The Fintech ecosystem in Latin America (LATAM) has undergone tremendous expansion, establishing itself as a primary point of reference for the financial demands of consumers. In just six years, Latin America has evolved into one of the world’s largest fintech markets, surging from a modest $50 million to over $2.1 billion—a growth of over 200 times its initial value.

With deep historical roots in the financial services and burgeoning banking sectors, LATAM serves as an ideal hub for startups across the spectrum. Supportive governmental policies and fintech-friendly regulations have further levelled the playing field for newcomers.

Factors that position LATAM as a promising location for Fintech include:

- Limited financial services

- A large unbanked population

- High mobile app usage

Mexico and Brazil currently lead the charge in this domain. Both nations command the majority of venture investments in LATAM’s fintech landscape, making significant strides in digital banking and attracting notable investors. In 2018, Mexico laid out a comprehensive framework for fintech companies to align with regulatory requirements and compete effectively. Similarly, Brazil approved its Open Banking initiative in 2019, prompting countries like Peru and Argentina to follow suit.

The region is now home to over 1,600 active fintech startups, adding to its allure for potential investors. Remarkably, fintech investments in LATAM account for around 38% of all VC funding in the region, compared to 26% in Europe and 17% in the US. While LATAM’s fintech funding might be lesser in volume than Europe and the US, it has significantly outpaced Southeast Asia.

Consumers in Latin America are now reaping the benefits of this surge in fintech, with increased access to digital banking platforms. And with industry predictions, such as those from SVB, hinting at even brighter prospects, the future beckons with more innovations and improved services.

Traditional banks, having been slow to adopt digital solutions in the past, have inadvertently opened doors for fintech firms to offer innovative and efficient alternatives.

Benefits of collaborating with a fintech provider include:

- Transfers via mobile wallets

- Money transfers using QR codes

- Crypto payments

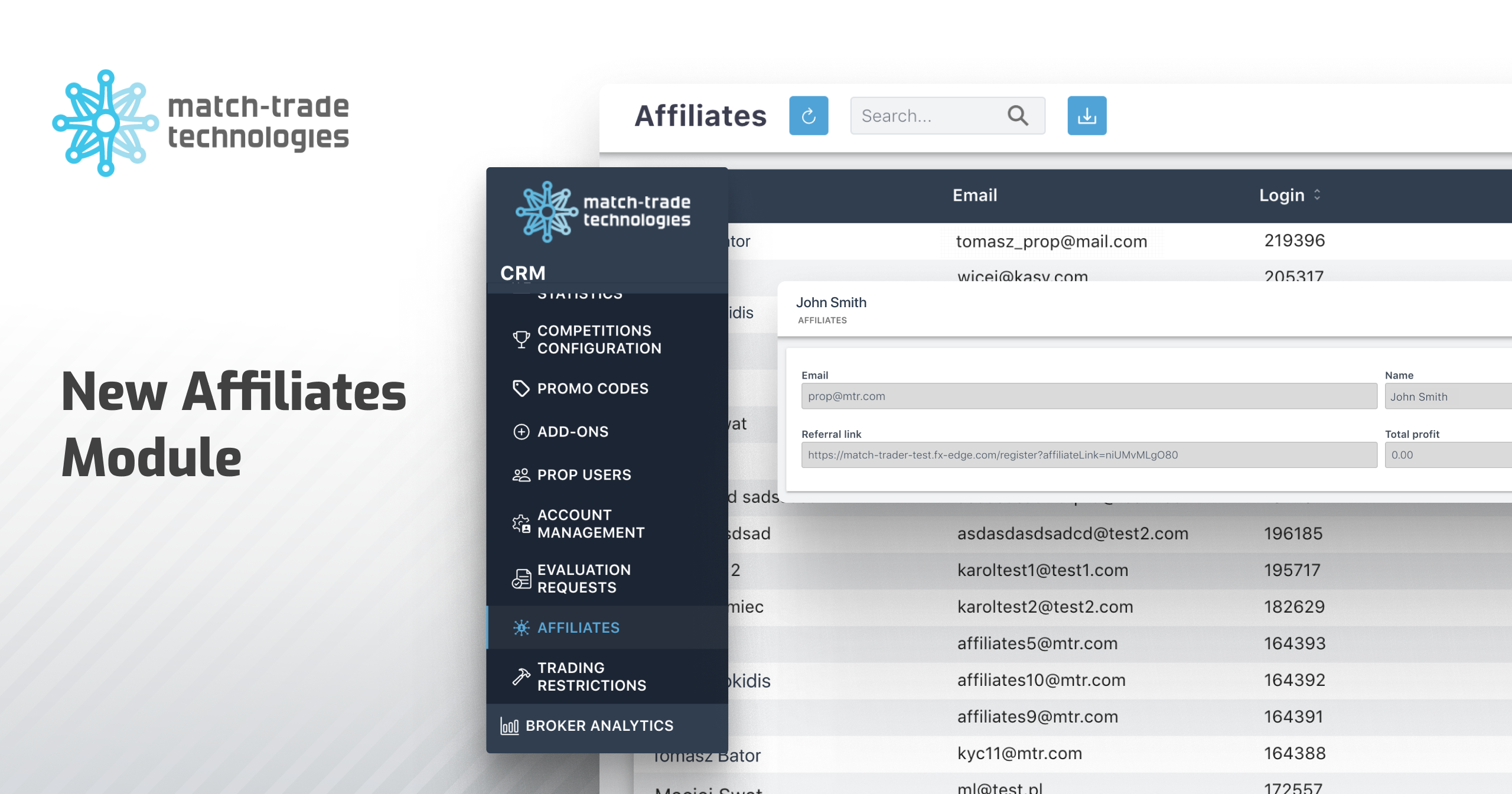

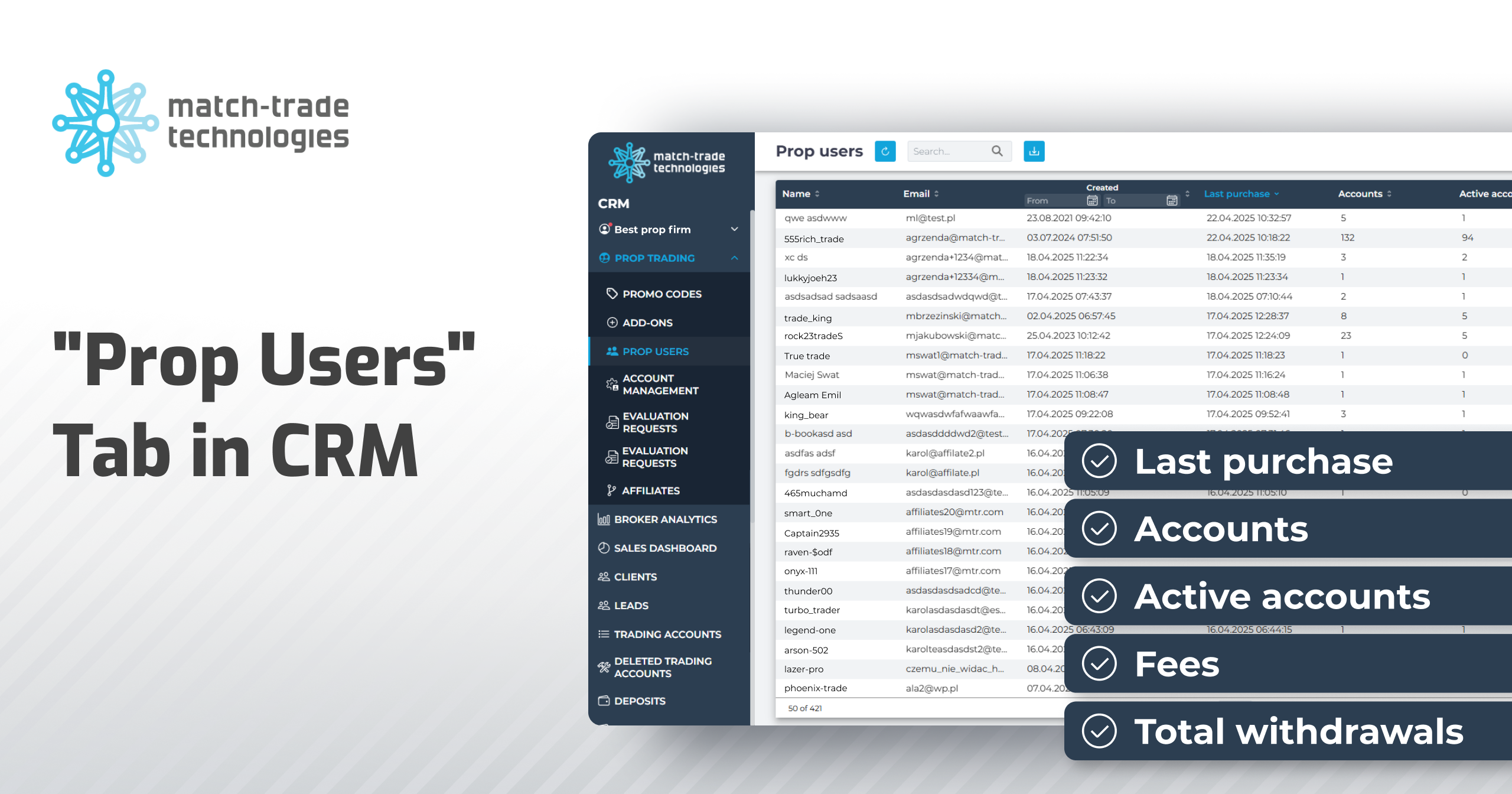

At Match Trade-Technologies, we’re aware of the challenges LATAM companies face with cross-border transfers. This understanding led to the creation of Match2Pay, our proprietary Crypto Payment gateway. Since its launch, it has witnessed substantial growth in LATAM, facilitating smoother inbound and outbound payments. As industry leaders, our comprehensive solutions ensure seamless onboarding for new Latin American clients, negating the need for multiple service providers.

In conclusion, as traditional banks are dragging their feet on digital adoption, fintech in LATAM is filling this void, bringing forth innovative and client-centric solutions. This upward trajectory is merely the beginning of a broader narrative—one that will define the future of global finance.