Many companies that have been operating in the Forex market for a long time, at some point start considering expanding their business and becoming a Liquidity Provider. Most often they are medium or large currency brokers but also technology providers and experienced business specialists cooperating with large Liquidity Providers. They have either experience or a customer base or technology but to become an LP it is necessary to have all these competencies. That’s why it is very difficult to become a Liquidity Provider without the support of a qualified business partner.

What risk model should you choose?

There are two types of models available on the market: agency model (ECN / STP / MTF) and market maker model. The first one involves the immediate routing of client orders to larger financial institutions. The Electronic Communication Network (ECN) model is the most widespread trading system on the Forex market. All risk is covered immediately, and the profit is the volume-based commission. It is a model used by many LPs on the market and does not create a conflict of interest between the broker and LP. The disadvantage of this model is the lack of flexibility because your customers will always depend on the performance of your LPs and you will have very limited impact on the LP if your customers claim that their orders were made at the wrong price. It is very important during significant market events to have control over the execution for your clients.

The second model is the so-called market maker who trades directly with customers. Liquidity Providers who is a market maker (or offers such services) is always the other party to the transaction and decides how to secure it. This model has been gaining more and more popularity among LPs and Forex brokers. In this model, we deal with the situation of creating the market. The LP simulates the real market, thus the broker opening a position on the platform concludes a transaction with the LP, who plays the role of the market maker. The tasks of the MM LP include the independent securing of client transactions on the interbank market, on his own behalf. Therefore, being a market maker can provide greater flexibility in creating attractive market conditions for customers. Additionally, if you use your own liquidity, you can always compensate your customers if any error occurs.

How to get a license for the Liquidity Provider

Another aspect on the path to becoming an LP is the choice of jurisdiction because each Liquidity Provider conducts its business under specific legal provisions. Beginner LP starts with offshore destinations such as Saint Vincent and the Grenadines, Belize, Vanuatu or Labuan due to smaller legal restrictions. This solution can be a good starting point for assessing business potential, because it does not require significant capital to invest, but it does not raise a reputation. One of the main obstacles to running a company subject to a foreign jurisdiction is the problem of obtaining a reliable bank account that can hamper business operations.

When your business develops, it’s a good idea to get a reputable license from European Union countries, such as Cyprus, Malta or the United Kingdom. Obtaining such a license enables the legal provision of financial services in all EU countries. However, you must know that obtaining and maintaining an EU license is quite expensive and involves running a local office and employing the required number of employees.

How to provide your clients with a good source of liquidity

A logical choice for many LPs would be a connection to the direct interbank market. However, after the Swiss franc crash in 2015, many banks terminated Prime Broker contracts (even those with large currency brokers) due to changes in risk policy, which makes it very difficult for new players on the market to access interbank liquidity without intermediaries. There are also very high capital requirements and monthly minimum fees.

You can choose other liquidity pools that often provide liquidity in the market maker model. Here, however, there may be a conflict of interest between your clients and the Liquidity Provider (when client’s loss is a profit for LP). This can cause situations in which your LP will worsen the conditions for customers who are profitable in the long run or ask you to turn off those customers.

You can always aggregate multiple liquidity sources by combining 2-3 or more sources at the same time, then client transactions will be split between different LPs. In this case, you must have multiple LP contracts and you will have to manage your exposure separately with each LP. To avoid excessive formalities, it is optimal to sign a liquidity contract with Prime of Prime or MTF. It is a company that usually has direct relationships with banks, aggregates many sources of banking and non-bank liquidity and is also available to smaller companies. The only drawback is that you have to rely on a specific PoP pool that can be limited in terms of liquidity or range of instruments.

How to choose a technology provider?

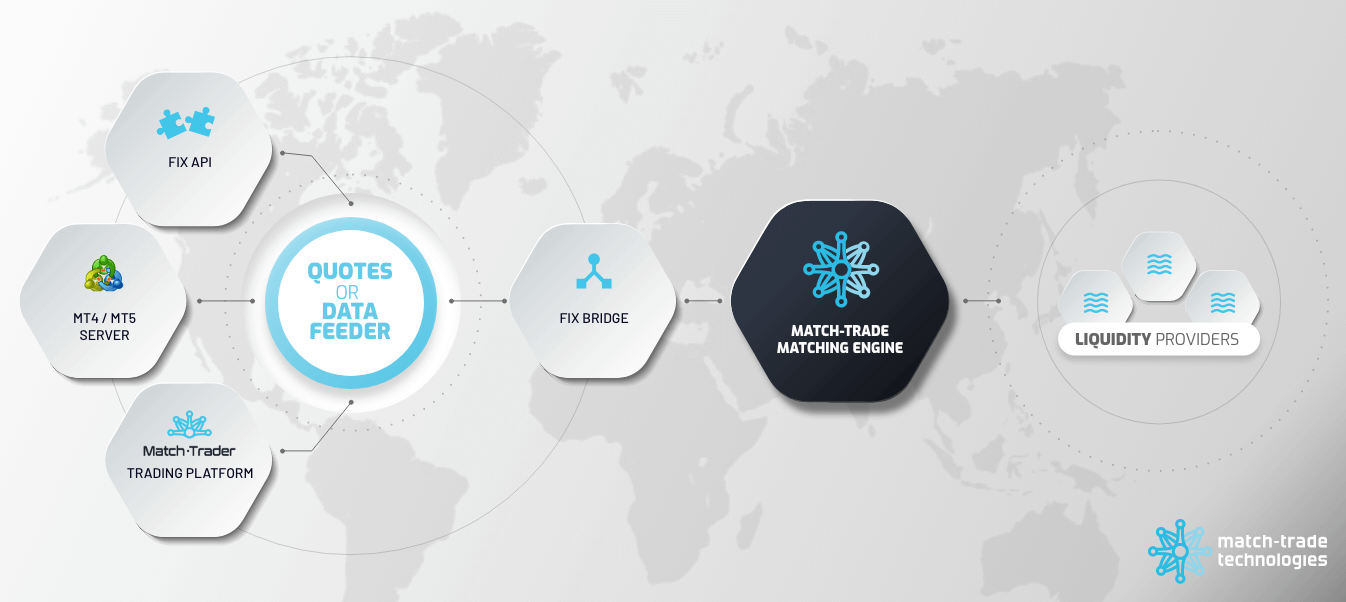

There are multiple technology providers, which provide a bridge, trading platforms and aggregation solutions. It’s worth looking for one that offers comprehensive solutions based on in-house technology. For example, MT4/MT5 Bridges can provide, in addition to simple routing, many different functions such as extensive reporting, risk management, advanced BBook execution and many more.

In addition to functional solutions, fees for the technology provider are also very important. If you decide to launch the ECN model, the profit margin will be relatively small, which makes it extremely important to use an affordable technology provider. When your business starts to perform well, you don’t want your income to be offset by fees.

Contact an experienced expert

The decision to become a Liquidity Provider requires thinking through many aspects and it is difficult to make it without the support of experienced experts. Match-Trade Technologies provides its clients with comprehensive support in building and developing effective Forex business. We have a number of solutions that will help brokers expand their business with Liquidity Provider as well as hard competences resulting from the provision of market making services on various exchanges. If you are interested in the topic, don’t hesitate to contact us.