Read the interview with Steve Kwon, sharing his opinion about the situation on the Korean forex market.

How popular is forex trading in Korea?

Compared to other countries in Asia, there are much less retail FX traders in South Korea. Statistics show that Koreans are more likely to be trading in the futures markets. Overall, Korea’s financial policies and regulations are not as favourable to the forex trader compared to Japan, Hong Kong, Singapore, or even China. However, people’s interest in the financial markets has always been very high, as shown by the explosive stock market growth in the 2000’s as well as the incredible fervor associated with cryptocurrencies in recent years.

What makes the forex industry in Korea lag behind other Asian markets?

First of all, the history of retail forex is filled with get-rich-quick pyramid scams and has a severely marred image. In most of these instances, one would be hard pressed to find any actual investment in the forex market at all. Scam artists used forex just as a front. Therefore, many people take extreme caution when investing their money, and rightfully so. Secondly, the regulated markets (through their domestic licensed brokerages) offer low leverage and require high margin, causing disproportionately low profits in relation to the risk incurred, making forex unattractive compared to other investments. Third, it has been the experience of my team that many Korean have found online forex trading rather difficult compared to trading in futures which in general offers simpler trading platforms that are easily navigated…. So the environment has not been optimal for forex in Korea. Reputable foreign brokers provide a very attractive option for Korean investors and can supply a much better trading climate. But Korean investors usually find it difficult to send their trading funds overseas because of banking restrictions, which represent the fourth reason that impedes the growth of the forex market in Korea in my opinion.

Which solution is dominant in Korea, White Label brokers or businesses based on full license platforms?

First there were individual traders who became IBs with foreign brokers. Then there came numerous White Label Brokers who obtained technology and liquidity from foreign brokers and in certain cases with the so-called Prime-of-Prime Brokers. But the forex industry is still in its infancy, and there remains a huge gap between the Korean entrepreneur with a lot of zeal but very little experience and the realities of what running a brokerage requires. As a result, surviving as a Broker beyond the first year has been relatively rare. There have been a few brokers who went all out on full license platforms only to realize later that they lack the knowledge, experience, and much more capital than they had anticipated just to survive. Also, the contracts that the brokers, both White Label and fully licensed, enter into with their counterparties overseas usually turn out to be very ominous and inflexible, much to their dismay and disadvantage.

So do you think Korea is a good place to start a brokerage business?

I would say that Korea is a good place to start a brokerage business because the forex industry is still developing here and the potential for growth is enormous. If you are equipped with knowledge and experience there is not much competition. And there are certain solutions already available in the market that will help Brokers attract many investors. With the right combination of these solutions as well as some cultural adaption, I believe a Broker can thrive here long term. It can be tricky though to find the right combination and will most certainly involve trial-and-error.

What do you think Korean investors need to be more willing to start trading with forex brokers?

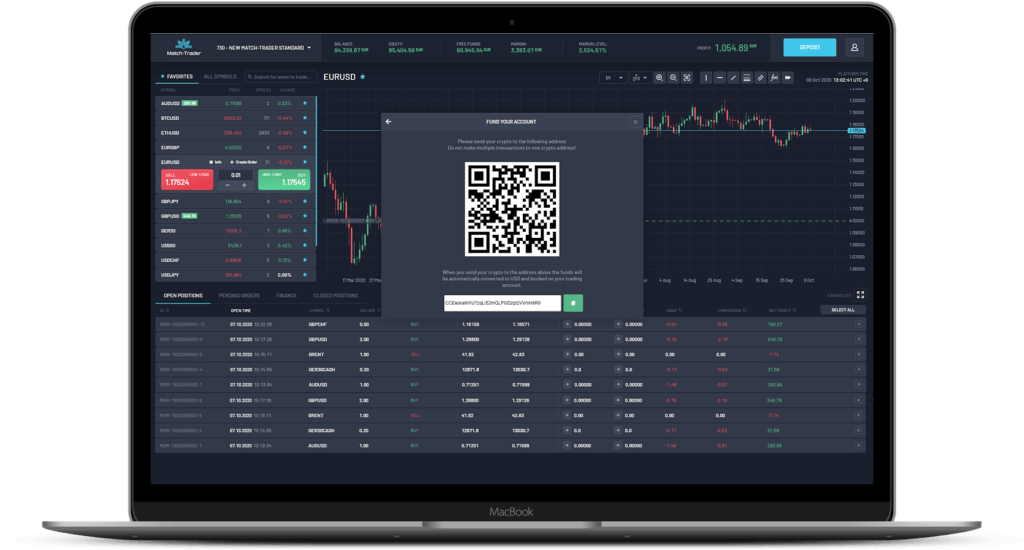

What Korean investors are looking for is high leverage and low margin requirements offered by Brokers who can be trusted. Retail traders usually fall into two categories: those who want simple and sensible no-headache trading, and those who like to delegate all trading responsibilities to money managers with EA’s – unfortunately, most of them don’t have a proven track record. So a platform offering MAM solution, on the one hand, and a transparent interface, on the other hand, will surely be well received by traders. That’s why I’m sure that Match-Trader with its intuitive interface and support of trading decisions by providing a full view of funds required to open the trade, expected result of take/profit and stop/loss orders become very popular among Korean traders and Brokers.

What do you think would encourage Forex Brokers to start operating in Korea?

Novice Brokers must have high-tech, modern trading platforms at a reasonable price to optimize starting costs and flexible liquidity offer to attract investors with good trading conditions. Another aspect is to solve the payment problems and overcome wire transfer and other banking restrictions, but these can be easily achieved with crypto payment gateways. The platforms, payment processing, CRM, and other components should be held together seamlessly for ease of operation, and the whole package should be offered and co-managed by a team who already has experience with Korean clients, the language, and the culture. And of course, Match-Trade and my team can supply just that.

Do you think traders who are used to credit card deposits will be open to using crypto payments?

For the customers to be able to quickly transfer funds to their (foreign) broker’s account, they need to use a crypto payment solution. The solutions available in the market offer convenient purchase of cryptocurrencies using credit card or wire transfer. The whole process is carried out in such a way that the customer won’t even feel that this is in any different from a regular credit card transaction.This method easily overcomes the current obstacles in banking and payment processing and opens the door wide for the Broker.

So if the existing barriers are disappearing, will Koreans bet on well-known reputable trading platforms or will they look for new solutions?

People who currently trade FX with MT4 will prefer to stay with MT4 (including those who use EAs), but MT4 appears difficult and cumbersome to people who are used to trading in the futures markets. Korean traders are also accustomed to technological innovations and expect a transparent and user-friendly interface. That’s why I think that Match-Trader would perfectly fill the gap. It was designed to meet the expectations of both novice and experienced traders. It has a built-in Client Office which further simplifies account management and making deposits or withdrawals. All these moving parts work together in a system as created by Match-Trade, and this presents a huge advantage to the Broker who does not have to acquire different parts from multiple sources at a much greater expense.