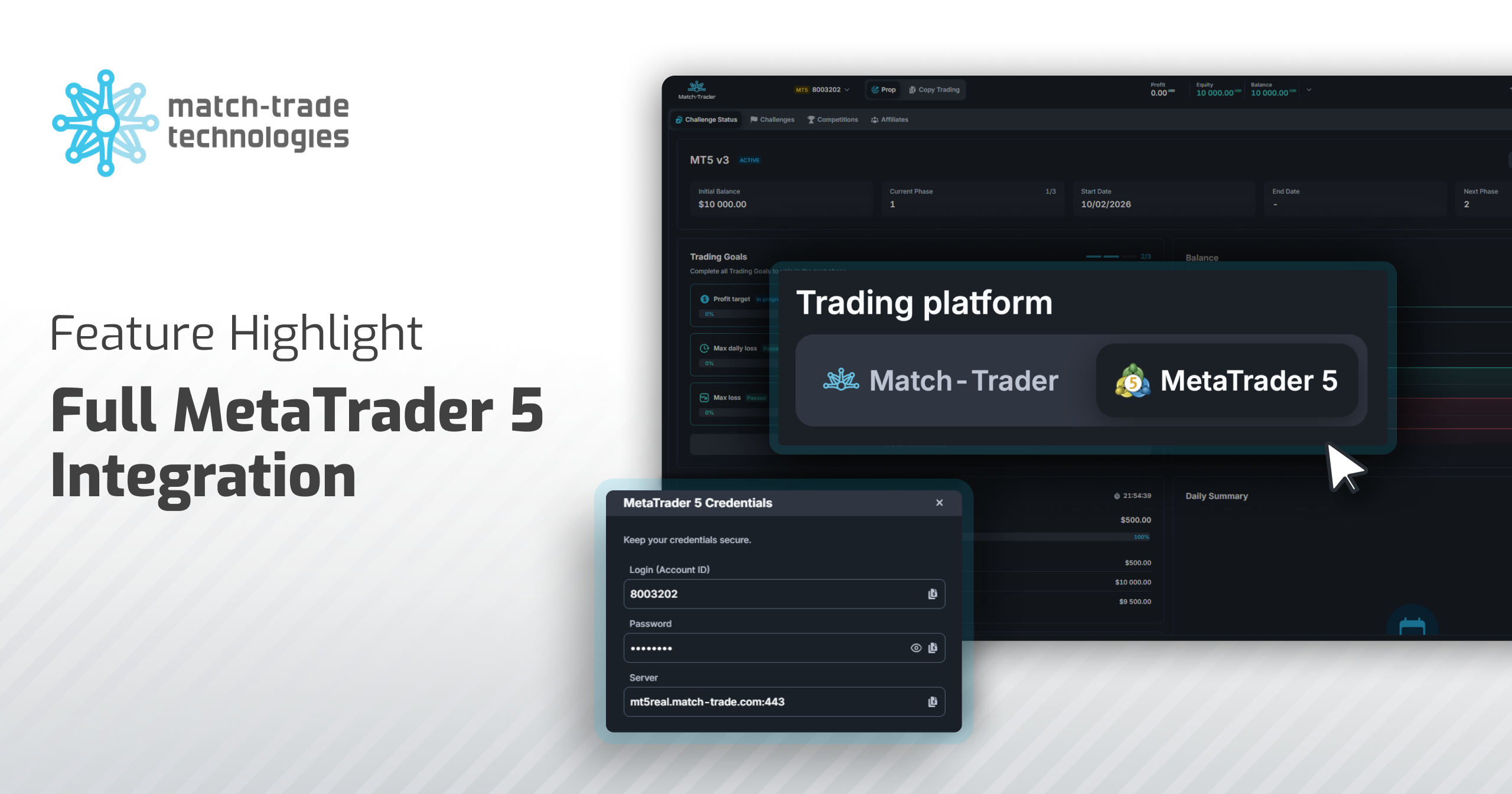

In our market, netting accounts have become the standard practice for hedging A-Book. However, it’s crucial to recognise that a one-size-fits-all approach may not be ideal for every company. Due to market changes caused by the turmoil surrounding MetaQuotes, we have observed increased interest in the Server License offer over the past few months. Some clients opt for our in-house developed platform, Match-Trader, while others choose MT5. However, they often require technical support and turn to technology providers offering a full range of services, such as Match-Trade Technologies. We thoroughly analyse new customers to understand their needs, find the best ways to help them in their work and identify appropriate solutions to offer. We have found that hedge accounts, as an alternative to netting accounts, can provide unique benefits and serve as an excellent solution for various business types. In this article, we will explore the factors behind the popularity of netting accounts, compare them to hedge accounts, and examine the opportunities both types offer for brokers.

Understanding the Popularity of Netting Accounts

To understand why hedging mode is almost non-existant and the vast majority of brokers use netting, we must first consider the differences between those two solutions. A netting account allows the broker to keep the risk exposure only for a particular financial instrument, while a hedging type account lets the broker keep both buy and sell orders simultaneously. Netting accounts also apply the FIFO rule when closing orders, meaning that orders are always closed in chronological order.

Now that we understand the differences between those two types, one can ask why so many professionals decided to use netting if a hedging account offers fewer limits and more freedom in managing the process. In my opinion, there are two main reasons for that- one financial and the other one technical:

- Netting an account is simply more profitable because a broker is paying less for commission and, at the same time, is charged less for swap points when he closes two opposite clients’ trades instead of keeping them open.

- The technical reason is related to the way trading platforms connect to liquidity providers, i.e. bridges. The bridges responsible for this connection use the Financial Information eXchange (FIX) protocol, which cannot distinguish if the retail client is opening or closing a trade. For FIX communication, there are only “buy” or “sell” orders, and that is forcing netting accounts to be used. What is worth mentioning, Match-Trade’s solution for MT5 bridge connected to our liquidity partners avoids this difficulty, which can entirely change brokers’ procedures.

Unique Advantages of Hedge Accounts

Recently, during a conversation with our partner, I heard: “Brokers I work with like to use retail hedge accounts because they don’t understand how to manage an account with netting & FIFO rules”. I perfectly understand how important a sense of control can be for a person managing a brokerage company. Primarily when no staff is dedicated strictly to dealing, and management oversees multiple parts of the organisation. Hedging accounts with retail mode reflect orders one-to-one, which is straightforward and easy to supervise. Time saved this way can be used in other departments, which is of great importance in the case of small teams in companies that are just developing.

Another psychological factor is related to the typical trading behavior of retail clients. Those customers often tend to hold onto losing trades for longer periods while quickly closing profitable ones, which leads to discrepancies between clients and FIFO-ruled netting account closed trades. In that case, the majority of the broker’s profits are from the difference in orders held open by his retail clients. However, by solely focusing on closed trades and disregarding open transactions, brokers may mistakenly assume they are losing money instead of earning it.

Additional Benefits

Even experienced brokers can encounter challenges in accounting reconciliations and tend to prefer accounts that do not employ order netting and FIFO. In such cases, hedge accounts with retail mode provide an excellent solution due to their simplicity. Its structure reflects orders one-to-one and dates and prices are identical, which makes it very easy to identify in case of any problems. All of these factors ensure effortless control over accounting-related matters. The retail mode was introduced to our offer at the request of medium-sized brokerage companies that were looking for a way to reduce the difficulties associated with managing the FIFO model. It facilitates management, shortens processes, and saves valuable time.

Summary

Using a non-netting liquidity account for MT5 A-Book does not compromise the usefulness of Match-Trade Bridge in any way. All the functionalities of risk management and supervision are meant to be used exactly the same way. Although at first glance it seems to be less profitable and therefore often rejected, it offers a number of solutions not available elsewhere, which can significantly facilitate running a brokerage business, leading to reduced time spent by accounting or dealing specialists. Choosing the right account type is a decision that every broker has to make individually. In order to choose the most appropriate product for business, one should take into account its price, but also the costs of maintaining the team that will use it, the legal situation in the country of operation, and many more.