The decision about starting your own Forex brokerage is not an easy one. Every investor knows there are multiple aspects of running a business that needs to be analyzed before launch. Nowadays, in the tech industry – the most crucial decisions to make are those concerning IT. Where will you host your services, who will maintain the server, quotes and execution etc? Investors usually decide to partner with a technology provider company offering White Label solutions as it is the safest and most reasonable choice. But how to choose the right one?

Two White Label options to choose from

- Buying WL from a well-established Forex broker,

- Choosing an independent fintech provider.

Both have advantages and several disadvantages assigned to them. The major advantage of a well-known forex broker’s solution is that it went through a trial by fire. It has a proven record of success in the volatile forex market. On the other hand, it has its limitations. These include using only the A-Book model, confined Client Office customization and payment processors integration or no individual plugin installation possibility.

Besides, using another broker’s White Label solution is always a little conflict of interest, which may affect our business one way or another. For example, your clients’ database can be easily accessed by the broker’s sales team. Thus, leaking the data might be a threat. If you have ever experienced any problems or you are unable to implement any upgrades to your WL platform, this might be the time to consider moving your business to another provider.

The second option for an investor is to choose an independent technology provider. By default, it eliminates any conflict of interest as both sides have a common goal, to make your business successful. You get full support not only in establishing your White Label broker platform but also in enhancing any settings later when you already operate. And since those WL platforms are very flexible, you can buy a solution tailored to your needs.

Considering the costs while choosing a White Label

But how to find the right partner among multiple technology providers? They often offer very similar services and conditions to set up a White Label platform. Especially when most of them deliver Client Office, PAMM/MAM, multilevel IB and a similar range of instruments. However, the devil is in the details, and the differences can be easily noticed in the monthly charges.

As broker becomes successful, gain more clients and have substantial daily trading volumes, the fees can get higher. It may significantly lower the increase in profit. First of all, many White Label providers charge turnover fees of $10-$15 per million traded. It can turn out to be a large amount of money to be paid at the end of the month. Above that, if the broker is an STP type, he pays a turnover fee of $2-$3 per million traded to a bridge provider (with a restricted minimum monthly fee of $1’000). Finally, in the A-Book model broker pays an additional $10-$15/mln commission to its liquidity provider with a minimum monthly fee varying from $1’000 to $5’000.

To sum up, STP brokers (even with no turnover) can be charged from the start $2’000 on average and $22-$33/mln in commissions, resulting in a significant brokerage profitability decrease.

Finding the right technology provider

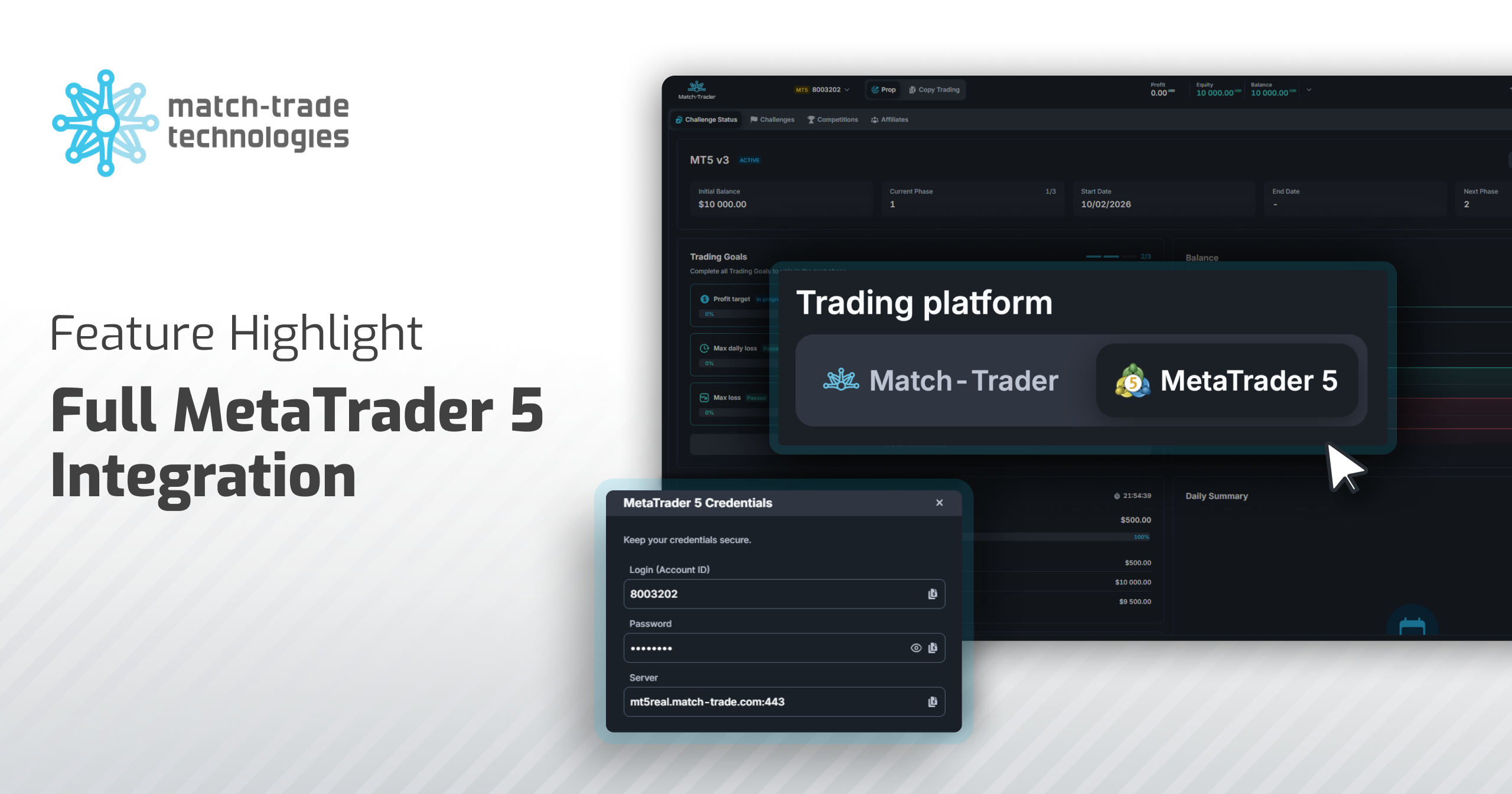

By moving your White Label to Match-Trade Technologies, you can increase the profitability of your transaction flow. In Match-Trade, we do not charge a turnover fee for B-Book flow in MT5. We aim to keep our client’s costs steady and easy to estimate. Additionally, Match-Trade’s partnership with the liquidity provider guarantees free connectivity to the LP via MT4/MT5 Bridge. Meaning that brokers are able to save on the bridge’s minimum monthly or turnover fees. Furthermore, at Match-Trade, we do not charge White Label Clients a minimum monthly fee for maintaining a hedge account at the LP.

We have already helped multiple forex brokers grow their income by switching to Match-Trade’s White Label. Our clients save from $3000 to $10000 monthly. If you’re interested in cost optimization, let us know. Knowing what your monthly fees are, we can estimate your possible savings.