In some ways, the crypto market crash in May of 2021 was the end of an era.

The 6-month period between December and April was a time of crypto euphoria. Cryptocurrency prices were driven to unprecedented heights; the media spotlight shone brighter on crypto than ever before–even Elon Musk got in on the game.

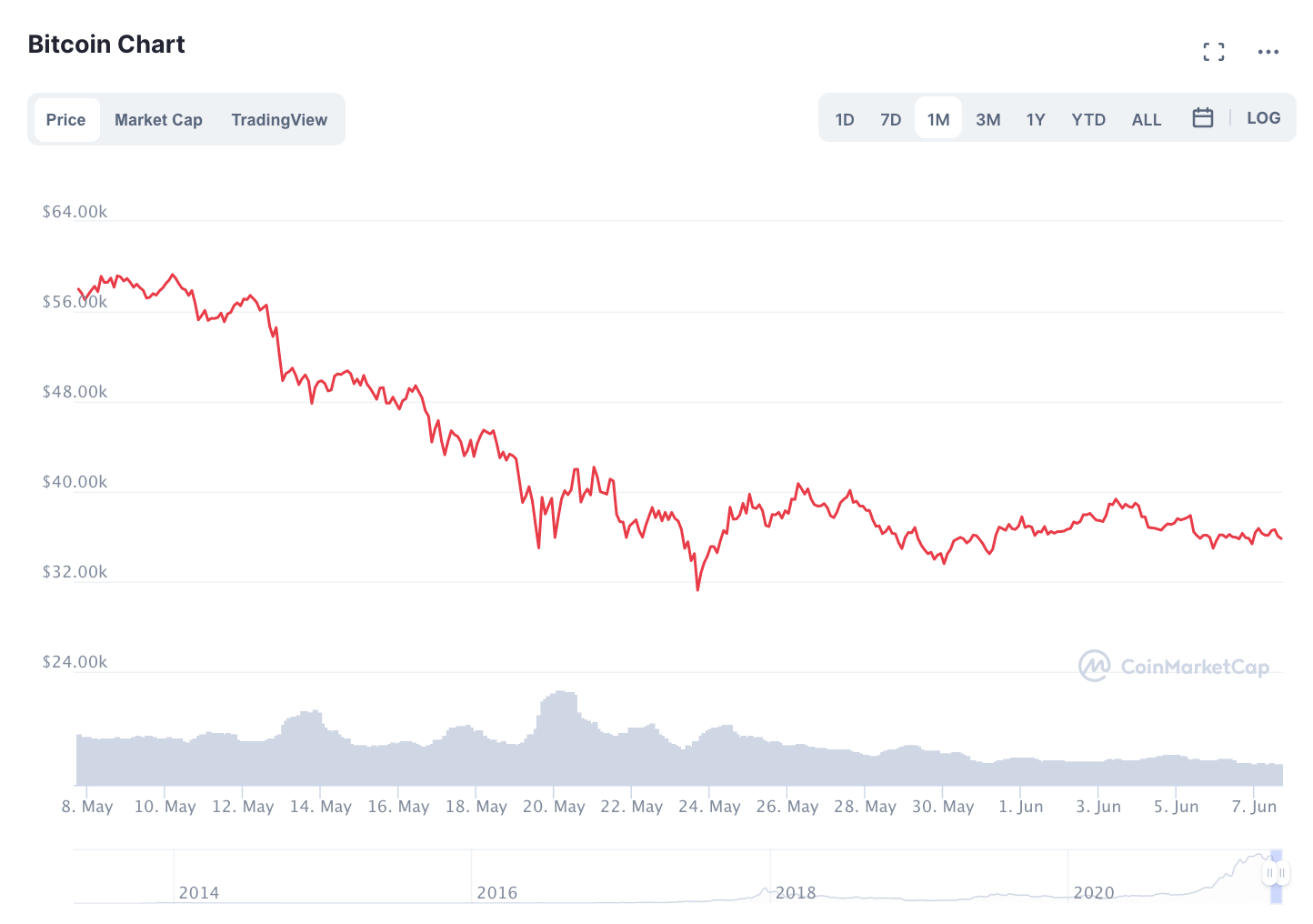

However, the excitement didn’t last. Mid-way through May, the price of Bitcoin suddenly dropped more than 25 percent, dragging altcoin prices along with it.

Initially, the causational factors behind the drops seemed to be fairly clear-cut. After all, the Chinese government announced that traditional financial service companies would no longer be allowed to provide services for crypto companies and warned investors against speculative crypto trading.

Around the same time, Elon Musk–former champion of crypto–announced that his company would no longer be accepting BTC payments, citing environmental concerns.

However, there was a third, hidden factor just below the surface of cryptocurrency markets–a force much more powerful than Elon Musk (or even the government of China.) What is this hidden, powerful force? Leverage.

What is leverage in financial markets?

Indeed, while the behavior of both China and Elon Musk probably did have something to do with BTC’s initial price dip, it’s what followed that made a real difference. The initial led to cascading liquidations of more than 800,000 leveraged Bitcoin positions worth some $12 billion.

What is leverage? Essentially, leverage trading platforms allow their users to trade with borrowed cash. This allows traders to take a larger position in Bitcoin (or another asset) than their holdings would ordinarily allow. Leverage trading is also called margin trading.

How does this work in a practical sense?

Imagine that you’re on a trading platform that allows you to leverage your trades up to 50%. This means that if you have $5,000 worth of BTC, you could use leverage to take a position up to $10,000: you would pay 50% of the purchase price, and the trading platform would loan you the other 50%.

In the best circumstances, this allows traders to make astronomical gains. However, in lesser circumstances, leverage trading can be disastrous. Why is this?

Imagine that you use 50% margin to spend $5,000 cash to buy 100 crypto tokens worth $50 apiece. A month later, the tokens are worth $70 apiece. This means that your holdings are now worth $7,000; if you sell, your profit will be $2,000. Without the margin, your profits would have been 50% lower.

But what if you use your $5,000 leveraged position to buy 100 tokens worth $50 apiece, and their price shrinks to 30%? Your holdings are now worth $3,000, and you’ve lost $2,000–double the amount that you would have lost without the margin.

Some crypto platforms allow their users to take extreme risks with margin trading

Margin trading is not unique to cryptocurrency markets. Many different kinds of capital markets offer leverage on traders. However, the difference between cryptocurrency markets and other kinds of more traditional financial markets is that margin trading in crypto markets is highly unregulated. As a result, some cryptocurrency exchanges allow their users to take extreme levels of risk.

Take, for example, BitMEX–one of the largest and most popular crypto margin trading platforms in the world.

For example, BitMEX allows its users–no matter their level of experience–as much as 100-to-1 leverage for cryptocurrency trades. This isn’t the case with all crypto platforms: Robinhood does not allow its users to use margin on cryptocurrency trades at all; Coinbase only allows professional traders to have access to margin trading.

Leverage can magnify losses in crypto markets, causing prices to plummet

In the worst cases, traders can end up owing a brokerage or exchange even more than the total value of their holdings. However, to prevent these kinds of extreme losses, some platforms implement a set of “sell triggers” that will ensure that traders can repay their debt. In other words, platforms will automatically liquidate their users’ holdings when the price of an asset gets too low.

This is exactly what happened in Bitcoin markets in mid-May. The news of China’s clampdown on crypto and Tesla’s suspension of Bitcoin payments did cause the price of BTC to drop–however, they also caused a sort of “domino effect” as hundreds of thousands of leveraged positions were liquidated.

In the beginning of May, before the Tesla- and China-related news broke, Bitcoin was riding high with a price of nearly $60,000. When the news broke, however, the price dropped to $50,000. This caused the liquidation of all of the leveraged accounts that had “sell” triggers set for $50K.

Therefore, the price of Bitcoin continued to drop: each time it hit a lower level, more accounts were liquidated. This cascade of liquidations continued until the price of BTC levelled out just over $30,000. Some analysts believe that if BTC would have dropped below $30K, there’s no telling how low it could have gone.

Is leverage good or bad for crypto?

While some analysts argue that cryptocurrency markets are boosted by the positive effects of margin trading, others argue that the presence of margin trading–and particularly with such high levels of risk–grossly exaggerates volatility in crypto markets.

Therefore, when the price of Bitcoin plummeted in mid-May, some analysts believed that it was “healthy” for the leverage to be “rinsed” out of BTC markets.

The ability to have such highly-leveraged positions in Bitcoin and other cryptocurrency markets has caused some analysts to believe that crypto “whales” use margin trading as a way to intentionally manipulate markets.

Whether or not intentional manipulation is at hand, however, the fact remains: leverage is a powerful force in Bitcoin and other cryptocurrency markets. Unless high-risk platforms are ever regulated, it will likely continue to play an important–if hidden–role in crypto markets.