Among the business formats that are rapidly gaining momentum in growth and development, a special place is occupied by the Brokerage Business. The stock and financial markets are constantly developing and improving, so there is fertile ground for the organisation of domestic Brokerage Business.

Becoming a Forex Broker is a good business opportunity that opens up many possibilities even for beginners. However, in addition to the initial investment, you will need a lot of knowledge and experience, without which the business will not last long. Therefore, many choose to cooperate with more experienced forex market participants at the initial stage in order to create a sustainable brokerage business.

We always advise cooperation with Technology Providers, so you will have more time to engage in attracting an audience to your business, and all technological tasks can be left to professionals.

If you are thinking about starting your own Broker, you will definitely need a Forex Brokerage Business Plan. This is necessary in order to create a concept of a brokerage company from scratch, for example, what services will be provided, what the company will invest in, and how it will earn. This is one of the most important moments in forming a potentially successful brokerage company since the business plan includes the idea, concept, development program and all the details that may affect the broker’s functioning.

Business plan for becoming a Forex Broker – a step-by-step

To become a Forex Broker, you need to have start-up capital, knowledge of how the Forex market works, and a detailed business plan. We can highlight eight main steps that you will need to take into account when creating your forex business.

- The jurisdiction of the business

- The budget you can spend on your startup

- The choice of technology on which your business and trading platform will be based

- Market analysis

- Unique market offer

- Choosing reliable payment systems for your future customers

- Marketing plan to attract traders

- The choice of a liquidity provider ensures a good flow of all transactions

And now, let’s go through each item of this business plan for forex brokers.

Definition of Forex Broker Jurisdiction

The first step towards becoming a Forex Broker will be to determine your target audience, the package of documents you will need to prepare depends on this. Also, determining the location of your potential customers entails choosing the right jurisdiction to register your Broker. In order to run your business, you will need to obtain a financial services license. You can read more about registering a Brokerage Business in our guide for brokers.

Investments in the Brokerage business

How much investment you need will depend on your choice of jurisdiction. At the initial stage, expect that you will need to pay for the trading platform, payment system, and liquidity for your Brokerage. Also, take into account the costs of marketing and company registration. To make it easier for you, you can find a technology provider who can offer you all these services in a package or provide you with a turnkey Broker solution.

We wrote an article dedicated to the question of finances for startup brokers, which you can read here.

Choosing the right Forex platform provider

How to choose a provider that will suit your needs? You can do it in 6 easy steps. They are as follows:

- Perform a market research

Collect information on the Forex platform providers existing on the market. Find out about the technology they offer and, most importantly, the features of each solution. Then, choose a few that seem the most promising.

- Perform a credibility check

After performing the first general check, you now need to perform a detailed credibility check. See how many clients the company has and who are their business partners. Moreover, do thorough research on their expert team. Learn if they take part in important events, such as industry expos, and whether they are interviewed by industry media such as Finance Magnates.

- Regional support

Another important step is to find out if the chosen company has a local office or representatives. Having representatives in various regions provides that the provider already has a stable position in the market.

- All-in-one Brokers HUB

Next, learn if your chosen provider can offer you a bespoke and all-encompassing offer. When starting your Forex Broker, you need to obtain a trading platform, Forex CRM, Client Office for Traders, and a liquidity connection. It is best if you can acquire all of them from one provider.

- Reasonable fees

As mentioned above, budget is an important part of creating a business plan for Forex Brokers. When choosing a Forex platform provider, you also need to consider what are the general market standards for Forex technology and how the offer from a chosen provider fits your budget. Match-Trade Technologies offers a simple monthly fee and no B-Book turnover fee. Straightforward conditions are essential when creating a new endeavour.

- Contact the chosen Forex provider

Finally, after gathering all of the above information, contact the company that seems to be the best fit for your needs. Check if what they present on the website is up-to-date and ask questions. Remember, an experienced Forex technology provider knows that startup brokers need support when creating their business and are eager to help you by sharing their knowledge and know-how.

Perform a thorough market analysis

After choosing the right Forex technology provider, you may now, using their help, learn about Forex itself. Gather all the information about the industry and the target market. Learn about your competitors and think of how your broker could fill in the niche you’re interested in. In your forex brokerage business plan, you also need to include what is consumer demand for the services you plan to offer.

Unique market offer

Your offer is perhaps the most important part of your broker business plan. What services do you want to offer, and who is your target market? When it comes to starting a Forex brokerage, it all boils down to the group you want to reach. There are a few options to choose from.

- Beginners

When targeting novice traders, you need to be able to provide them with the right technology and support. A modern trading platform with an intuitive design is a must.

- Experienced traders

Another option is to reach professional traders. They not only demand modern and user-friendly solutions, but they also need cutting-edge analytical tools to get their trading to the next level.

- Introducing Brokers

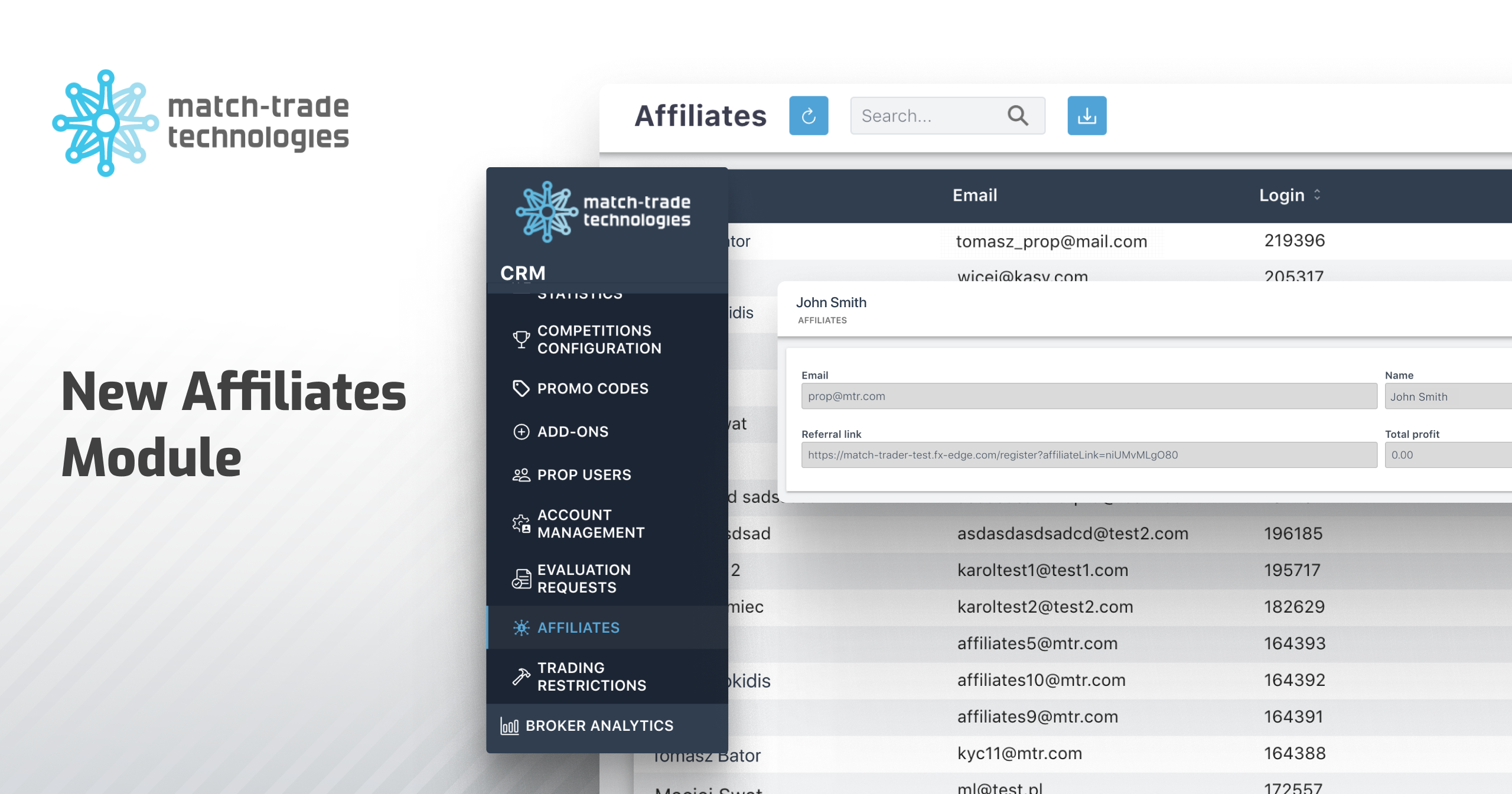

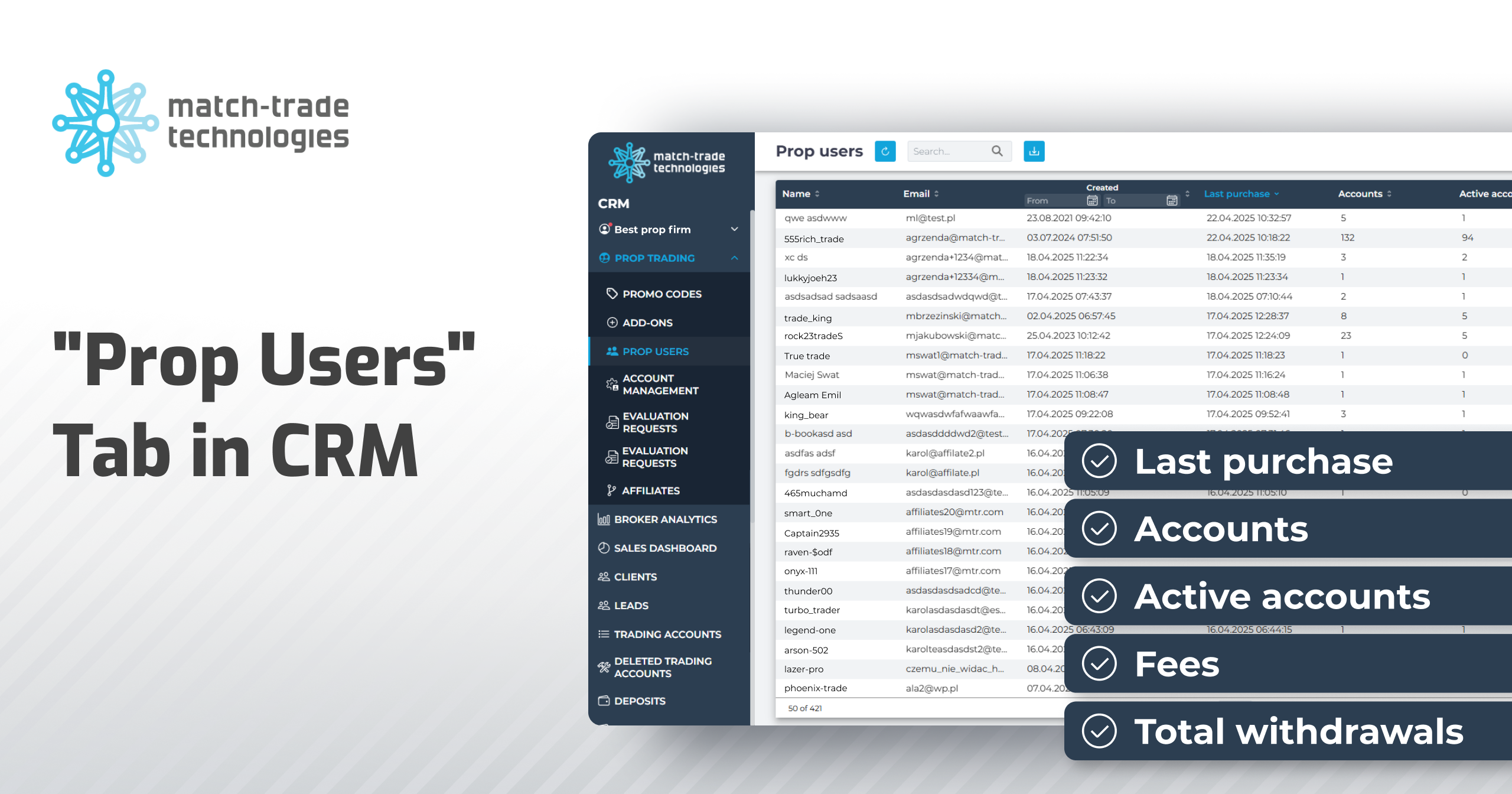

You can attract IBs to your business, which will contribute to the rapid development of your Broker, as they are extremely helpful for recruiting and supporting new traders. However, this will require not only an attractive affiliate program for IBs but also plenty of instruments, an excellent client office, ultra-fast data feeds and reporting tools in a Forex CRM.

Answering these questions will allow you to create a specific offer and the pricing structure. In your business plan for brokerage business, you also need to include the benefits for your future customers.

Payment methods customised to traders’ needs

To determine which payment options you need, analyze the competition. The more payment options you’ll prepare for your traders, the more potential audience you can attract. For new forex brokers, we recommend a reliable payment processor, where you will receive several payment options at once with one forex payment solution.

And remember, when choosing payment methods, you need to think about your customer’s preferences. Offering traders smooth and effortless ways to make deposits and withdrawals will set you ahead of your competitors.

Marketing strategy to attract traders

A website and social media engagement are the most basic ways to promote your brokerage business. They are not enough, however. You need to create a detailed marketing strategy and include it in your brokerage’s business plan. In addition, you need to decide what message you want to deliver to your customers and try to make it as personalized and trendy as possible. When the initial stages have already been completed, you can also think about bonuses and a reward system for the most active traders, emails with promotions for potential clients, newsletters for regular ones, and much more.

The choice of a liquidity provider

It is wise to choose a multi-asset liquidity provider who is able to handle every kind of liquidity requirement. If you want to attract traders of any level, you will need to find a liquidity partner that covers Forex, Crypto, and other trading products such as stocks, oil, metals and others. Also, look for a Liquidity Provider that has reliable exchange technology. This ensures the quality of performance, higher speed and execution, and better technical support.