Read the recent Game Changers interview, Michael Karczewski speaks about the nature of Whitelabel’s business as a whole, the beginnings of the Match-Trade brand and further steps for Forex Businesses in the constantly changing industry.

Q: Could you tell us more about the beginnings of the Match-Trade brand?

A: It’s a little piece of history as the company turns 9 in March. It started like most businesses, I suppose, from wanting to have something of your own – being able to pursue your ideas the way we saw that fit. All board members have worked together at some point, we knew each other well, and we trusted our competencies. To this day, we have clearly divided areas of responsibility because everyone is an expert in a slightly different field. But we all gained experience working for a large European forex broker, and we know the industry inside out. We got to know from the inside how the brokerage company works and what traders need and expect. It was only natural to start the technology provider for forex brokers as we had the business know-how and high IT skills to develop technology that was missing on the market and thus improve the functioning of popular systems. This is what we initially based our business model on, selling our own technology bundled with popular WLs, and creating added value for our clients.

Q: Did the more stringent law changes regarding FX make you look further abroad to expand your business?

A: Yes, of course. The industry is constantly changing, and I’ve observed that for a decade. It has been clear for several years now that the industry is moving towards tighter regulation. There is no doubt about it; the rules of doing forex business will continue to tighten. But no wonder wider regulations are to increase the safety of investors. Even a company like Match-Trade, which provides technology, therefore, is not subject to any regulations, had to adapt in some way. We are constantly developing new features in our proprietary trading platform or management app, so they meet all the requirements. We cooperate with local PSPs around the world cause it’s the best way to meet legal requirements. We are not looking for half measures. We’re aiming for permanent solutions. Hence the strategic partnership with the regulated Liquidity Provider I have co-founded. We are also expanding Match-Trade’s Cyprus team looking to acquire FX consultants for the MENA region. I can’t reveal too many details, but recently a Business Development Manager has joined our team. His main focus will be further business expansion, including a new area of regulation.

Q: With it being to get PSP’s for offshore brands, will this change the nature of the WL business as a whole?

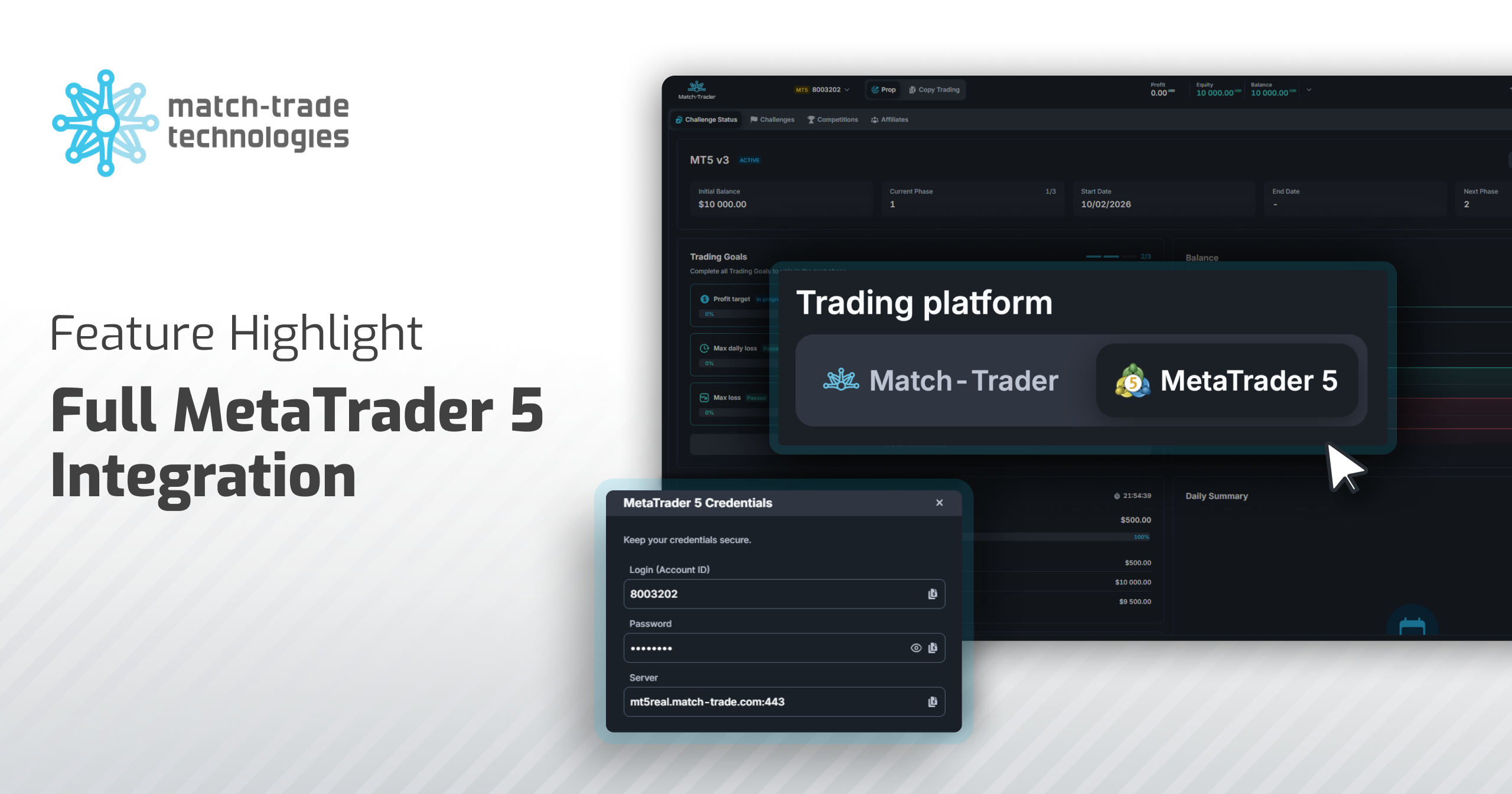

A: It seems that there are many different aspects that influence the changes in the White Label broker market. For example, MetaQuotes changed its pricing and compliance policy. The largest producer of White Label platforms changes important business aspects of their offer. Ultra popular MT4 White Label Brokers are slowly becoming a thing of the past. The area without regulations is also shrinking more and more, which can be explained by the pressure from banks and financial institutions. But on the other hand, we also see a change in mentality and an increase in the traders’ expectations. With such a saturation of the market of forex brokers, it is practically impossible to compete in terms of offers. You have to look for new ways to attract and retain customers. And those are modern software providing all-in-one solutions and the best possible customer service. The new generation of traders puts convenience above all else; what counts is speed and simplicity. Therefore, I believe that meeting the basic conditions for trading, such as the proper operation of the platform and the ability to make deposits with a card, is no longer enough to grow your brokerage and be successful in this industry. And we have indeed been noticing for a while the demand for tailored solutions among our WL customers.

Q: Were you ever tempted to have your own retail brokerage?

A: That’s a tricky question. Well, yes and no. I think that everyone in this industry at some point has considered opening a retail broker. Especially after many years of work, when you already have a lot of experience and have gone through the path of obtaining a license, you sort of paved the way. Plus, Match-Trader, our proprietary trading platform, has just won the People’s choice Forex Award for the Best Multi-asset Trading Platform. So technically, I’ve got the know-how and the best possible tools… But I also know how time and resource-consuming is growing the technology provider we are. How Match-Trade has developed in the last two years has exceeded all forecasts and even our expectations. We are very proud and put all our energy into expanding our Broker Solutions Hub. Life has taught me never to say never, but for now, we focus only on brokerage services.

Q: It appears the future of FX WL providers is following your lead by combining a tech and liquidity provider. Is this complex to run on a day to day basis?

A: I believe it’s the best way to run your business. It’s definitely the best combination for our clients. As a technology and liquidity combo, we can offer a level of flexibility rarely found on the market. The technology behind the Match-Prime Liquidity was developed in-house by the Match-Trade team; we’re not limited by any third-party systems; we don’t need to negotiate any changes or adjust to someone else’s software. The only thing that limits us is reason and time. The most important thing for our clients is to react as fast as possible to changes in the market. Whenever there’s a new hype for the unusual instrument starting on the market, we make sure to add those into our clients’ offers ASAP. We constantly monitor the situation on the market and expand our instruments’ offer so we don’t miss the momentum of new coins skyrocketing fueled by the social network. We can also create synthetic instruments at Broker’s demand. Besides, when you get to know how it feels to have one team that takes care of everything, you will never go back to dealing with multiple providers. Of course, I’m exaggerating, but it’s things like good relations, trust and support that makes the difference.

Q: In 2022 will you be looking to add to your current brands or develop what you have

A: As I mentioned, we’ve got so many things going on right now that we’re definitely focusing on improving what we have. We want to set market trends and bring new quality to the table, so we are polishing new features of the Match-Trader platform and enhancing our Client Office and CRM to meet the requirements of professional sales systems. I can only say that we started as a fintech startup is now shifting towards an international corporation, so you will see significant changes, but that’s all the details I can give for the moment.