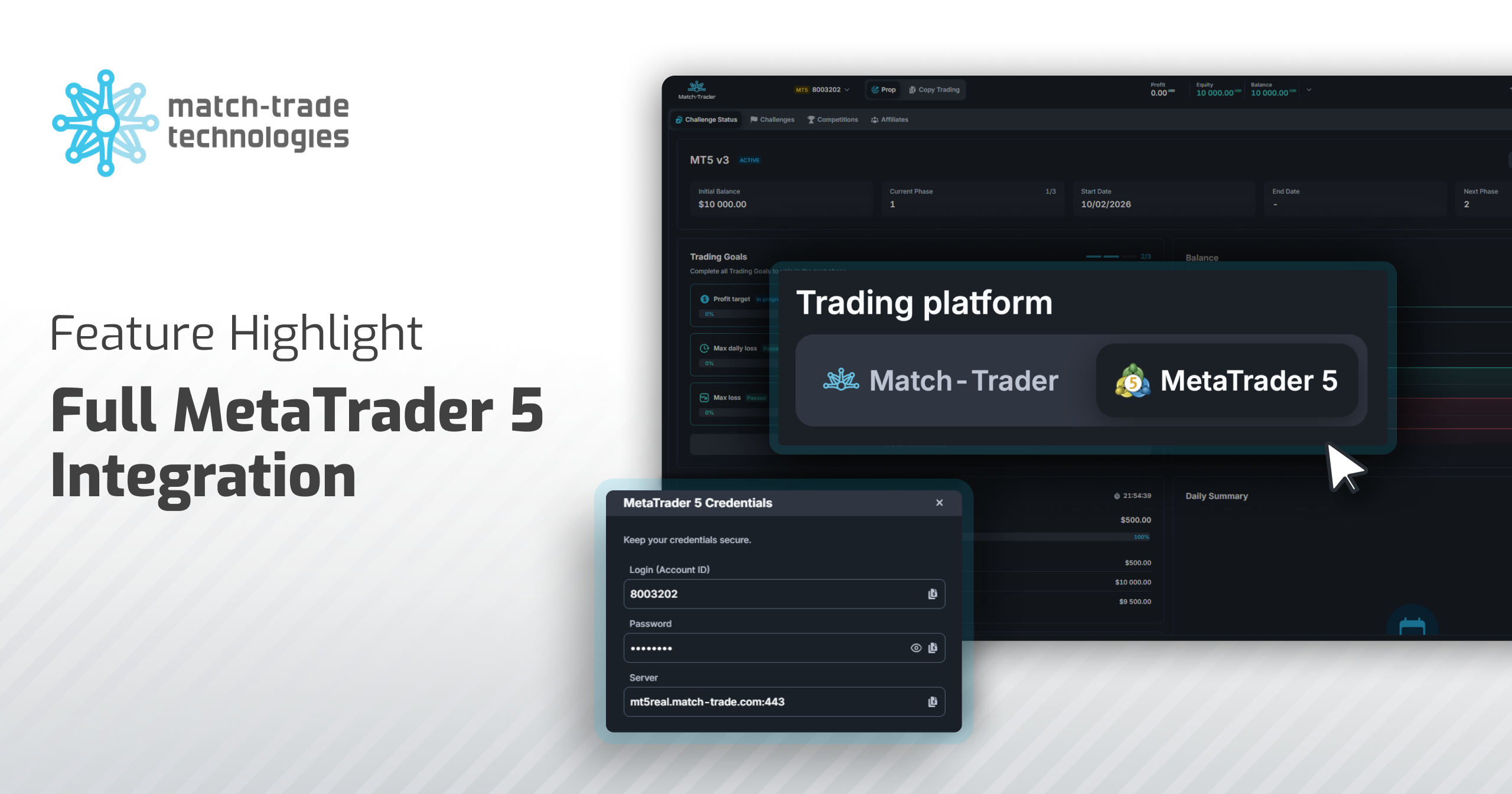

Another aspect is the selection of an appropriate trading platform. Choosing the right technology can be challenging for individuals whose core business is brokerage rather than IT. So, how can you choose the best solution, especially in such a highly saturated market? First and foremost, focus on the business aspects. If time is a concern and you lack an IT team, choose a White Label platform that will be set up and supported by the provider. In the case of the Match-Trader platform, created by Match-Trade Technologies and operating since 2015, you gain access to an entire trading ecosystem developed in-house by a reputable and multi-award-winning provider. Another aspect that significantly affects business profitability is the fact that by using services from a single provider, you not only save on individual fees but also ensure that all applications work seamlessly together. Match-Trader platform has been awarded prestigious prizes for its modern design and user experience, designed to maximise user retention. Match-Trader White Label is an all-inclusive solution that includes a built-in Social and Copy trading feature to keep users engaged on the platform and help brokers attract signal providers. The platform is also seamlessly integrated with Client Office, allowing traders to independently open and manage trading accounts, initiate deposits and withdrawals, transfer funds between accounts, verify transaction history, and more. The CRM (broker’s back office) in conjunction with the trader’s application significantly increases first-time deposit conversion (FTD).

While most trading platforms offer similar investment functionalities, there are a few aspects that set them apart. What distinguishes the Match-Trader platform in the industry is the technology it is built on: Progressive Web App (PWA). In simple terms, Progressive Web App means that the platform is a single application that adapts its interface to the user’s device. This makes it convenient for traders who invest on the go. They can easily switch from a laptop to a smartphone, and all their account settings will be synchronised in real-time, allowing them to monitor their investments continuously. Furthermore, the PWA technology provides broader distribution possibilities, as the platform can be downloaded from Google Play and the App Store or directly from the broker’s website, and it works on any operating system, ensuring availability for all mobile users.

Diversify your deposit options for traders worldwide

Another significant advantage for brokers starting their business with the Match-Trader White Label platform is that Match-Trade, as the technology creator, has also equipped the platform with its own crypto payment processor. Match2Pay is a payment gateway that uses blockchain technology to automate deposits. This is an especially convenient solution for brokers serving clients from different countries, where issues with transfers between foreign banks may arise. The seamless integration between the Match-Trader platform, Client Office, and the payment gateway allows traders to instantly top up their trading accounts, avoiding the need to close positions after a margin call. This not only streamlines the flow on the platform but also has a tremendous impact on the trading experience, helping brokers attract more clients.

To A-Book or B-Book, can your forex business afford not to hedge?

The final decision that a broker must make is the business model they want to operate, namely how they want to hedge transactions on their platform. This relates to liquidity. Simply put, a broker can either act as an intermediary for transactions (A-Book model) or as a counterparty (B-Book model).

A Forex broker adopting a full A-Book model serves solely as an intermediary, sending their clients’ orders directly to a liquidity provider. In this model, the broker earns revenue from commissions and takes a minimal risk, eliminating any conflict of interest with traders. While in the B-Book model, a broker chooses to trade against their clients, internalising their orders and assuming the associated risk. The potential profits in this model can be higher, but potential losses can jeopardise the entire business. Additionally, as this model inherently creates a conflict of interest between the broker and traders, clients often seek confirmation that the broker has a hedging account with a liquidity provider.

Keeping the entire flow on the B-Book model may limit the broker’s profits and become a single point of failure for their business. On the other hand, relying solely on the A-Book model may significantly restrict the broker’s potential profits. Therefore, the majority of brokers opt for a hybrid model that allows for a reasonable distribution of risk between the broker and liquidity provider. This is especially beneficial considering the unpredictability of the Forex market.\

Choosing the right provider is crucial for your business

Match-Trade Technologies has been supporting Forex brokers for the past 10 years. We are the creator of the Match-Trader platform and have built a comprehensive technological environment that allows us to provide one-stop-shop services to clients worldwide. We also collaborate with liquidity providers who use our institutional Match-Trader PRO platform.

In conclusion, starting a Forex brokerage business requires careful consideration of various aspects, including company registration, technology selection, and risk management models. Match-Trade Technologies, with its comprehensive White Label solutions and expertise in the industry, can assist you in navigating these challenges and setting up a successful brokerage venture. Contact our experienced team to learn more about our services and how we can support your Forex business in the LATAM region. If you would like to meet with us, visit our booth at the Money Expo in Mexico City (24-25 May) or at the SiGMA Americas Summit in Sao Paulo, Brazil (15-17 June). You can find all the information about our services on our website: www.match-trade.com.