Nowadays, to become a forex broker, you do not need a lot of effort or a significant financial outlay. What you do need, however, is the right solution. In theory, predictions about the behaviours of the market are more accurate during a crisis. That is why there are more and more traders ready to invest. Forex market volatility makes it an intriguing job to consider. However, no markets are fixed, and no one can predict the future. Therefore, investing in becoming a forex broker is more sensible and reliable. The question remains: how much does it cost to start a forex brokerage?

How much does it cost to start a forex brokerage?

If you want to become a Forex broker but you are concerned about unforeseen costs, this article is for you. In it, we will explain what fees you will have to bear and what their amount depends on.

What do you need to start your forex business, and what is the cost?

Firstly, you need to invest in the service necessary to become a broker.

- Registered company

- Offshore registration is not only fast and relatively cheap, but it’s also obtainable for everyone; that’s why 9 out of 10 brokers choose to register offshore. In just one week, you can become the owner of a forex company for a cost of $1600. If you wish to add a corporate bank account to ease financial settlements, the cost will grow to $4500 (this may differ).

Choosing the right technology for your forex broker

Now that you have a company, you must choose the proper technology provider.

- White Label Forex broker cost / White Label trading platform

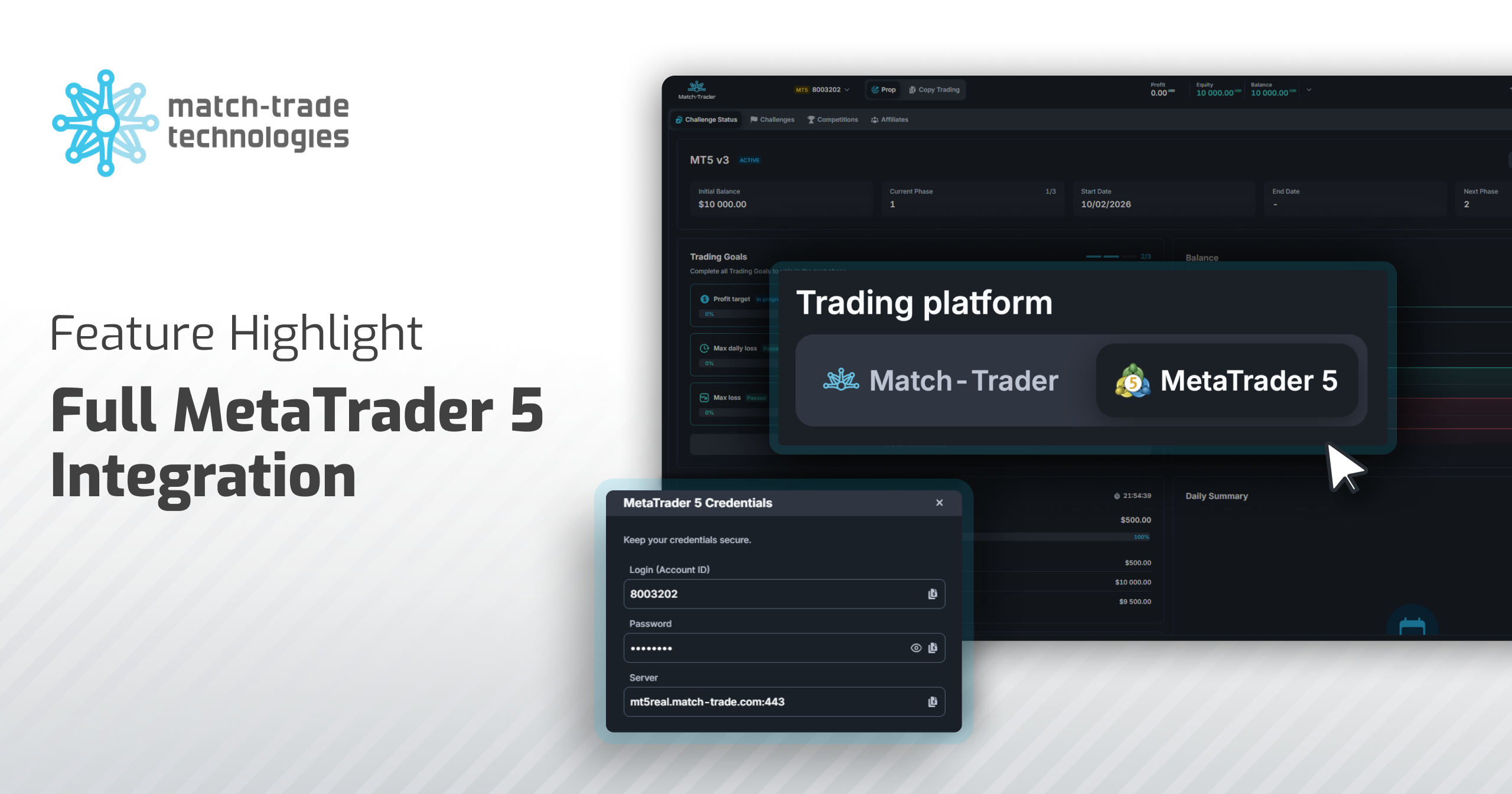

- There are at least a few technology providers on the forex market whose proprietary trading platforms are worth considering. In this case, going beyond the most popular ones can bring you serious savings. For example, our proprietary Match-Trader platform with CRM costs $2000-3500 in monthly fees (contact us for a special offer). A basic MT5 WL monthly fee is $3000 (3 months upfront payment of $9000 for a new WL is required) plus our monthly fee, which is $1750-3000.

- Client Office Forex CRM

- It helps to manage your business and guarantees smooth service for your investors. Without it, it’s impossible to provide instant deposits to trading accounts or automatic registration to your platform and fast onboarding. And these are the things investors are looking for. Match-Trade’s Client Office cost starts at $1500-3000 + monthly fee when added to MT4 WL. But if you decide to choose Match-Trader WL, it’s already included!

- Crypto Payment Gateway

- Integrated with Client Office guarantees effective payment methods regardless of the region your investors operate in. It provides convenient transfers without any risk of chargeback. We made sure to integrate reliable and cost-effective crypto exchangers. Therefore, clients can buy cryptos via wire transfers and credit cards without the broker having to sign additional agreements. And the cost starts as low as 1% per transaction.

Cooperation with a reliable Liquidity Provider

- Liquidity for forex brokers

- The way you will provide liquidity for transactions made by clients on your trading platform and the Liquidity Provider you’ll be taking it from. At Match-Trade, we focus on delivering all-in-one solutions for Forex Brokers; therefore, we offer special conditions and free connection to our partner’s liquidity pool for our White Label clients. All thanks to our cooperation with Match-Prime Liquidity, CySEC regulated Liquidity Provider.

What type of fees to expect for forex business?

The prices on the market vary, and many factors affect them. It is, therefore, difficult to average them. Below, you can find the three basic fees you must expect after becoming a broker.

- Setup fee

- There are some fees for configuring a service to suit the client’s requirements. Some examples include buying a White Label platform, Client Office, or liquidity.

- Monthly fee

- It’s like a subscription fee to the technology provider for using its solution.

- Volume-based fee

- This is the commission you pay to the Liquidity Provider for each transaction made – always charged per volume.

Sometimes, if you use an older platform that requires a Bridge to connect your Liquidity Provider, you’ll also need to pay the bridging technology provider fees.

This is the standard cost. However, even if you manage to collect the cheapest solutions on the market, it does not mean that you will incur lower charges. If you buy each item from a different supplier, you will bear the cost of maintaining several providers. Besides, there is the issue of complaints and solving customer problems. With different suppliers, their responsibility is blurred, and it can be hard to determine who is responsible for errors.

What are the benefits of the all-in-one or Instant broker solution?

First of all, it is a reduction in fees. One provider who makes money on several elements, such as the platform and liquidity, can always offer lower prices than the sum of the costs you will have to incur for several providers.

One team supports you and takes responsibility for the functioning of the entire system. The main advantage of the all-in-one solution from one technology provider is a seamless integration that mitigates the risk of any technical problems.

And last but not least, choosing an all-in-one solution will not only save you money but also a lot of time. The sooner you start operating as a forex broker, the sooner you start earning money, and the money invested will be returned to you.

If you are still afraid of risk, contact our business consultant and ask for a forex broker set up in which you do not bear any risk (A-book brokers only). We will calculate the estimated income and the time in which the investment will pay off.

So, how much does it cost to become a broker?

As shown above, the startup cost of a brokerage business is not easy to determine. There are many factors to consider and decisions to make before calculating the final amount. However, depending on your chosen trading platform, you may expect a cost between $7000-$20000. The cost of setting up a white label forex brokerage is around $7000 when choosing our trading platform, Match-Trader.