We often get asked: what is the White Label Forex Broker cost? The answer is as many things on the Forex market: ever-changing and complex. In today’s article, we will dive deep into the topic and explain the costs associated with starting and running a Forex Broker. Additionally, we will detail what these costs depend on.

White Label Forex Broker cost for Startup Brokers

Cost of the company registration

Cost is one of the aspects novice Brokers need to thoroughly examine before starting their business. The first step is choosing the right jurisdiction, which will greatly impact their expenditures.

Market Data shows that approximately 95% of startup Brokers start their business offshore; that is both the more convenient and less costly choice. When registering offshore, White Label Forex Broker cost starts at $1600. Of course, if the Broker chooses to add the corporate bank account, the amount will increase (around $4500, although it may differ depending on other factors).

If you have a substantial amount of money, you may also choose to acquire a Forex licence. Its costs differ greatly depending on the jurisdiction. A licence from CySEC, the Cypriot Regulator, requires a deposit of initial capital of around $150 000 and running a physical office.

Cost of Forex technology

Monthly fees

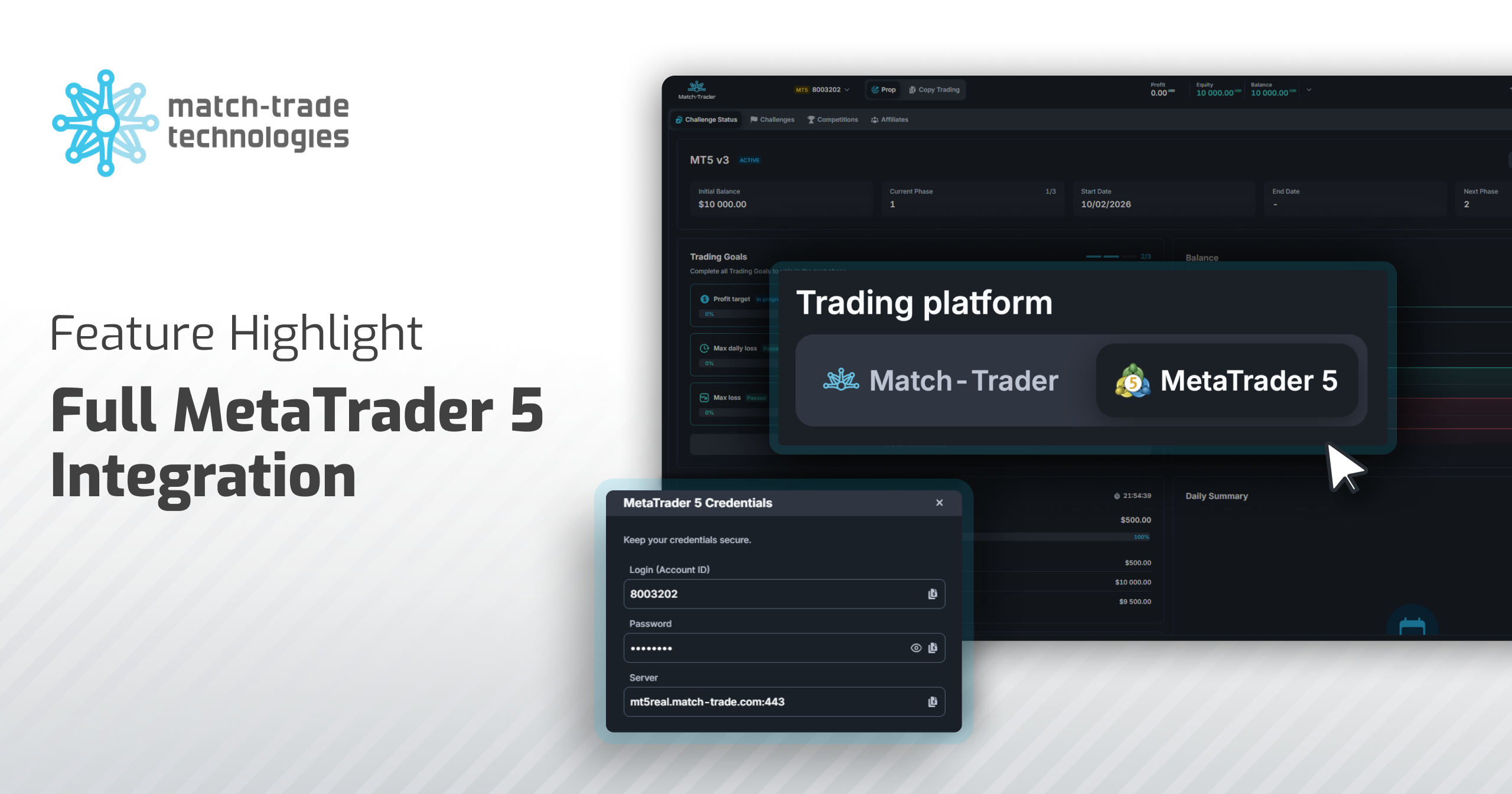

The cost of White Label with our proprietary trading platform Match-Trader is $2000-3500 in monthly fees.

Match-Trader trading platform available on the web, desktop, iOS, and Android devices

Setup fee

Depending on the technology provider you choose, the setup fee may differ. At Match-Trade, we don’t charge any setup fee. As of today, the setup fee at Spotware Systems is $5000, and at dxTRADE, it is $10000.

Volume-based fee

A volume-based fee is another important factor to consider when acquiring a White Label trading platform. Again, at Match-Trade, we charge Brokers only for the White Label Match-Trader package depending on the number of active accounts; there is no B-Book turnover fee. At Spotware Systems, there is a volume-based fee of $5 per every million traded.

Apart from those, to operate a Forex brokerage company, you will also need turnkey brokerage solutions, including a payment solution and a Forex CRM with Client Office for Traders. You may buy them separately or choose a WL solution in a package with all of the mentioned tools and services. At Match-Trade, we provide startup Brokers with an Instant Broker Solution combining the Match-Trader platform, a payments processor, Forex CRM with Client Office, connection to multi-asset liquidity, 24/7 support, help with company registration and more. Choosing this solution, you can set up a Forex Broker in a few days, and the cost is around $7000.

Cost of connection to liquidity pools

Finding a reliable liquidity provider is another part of White Label Forex Broker cost. According to experts, brokerage firms need more than one provider to operate optimally and manage risks better. Connection to multi-asset liquidity allows Brokers to provide liquidity for transactions made by your clients. At Match-Trade, we focus to provide you with every tool and service you need to start and operate your White Label Forex brokerage. Therefore, when acquiring a Match-Trader White Label, you receive free access to a trusted liquidity provider. All thanks to our cooperation with an award-winning Liquidity Provider Match-Prime Liquidity (regulated by CySEC).

What is the White Label Forex Broker cost?

Put simply, the cost of starting an offshore White Label Forex Broker is $7000-20000. It all depends on the jurisdiction, whether or not you want to acquire a Forex licence and the technology provider you choose.

Contact us if you need assistance with choosing the right option for you.