LeapRate Interview: Match-Trade’s Imran Firoz Elaborates On Turnkey Matching Engine

Mar 14. 2014: Posted by Andrew Saks McLeod in News Californian financial technology company Match-Trade’s recently launched turnkey matching engine solution for retail FX aims to reduce STP and bridge costs. LeapRate goes into detail with Match-Trade Managing Director Imran Firoz on how to operate efficiently.

A well worn adage among companies at the forefront of software development is that competition plus consumer demand creates innovation. Just as development timescales are decreasing, resulting in new software entering the market continually, the entire FX business is also now operating along very exacting parameters, with margins decreasing for brokers in what is becoming a technological marathon between firms. At the end of February, Californian financial software company Match-Trade released its matching engine for the retail FX market, which is integrated with MetaTrader 4 and intends to reduce the cost of utilizing a bridge, and ease the burden of liquidity capitalization for Brokers.

In order to provide a full synopsis of the Match-Trade System’s raison d’etre, LeapRate spoke to Imran Firoz, Managing Director of Match-Trade, who elaborated in great detail.

Leaprate.com: What was the ideology behind the launch of a matching engine for spot FX, and what market participants do you expect will utilize it?

Imran Firoz: We want to achieve three main goals in the retail forex market – Firstly, to reduce retail forex brokers’ STP/Bridge costs through our Match-Trade System, a fully integrated matching engine technology. Secondly, we want to expand and grow Match-Trade Liquidity Cloud, an open, transparent, and distributed trading venue where diversified forex market participants share their liquidity with one another.

Thirdly, we want to create transparency for retail trading clients as our FX Market Depth Plugins (level 2 pricing) allow them to see their orders as part of market making process. It is important to understand that all limit orders placed by trading clients will enhance forex broker liquidity, thus reducing spreads for other trading clients within retail forex broker’s environment.

In a simple single set-up where a retail forex broker utilizes our Match-Trade System as a complete package, we have the retail forex broker with its trading clients, FIX compliant platform providers and liquidity providers as main market participants. In our Match-Trade Liquidity Cloud we have diversified market participants – including but not limited to Retail Forex Brokers (all sizes/risk/revenue models), Liquidity Providers (Banks and Non-Banks), ECNs, FX Prime Brokers, Hedge Funds, Dark Liquidity Pool and other qualified institutions which desire to share (take/provide) their liquidity to cloud members.

Leaprate.com: On a cost-per-million basis, how do you envisage the Match-Trade solution to reduce the STP and liquidity bridge cost to FX brokers, and do you anticipate that brokers will be able to reduce the spread that they offer to retail FX traders, or use the reduction in cost to generate more profit as margins are very narrow these days?

Imran Firoz: Our Match-Trade System allows retail forex broker’s clients to trade with each other. In other words, when one client’s limit order matches with other client’s limit or market order, the order is executed in our Match-Trade System and is not sent to the liquidity provider. If we assume following scenario for a STP Broker doing 10,000 contracts per month and with LP/FXPB cost between $10 to $15 per million (notional USD FX volume).

Then we estimate that up to 30% of the trades will be matched by our Match-Trade System. Consequently, only 7,000 trades will be sent to the liquidity provider, and thus the retail forex broker will realize significant savings on its liquidity costs. These savings are further enhanced, as we offer Match-Trade Bridge, Match-Trader Platform (web based) and Match-Trade Admin Tools & Manager (Back Office) and connection to five (5) Liquidity Providers for no additional cost to the retail forex broker.

We strongly believe that these savings will have a positive impact on the cash flow for retail forex brokers. The way they will utilize this increase in cash flow will depend on their revenue/risk model. For example – a new forex broker can transfer these savings on the spreads and compete effectively with other STP brokers (without our Match-Trade System). From the branding and positioning side, retail forex brokers with our Match-Trade System can offer an open and transparent order book and level 2 pricing feature to their clients, and provide them institutional and professional trading experience.

Leaprate.com: How is Match-Trade capitalized?

Imran Firoz: Match-Trade is funded by its founders and we are continuously improving our balance sheet and financial strength as we are generating revenue from sales of our technology solutions and keeping our overheads low. We are very aggressive in finding the right solution for our clients at an affordable cost. Going forward, we will be announcing our technology solution/service agreements with various clients as we complete and sign off our user acceptance test.

Leaprate.com: MetaQuotes has taken a dim view recently toward the reduction in revenues generated by third party firms having enabled direct access to liquidity via the MetaTrader 4 platform compared to the large margins in the days of the dealing desk brokers that it was initially invented for. How does Match Trade intend to mitigate any potential discourse from MetaQuotes which may arise from the usage of the matching engine?

Imran Firoz: We don’t see any issues from a business, legal and technology point of view with MetaQuotes. Our core system (matching engine, risk engine, routing engine) does not in any way violate/modify/change FIX compliant platforms including FX. Our Match-Trade Bridge uses Manager API and it is not a plugin, which is a native FX communication protocol.

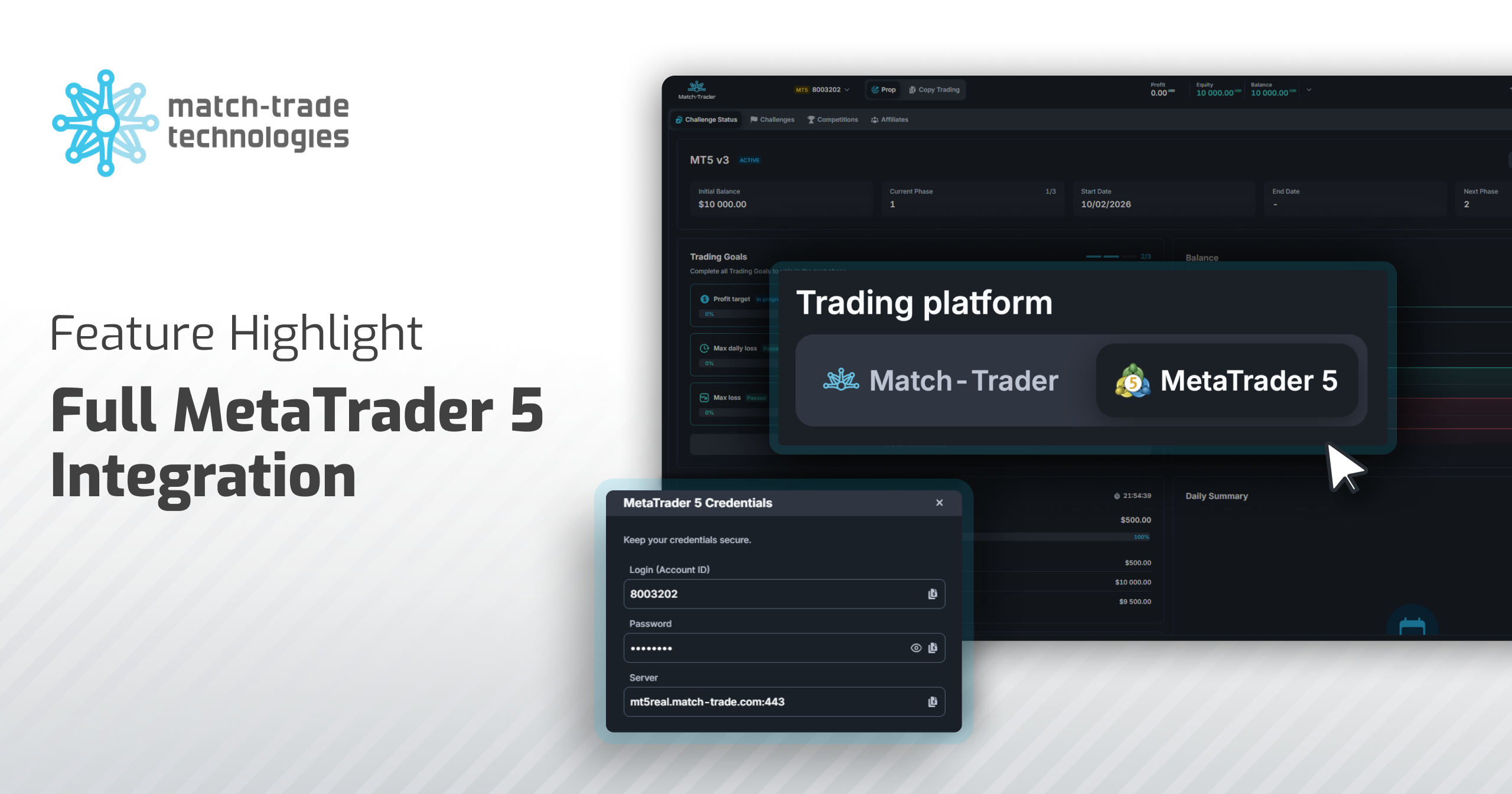

As far as we know there are no requirements for bridge providers to be approved by MetaQuotes. Our Match-Trader is our proprietary ultrafast web based platform, independent of MetaQuotes and it supplements the demand from majority of forex brokers who believe they need to offer more than 1 choice of trading platform to satisfy their customers.

Leaprate.com: What is your opinion on the use of open source matching engines within the retail FX industry, and on a larger scale, fully customizable solutions within which the parameters can be set by the broker itself?

Imran Firoz: We definitely see some opportunities for open source matching engine system, which can be used as a basic matching solution for small size forex brokers who are willing to trade off many benefits of our complete technology solution to obtain a low cost (or free) software. Our many benefits include but not limited to – commercial viability of our product, easy to use user interface of our Manager (Back Office) and Admin tools, 24/7 Technical Support (fixed or pay as you go) and our corporate responsibility and accountability of our legally binding technology solution contract with our clients.

When we put our software out for commercial use, we ensure that it is in line with all market participants in the value chain and is reliable on every step of a forex trade cycle. This is often a challenge for open source software as authors/developers are not taking full responsibility for their customized solutions. We also believe that building a simple matching engine is not the end game but to integrate such system effortlessly with external systems and adding managerial and administrative functions require deeper knowledge of the whole forex market infrastructure.

Consequently, we offer a complete solution comprising of all important modules that communicate and work seamlessly with one another and are necessary to utilize the full benefit of a matching engine technology solution. We have built our matching engine system from ground up to ensure it meets all business requirements of market participants and is seamlessly integrated to their existing technology infrastructure.

Leaprate.com: How do liquidity providers view the use of matching engines in retail FX?

Imran Firoz: We strongly believe the use of matching engine technology will have a positive impact on overall retail forex market. As retail forex brokers realize these savings and become more efficient in their operations, they can pass on these savings onto their trading clients in terms of better spreads, consistent execution, open and transparent trading experience, and improved customer service. This will ultimately result in increased in retail trading volume thus benefiting all market participants in the value chain including – liquidity providers.

Our Match-Trade System will increase the size of the pie (increase in overall trading volume) when implemented by retail forex brokers. It is a known fact that whenever technology improves the efficiency in the value chain, it benefits the overall industry, especially the end users. Of course, market participants which are inefficient and antiquated will have to reinvent themselves or face the consequence of being left behind.

Leaprate.com: What is the company’s next development project, and where do you see retail FX brokers needing to invest in areas of technology that will improve their efficiency this year, especially as volumes are not as high as they were 6 months ago?

Imran Firoz: As mentioned earlier, our ultimate goal (or end game) is to expand and grow Match-Trade Liquidity Cloud, an open, transparent and exchange like trading venue with many diversified forex market participants sharing their liquidity. Currently small to medium size forex brokers get different spreads and fees from LPs, which are often set on unclear and subjective requirements (relationships).

We believe that our Match-Trade Liquidity Cloud will significantly change the retail forex landscape as we plan to create a level playing field for our Cloud members by offering them attractive but standard trade conditions. This will create an open, professional and aggregated market.

As we continue to implement our Match-Trade System, we expect forex brokers and other buy/sell side institutions to see the many benefits of our technology and additional advantages to participate in Match-Trade Liquidity Cloud. We further believe that retail forex market will transform from simple liquidity taker role into real market participation (take – buy/provide-sell liquidity) which in turn will enhance global liquidity and gradually shift the power from top (LPs) to retail forex brokers and ultimately to retail trading clients (bottom).

We strongly believe that retail forex brokers should invest in technologies and adapt business practices that improve overall end user experience and streamline their operating costs. For example, our Match-Trade System not only reduce liquidity costs but also provides professional experience to retail traders as they actively participate in market making which can be viewed through our Market Depth Plugin.

We also expect retail forex brokers offering user friendly algorithmic and automated trading platforms to retail clients. Another way to improve forex broker efficiency is for technology providers to offer flexible pricing options so that forex brokers can minimize their operating costs by choosing the option that fits their current revenue/cost model. As a result, we offer retail forex brokers the flexibility to pay us on the basis of fixed licensing fee or volume based fee or from percentage of savings realized from the use of our solution.