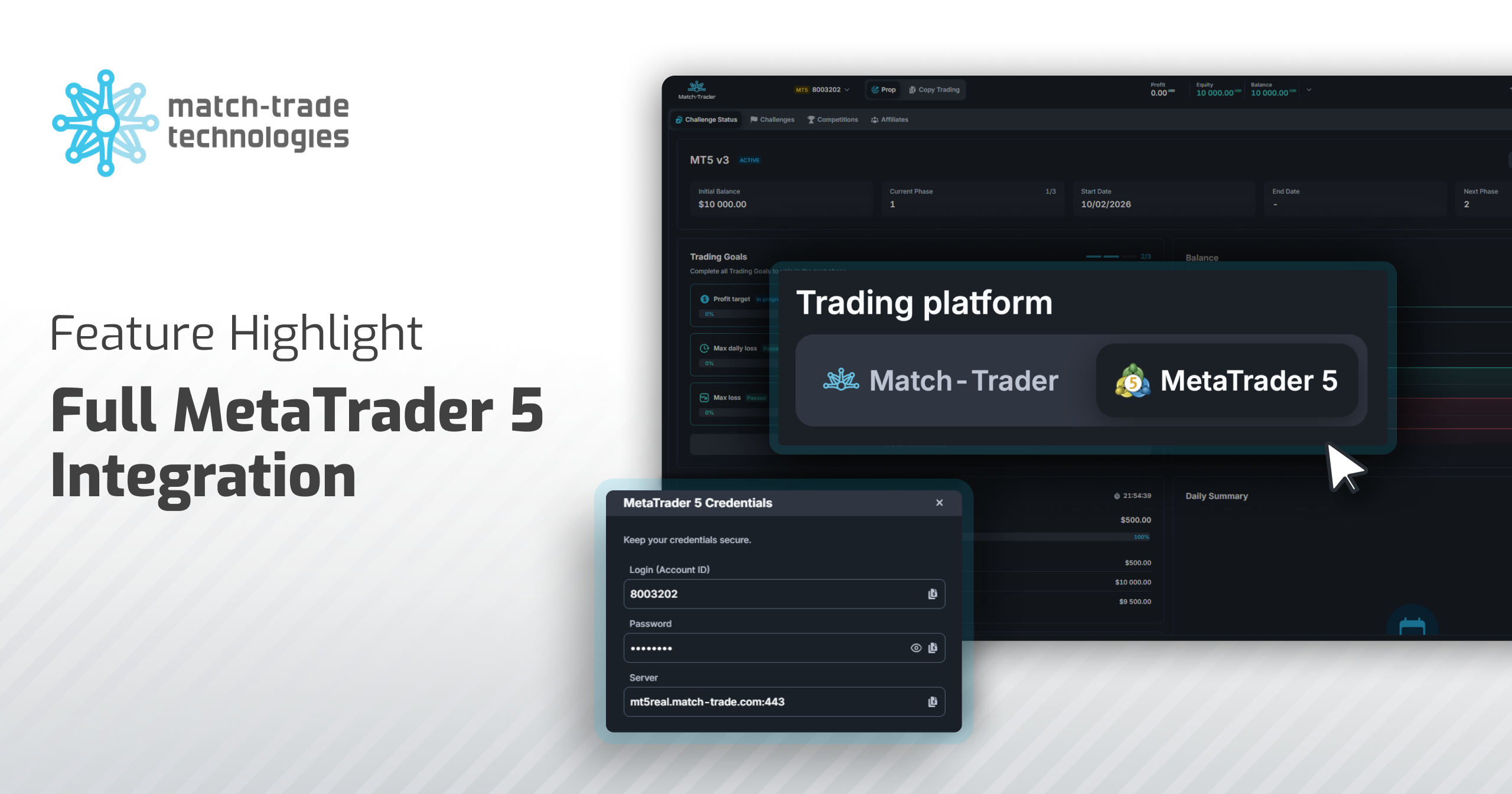

cTrader and MetaTrader 4/5 are the two most popular trading platforms available to forex market players. However, they are not the only ones worth considering. Given that both platforms were developed years ago, more and more Brokers are seeking newer tools developed according to the modern way of trading on the go.

This comparison covers the two most popular trading platforms on the forex market and Match-Trader, a modern trading tool that is becoming the dark horse of trading software. What is the difference between MT4 and MT5, Match-Trader, and cTrader? What are their strengths?

The biggest difference between MT4 and MT5

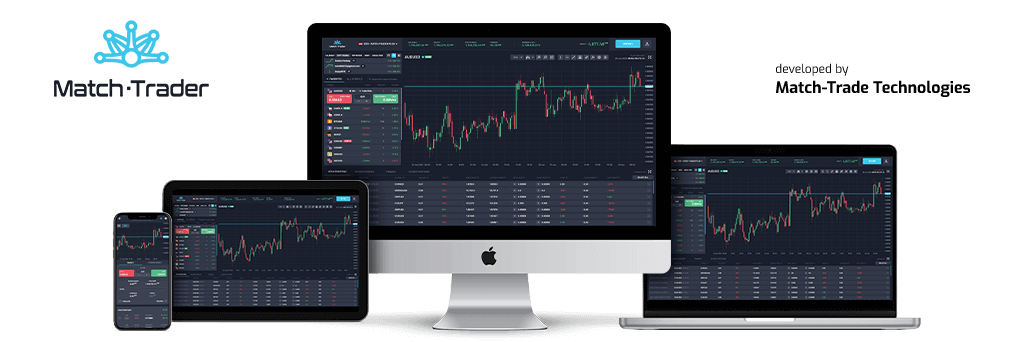

At first glance, you can see significant differences in the user interface of all the platforms. MT4 with its raw layout focuses on simplicity and an extensive system of Expert Advisor bots. The latter has become invaluable support for traders. MT5 differs a lot from its predecessor and like the cTrader platform is more flexible and has a higher capacity. On the other hand, there’s Match-Trader, relatively new on the forex market. As a result, its design is clean and modern – focused on usability and providing the best trading experience.

What then makes MT4 – the oldest and less capable platform – still the most popular platform among traders? That’s the EA bots. Every platform has its own bots programmed in a specific language MQL4 or MQL5. On the Internet, there are a lot of ready-made solutions written in the MQL4 language. Any novice trader can use them to copy signals and replicate the strategy of experienced users. Yet, MT4 MetaQuotes doesn’t develop MT4 anymore so sooner or later it will have to give its way to newer platforms.

Desktop, Web, and Mobile

Another big difference between MetaTrader, cTrader and Match-Trader is the type of their platforms. MetaTrader 4 and 5 were built as applications. Both desktop and mobile versions need to be downloaded and installed on users’ computers. cTrader was originally a web platform, and as such is easily accessible from every browser. Match-Trader, on the other hand, was developed using Progressive Web Application (PWA) technology. PWA provides a native mobile experience for web apps. This makes it a universal app that can be launched from an icon on the home screen of a chosen device. All settings and user data synchronise in real-time. Traders can easily switch devices and always access the same platform view.

Also, mobile apps differ significantly. MetaTrader offers only a basic bulk application where a trader needs to choose his broker from the list. Both MetaTrader and cTrader mobile apps, however, are assigned to a given broker. Match-Trader offers its Brokers a fully branded mobile app with its own icon and name. Traders can download it straight from the Broker’s website limiting the outflow of potential clients.

Platform customization options

All of the platforms are available in the White Label model. Therefore, they all allow some customization like adjustment of settings, adding logo, changing the platform skins and etc. Match-Trader seems to offer the widest range of branding possibilities. In addition to selecting any name for the application, the Broker can add his icon and change the colours of buttons and hoovers to match his logo and the entire brand.

What is the difference between MT4 and MT5? As to features and functionalities, MT4/5 allows connecting custom-made plugins and supporting applications. When it comes to cTrader, Spotware’s team develops extensions and the broker can only report the need for an additional feature. Match-Trader on the other hand already contains features like account management for traders and convenient payment methods. This standalone trading platform is an all-in-one tool. Brokers who value their time and need an effective solution to focus on attracting customers instead of administering the system appreciate its comprehensiveness.

Automatic trading

As for the possibilities of automatic trading, MetaTrader (especially MT4) is the undisputed leader in terms of functionality and available trading tools. It offers the function of Expert Advisors – trading bots that are fully customizable and easy to use even without programming skills. Especially considering the support of a very active online community.

cTrader offers the equivalent of EA in cAlgo form, but due to the little online community of cAlgo users – there is a finite amount of ready-made robots (cBots).

The creators of Match-Trader proposed a completely different approach. Instead of robots, they put a number of solutions on the platform that help traders make decisions. For example, Match-Trader provides a full view of funds required to open the trade, expected result of take/profit and stop/loss orders. Also, all charts in the platform are drawn at exactly the same prices as they are visible in the market watch, even when marked up.

Match-Trader – main advantages for users

- Designed to trade on the go

- All information & settings synchronise across all devices in real-time. Traders can open a position at home and close it on the way to/from work. Regardless of the device – the trader always sees the same information.

- High performance of lightweight

- A full version of the Match-Trader platform (all features available) takes up no storage space on the device. Therefore, there’s no need for a high-end smartphone.

- Self-management for traders

- Automatic registration just by e-mail and setting a password to enter the platform immediately. Instant deposits from the platform – there is automatic transfer of funds to the trading account without any delay.

- Social Trading

- Social Trading App is built into the platform, allowing less-experienced traders to invest with support from Money Managers and/or professional traders.

- Effective Payment Solution Embedded

- Match2Pay Payment Processor allows for making payments in a fast, secure, and hassle-free way. It lets traders top up their accounts to avoid closing positions (without leaving the platform).

cTrader – main advantages for users

- Market trends preview

- cTrader offers three modes of charts: Multi-Chart, Single Chart, and Free Chart. They are very useful for getting different views of market trends.

- Market Depth

- cTrader provides the opportunity to accurately assess the depth of the market in 3 different variants: Standard, Price and VWAP. Thanks to this, the investor can accurately track the liquidity of the market and place pending orders at precisely planned prices.

- Indicators and time intervals

- the platform offers a wide range of indicators for analyzing market data (moving averages, MACD, Bollinger, etc). It also provides the possibility of setting different time intervals (classic 1/5/15 minutes, 6-minute, 20-minute and many more).

- Algorithmic Trading

- cTrader offers its algorithmic trading tool in the form of integrated cAlgo (cBots), similar to the famous EA available in MT4. It allows programming robots to carry out automated trading operations, creating indicators, strategy optimization and backtesting. The tool works in C # and .NET Framework.

MetaTrader – main advantages for users

- Expert Advisors

- MetaTrader enables performing algorithmic transactions with the help of Expert Advisors (EA). They offer the possibility to personally configure it and perform commercial operations on behalf of users. EAs are especially useful for novice traders who want to use strategies from experienced investors.

- Multilingualism

- Thanks to its huge popularity, the platform is available in many languages, which is very convenient for users around the globe who can benefit from trading in their native language.

- Simple and popular

- MetaTrader platforms are very intuitive and easy to use, especially for inexperienced traders. Also, they’re more recognizable and accessible on the market. This makes it easier for the broker to gain customers but at the same time, they must expect bigger competition.

Nowadays, there is a variety of different turnkey solutions available on the market. What’s worth focusing on are those delivering business efficiency. An experienced technology provider offering smart solutions is an investment Brokers cannot afford to pass on.