Although the “market makers” (market making services) have been present for a long time in the world of financial trading (like forex, stocks or futures) only recently they have gained a well-deserved rank. Their importance is irrefutable as they are an integral part of the financial ecosystem bringing structure and flow to the trading activity.

What is market making?

Market makers’ main activity is to create a healthy and active market for both buyers and sellers. They do that by placing multiple limit orders in an order book of an exchange. Institutions providing market making solutions usually have signed a special agreement with an exchange. Such an agreement, on one hand, grants them special trading conditions including lower fees. On the other hand, however, it obligates market makers to provide a certain quality of liquidity. The quality of liquidity available on different exchanges can be measured by the depth of an order book and the size of the spread.

Market makers are already widely operating across every well-known exchange that cares about the turnover, like NASDAQ or NYSE. Although market makers nowadays trade electronically, on a mature stock market their role is fulfilled by High-Frequency Trading institutions. They hire the best quantitative finance experts in the world to create the most robust trading algorithms. As market making is getting more popular and widespread, the quality it adds to the trading industry becomes more visible. But there is still an important part of the market that stays uncovered by market makers’ services.

Crypto Market Makers

Given that the cryptocurrency market is still very young, there are not many market making institutions operating there. And due to its decentralization, assets’ prices may significantly differ across multiple exchanges, especially on small and medium exchanges not using market makers’ services. Consequently, without market making, cryptocurrency prices are very likely to differ from their market price. Differences in prices between several exchanges may result in clients being forced to sell their bitcoins cheaper or buying them more expensive than they would normally do on other, bigger exchanges.

Increasing market depth

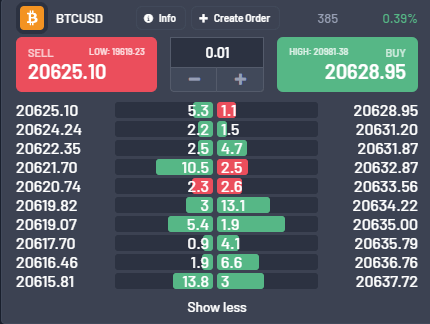

Market maker places multiple limit orders and waits for a trader, whose market order will match with their pending order. All orders of market makers added to the order book increase available market depth. This in turn guarantees that a particular cryptocurrency can be traded fast without compromising its value. This is crucial for high net worth traders, as they usually place much bigger orders. If market depth reaches a satisfying level then such orders ‘ execution takes place without significant slippage. Therefore inviting more market makers to the exchange would significantly reduce the risk of decreasing liquidity. Especially in the situation when one of them switches off.

Making transactions more profitable

Additionally, the more algorithms are working on the exchange, the bigger the order book offered to clients can be. When talking about the cryptocurrency markets, it’s hard to overlook the crucial role market makers are playing in the course to make transactions more profitable. By creating efficient market mechanisms, they provide unique surplus value for both investors and exchanges.

Spread in control

An additional role of the market maker is to keep spreads in competitive values compared to other exchanges. Market making guarantees that spreads are stable in line with its role in providing liquidity. The volatility of spreads jumping from 10$ to 300$ has a serious influence on trade’s profitability. It may even cause clients’ exodus. The level of spreads depends on multiple conditions including an agreement between a market maker and exchange, volatility and global market liquidity of particular trading pair. Below shown an example of stable spreads provided by the Match-Prime market-making algorithm on one of the crypto exchanges:

To sum up, market makers create a well-structured and stable financial environment on the market where a natural buyer and seller may not exist. So in a realm of a decentralised market, an external institution keeping the price, volume and spread safely stable seems to be a fair option to satisfy the customers, and so the exchange.