Prop trading stands at the intersection of innovation, risk and business transformation, challenging prop firms to rethink and reinvent their operational strategies. What specifically drives success in the dynamic global marketplace, and how can they secure a competitive edge?

Financial Health of Prop Firms

Recently, the prop trading sector has seen numerous firms shut down due to difficulties in managing profit payouts. The underlying reason seems straightforward—without strategically hedging trades from the outset, firms are essentially setting themselves up for failure. The critical question remains whether these companies can survive or if the only viable path involves executing trades through a liquidity provider (LP) and generating revenue from authentic prop trading operations.

Strategies for Ensuring Profitability in Prop Trading Firms

Keeping a prop trading firm profitable isn’t just about discovering a singular winning formula—it’s a complex ecosystem. Success emerges from skillfully blending multiple strategic components: the business model, marketing approach, sales strategy and technological infrastructure.

Business Model

Relying solely on a pure B-book model is often a temporary strategy that will eventually collapse. In the short term, it might work, but long-term sustainability remains questionable. The fundamental problem lies in its dependence on continuous new sales to fund existing payouts, which can be risky. That’s why prop trading firms committed to real staying power must adopt a multi-dimensional, hybrid approach.

By leveraging both A-book and B-book models, firms create a more resilient operational framework. The critical element here is sophisticated risk management. Companies must employ risk profiling and advanced data analysis to route varying trading flows. Consequently, low-risk trades are channelled to the B-book, while high-risk trades are directed to the A-book. This method maximises profits while offsetting certain risks to the LP.

Tournaments recently introduced by Match-Trade Technologies exemplify this approach—specifically, minimal-risk, single-phase competitions where the prizes are set upfront. These represent legitimate alternative revenue streams that can strengthen a firm’s business model.

Marketing Approach

Trader-funding firms need to fundamentally reimagine themselves as long-term partners dedicated to trader development. By prioritising education, prop firms can create an environment where success is measured not just in immediate profits but in the continuous improvement of trading capabilities.

In an industry where credibility has been undermined by questionable practices, transparency must become the foundation for every prop firm. This means being open about business frameworks, precisely reporting performance metrics and maintaining clear communication regarding payout structures.

Technological Infrastructure

In today’s prop trading ecosystem, staying competitive requires more than just basic challenge platforms and trading dashboards. A forward-thinking technology provider must deliver innovative features that boost both trader engagement and business expansion, such as scalable funded phases and educational tournaments.

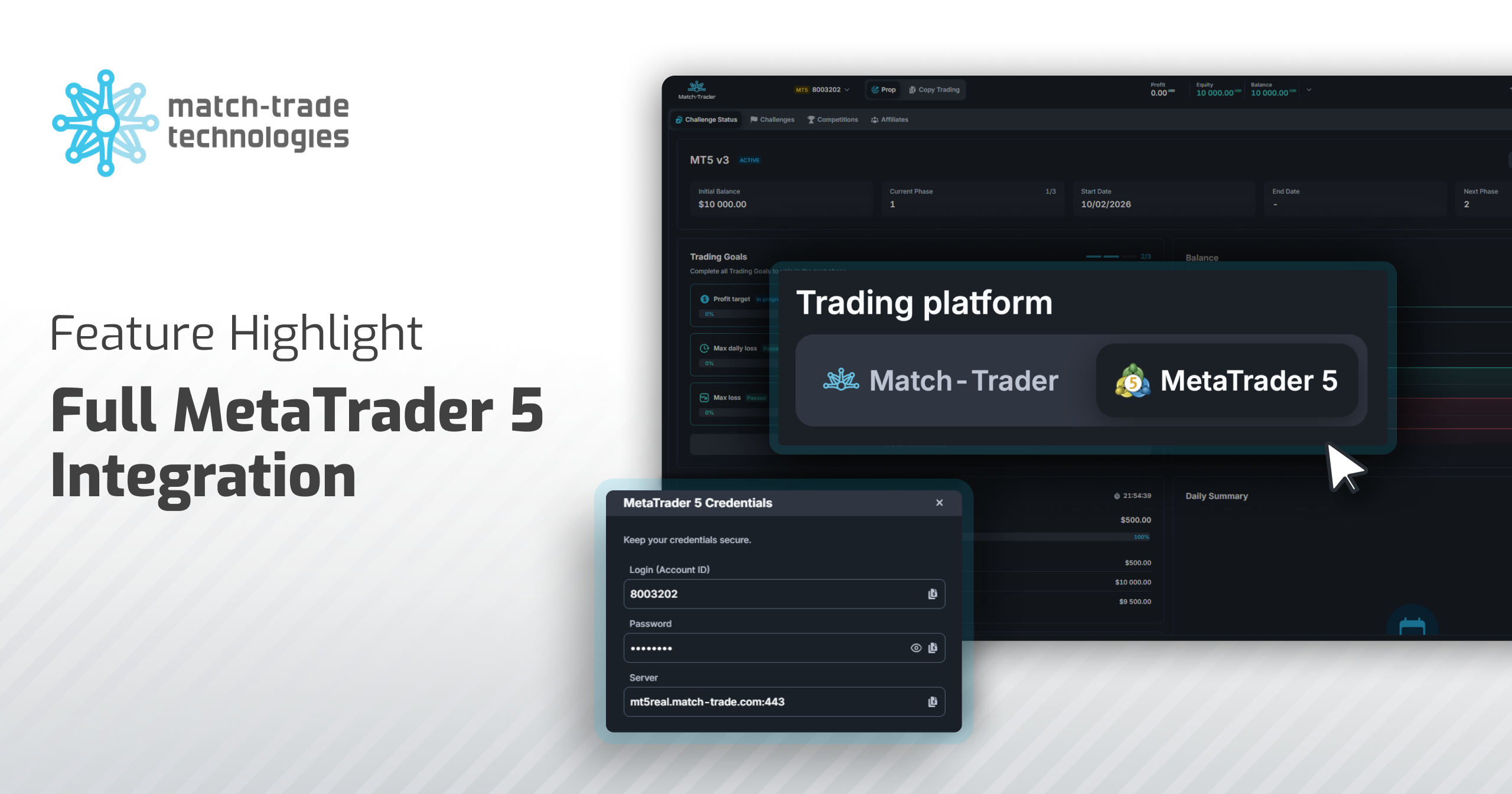

Match-Trader distinguishes itself by prioritising trader growth and offering a purpose-built prop trading solution, rather than a traditional forex platform with added prop features. Its dedicated architecture includes built-in challenges, prop dashboards and performance statistics, all while utilising VWAP-based demo execution to simulate realistic market conditions.

Gamification vs Gambling

The gamification of trading platforms, when implemented thoughtfully, can create a powerful environment for trader development and engagement. By emphasising elements like tournament leaderboards and healthy competition, prop firms can nurture a culture of skill enhancement. These features aim to elevate the learning experience and motivate performance improvement while maintaining a clear distinction from gambling-style entertainment by emphasising expertise over random chance.

The key to upholding a professional image lies in promoting responsible trading practices. This includes providing scalable funded accounts to reward skilled traders, delivering comprehensive educational resources, and maintaining complete transparency about success rates and potential risks. Unlike gambling establishments that profit from player losses, successful prop firms thrive by investing in trader development and creating mutually beneficial growth opportunities.

New Set of Regulations?

The prop trading industry is in a constant state of evolution, with regulatory frameworks still being a critical missing component. Leading technology providers are already implementing robust compliance measures, including AML and KYC checks for funded accounts. The future regulatory environment will likely centre on net capital requirements and transparent risk management protocols, effectively filtering out operators unable to meet these standards. This selection process will help establish industry best practices that build trust and legitimacy in the prop trading space, at the same time protecting both traders and prop firms.

Prop Trading Future

The landscape of prop trading is approaching a major transformation, as the traditional boundaries between prop firms and forex brokerages are dissolving. Rather than remaining a specialised niche, prop trading is set to seamlessly integrate into mainstream forex platforms, mirroring the evolution of social trading from a novel concept to a standard feature. This integration could see prop firms and brokerages merge their operations, creating a more sophisticated, transparent and interconnected trading framework that more effectively serves both seasoned traders and market newcomers.