Forex market worth is estimated at $2,409,000,000 ($2.409 quadrillion), up from 2016 when it was valued at $1.934 quadrillion. Even significant market volatility doesn’t discourage those wanting to join in. In fact, the number of novice investors has been steadily increasing over the years. That, in turn, makes starting a forex broker even more appealing. The below guide details every step and decision to make while creating a forex brokerage business from start to finish.

How to start forex brokerage – step by step

- Define your target location

- Consider the costs of starting a forex broker

- Register a forex brokerage company

- Choose the right technology provider

- Choose a trading platform trusted by traders

- Sign an agreement with a chosen Liquidity Provider

- Acquire a Client Office with Forex CRM

- Consider payment solutions needed to start a forex brokerage business

- Create a brand and generate leads

- Build a loyal client base

Firstly, you need to consider where you will register your brokerage business. The answer will give you a structure upon which to go further. This guide will focus on solutions catered to startup brokers that want to operate offshore, as this is what novice brokers usually choose.

Define your target location

Defining your target region should be the first step in starting a forex brokerage. The country you choose to operate in dramatically impacts your entire business strategy, as the licencing requirements differ from country to country. What are the questions you should ask yourself when making this decision?

- What is the amount of capital you have at your disposal?

- How soon do you wish to start your business operations?

Research shows that 95% of startup brokers begin their operations without acquiring a licence. They register their company offshore, making the entire process painless, low-cost, and free of a plethora of formalities.

Consider the costs of starting a forex broker

When it comes to the cost of a startup broker, it also depends on the region and whether or not you want to acquire a licence. The first option doesn’t require significant financial outlays, whereas obtaining a licence from a regulated entity is time-consuming and costly.

That’s why you must decide on where you want to register your company before making legal arrangements.

If you want to learn more about the cost of a startup brokerage, read our article What are the costs you should expect when starting your forex business?

Choose the right technology provider

Experienced and reliable technology providers will assist you in starting and operating your forex broker. The question remains: how to select the right one? We compiled a list of questions you should ask yourself before deciding on a preferred provider.

- Does the provider have the necessary experience and something to show for it? How long does it operate on the market? What do its clients say about its products and services?

- Does it operate globally?

- Does the provider offer all the solutions necessary to start forex brokerage? Choosing a few providers may seem like a chance to save money, but in the end, it turns out to be even more costly and time-consuming.

- What is the cost of an all-inclusive solution needed to start a brokerage offered by this specific provider, and does it fit your budget?

- Does it offer a connection to the liquidity pool?

- Does it offer technical support 24/7?

When starting a forex brokerage, it might seem overwhelming to handle all the necessary formalities, make all the decisions, and carry out every step. That’s why starting a broker business with support from an experienced entity is advised—finding a trusted partner to help you will significantly increase your chances of creating a successful brokerage business. With a small monthly fee comes plenty of benefits, including assistance in choosing the right White Label trading platform, registering a company, choosing a payment solution, and many others.

Start forex brokerage by registering the company

Now that you have chosen the right technology provider, you need to take care of registering your forex broker and all the necessary formalities. Of course, to make the process hassle-free, a reliable technology provider can take care of all formalities for you. All you need to do is provide the necessary documents and not worry about anything else.

The said documents may include:

- The business name of your registered company,

- A notarised copy of national identity or passport,

- Proof of address (like copies of bank statements or utility bills),

- A notarised bank or professional reference letter.

What’s worth noting, you might be requested to give notarised copies or an apostilles stamp, an internationally recognised certification mark issued by your local government, to prove the legitimacy of the documents you submit.

We created a detailed guide on the broker company registration. You can download it here.

Choose a trading platform trusted by traders

Selecting the right FX trading platform should be next on your list. Based on your budget and the plans you have for your business, you can, accompanied by the technology provider you choose, decide on a specific trading platform. While starting a forex broker from scratch, it is recommended that you choose a White Label solution with a platform that best suits the needs of your newly-founded company. What are the aspects you should consider while doing that?

Look for solutions created with novice brokers in mind and thus catered to their needs. What is also important, the platform needs to be modern and user-friendly. That way, attracting customers will be painless.

To help you make an informed decision, we compiled a list of characteristics your chosen trading platform needs to embody. They are as follows:

- Up-to-date technology synchronised on different devices;

- Mobile-friendly design;

- Apps designed with Traders’ needs in mind;

- Branded apps available in the official app stores;

- Copy/Social Trading feature;

- Embedded Payment Gateway with Exchangers.

Currently, the most trusted platforms on the market are:

- MetaTrader 4,

- MetaTrader 5,

- Match-Trader,

- cTrader,

- Utip.

What’s worth mentioning, if you want to choose MT4/5 White Label, you need to obtain a corporate bank account under the name of your registered entity. Additionally, recently MetaQuotes presented tighter requirements for the new White Label Brokers.

If you want to learn more about choosing an optimal White Label offering, read this article.

Partner with a Liquidity Provider

Liquidity is yet another critical component of operating a forex broker business. Access to suitable liquidity pools will ensure you can offer your clients leverage to function optimally.

Before deciding, consider your target group and what their specific needs are. Essential aspects to consider while choosing a liquidity provider include low commissions and spreads, ultra-fast execution, easy integration, and a straightforward onboarding procedure. You must also consider whether the LP is registered or not and what it means for your business to cooperate with either. Usually, when you choose a reliable technology provider, it already works with an LP. Cooperating with one entity offering all the tools you need, support, and LP connectivity is the most optimal solution. As a technology provider, Match-Trade Technologies is partnering with Match-Prime Liquidity to offer its clients the comprehensive package of tools and services they need.

Client Office with Forex CRM

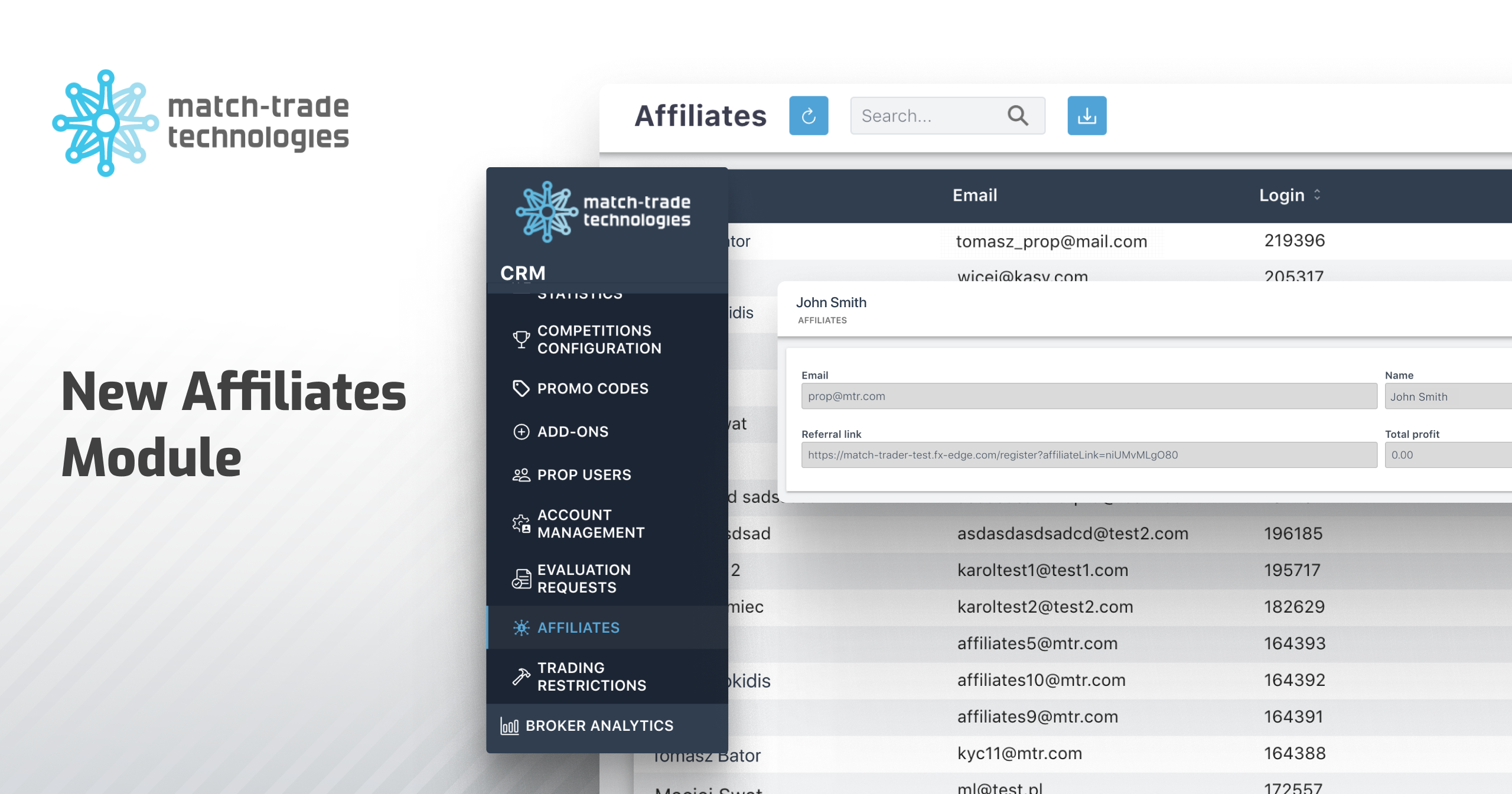

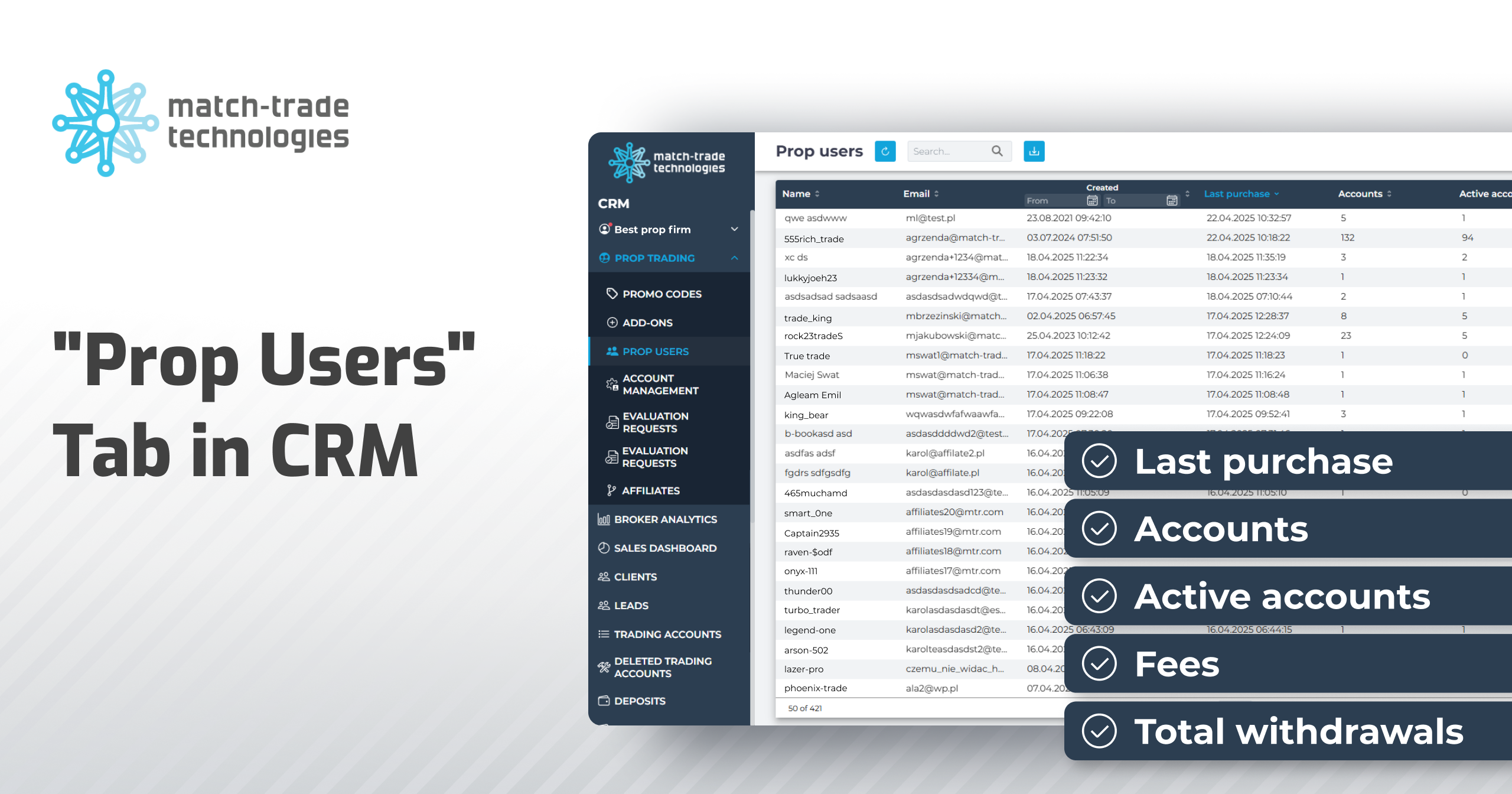

To run a forex company, you also need a Client Office with CRM. The first will allow your clients to make transactions, and the latter will support you and your marketing and sales teams in your daily work. Both solutions need to operate smoothly with your chosen trading platform and have some key components. These include:

- a dedicated IB system,

- a comprehensive leads management system,

- analytical tools,

- and many more.

Forex CRM should be acquired at the beginning stages of creating an FX broker, as it is usually integrated with other tools. It is recommended to buy all of them from one experienced provider. Although it may seem like startup brokers don’t need all the tools initially, it is not the case. Attracting more and more clients, as well as working with bigger brokers through an IB system, requires an already set up and running CRM.

Payment solutions needed to start forex brokerage business

Another vital aspect of creating an FX broker business from scratch is choosing the payment methods you will provide your clients. Nowadays, there are plenty of options, including credit cards and e-wallets. Unfortunately, though, these are not available to brokers registered offshore.

To solve this issue, use the payment gateway system. This way, you will be able to build your reputation and offer clients the most convenient solutions. How? By choosing a payment provider integrated with reliable partners (e.g. PRAXIS Cashier, Moonpay) and offering instant deposit and withdrawal options. Choose a system already integrated with a Client Office with Forex CRM (or with extensive API capabilities). As a result, your clients will gain access to many PSPs with different payment methods.

Create a brand and generate leads

Next on our list is creating a brand that will be presented on the forex market. You must start showcasing your presence, clients, and accomplishments as soon as possible. To start, we recommend taking care of the following activities:

- Creating a logo, brokerage website, and social media channels;

- Promoting your business online;

- Creating different types of sales funnels using the above media.

Build a loyal client base

Lastly, you need to engage your customers by keeping them active, bringing you the desired results. Active traders are the valuable clients with whom you want to build a strong relationship. How to do that?

By offering them the best tools and conditions. We recommend that you acquire a Trader’s Room (also called Client Office for Traders) that will allow your clients to quickly transfer money, open new accounts, send instant deposits or request instant withdrawals, among many other things. The Client Office needs to work smoothly with the Trading Platform you chose. Modern traders appreciate state-of-the-art features like Social and Copy Trading, MAM, and PAMM. To learn more about them, click here.

As shown above, all of these steps could be taken care of with the assistance of a technology provider like Match-Trade Technologies. Contact us if you want our help starting your forex brokerage business.