Do you want to become a crypto broker in just one week? Solutions available on the market allow wannabe brokers to start their operations in a few simple steps. If you are looking for an answer to “how to be a crypto broker?”, today’s article is an ultimate guide on how to start a crypto business.

How to become a crypto broker?

The easiest way to become a cryptocurrency broker is by partnering with a trusted technology provider. That way, you can be confident that all necessary aspects of creating and operating a crypto business are taken care of.

Below you can find a step-by-step process for becoming a crypto broker. If you want to hear about the solutions you will need, watch this video:

Choose a Forex technology provider

As mentioned above, the most cost and time-effective way to become a cryptocurrency broker is to choose support from an experienced technology provider. To find the right one, you need to thoroughly analyse the ones currently operating on the market, as well as the problems they will solve for you. To make that decision, answer the following questions:

- What is your experience in the crypto industry?

Depending on your knowledge and background, you will need specific assistance while creating your crypto brokerage. If you’re starting out, it is best to rely on a trusted advisor that will answer your questions and help you make strategic decisions.

- How big is your budget?

A technology provider will assist you in analysing your capabilities and the costs of starting a crypto broker. A ready-made solution for Crypto Brokers often turns out to be the most financially-wise strategy. Our Crypto Broker Turnkey, which allows you to become a crypto broker, requires only a monthly fee of $2750-3500.

Register your brokerage business

Depending on your chosen technology provider, you can either register your company yourself or with the assistance of the provider. The latter is a significantly more convenient option, as the provider already has experience and connections to manage the entire registration process.

Before that, however, you need to choose where you would like to register your company. There are some areas where cryptocurrencies are banned. Some of them include Bolivia, China, India, Indonesia, Colombia, and Turkey.

Other than that, regulations concerning brokerage businesses also apply. That means, before becoming a broker, you must choose whether you want to acquire a licence or not. The countries most often chosen by unregulated brokers include Saint Vincent and the Grenadines, Nevis, and the Marshall Islands. Operating without a licence is typically chosen by startup brokers as it is cost and time-effective. Starting operations without acquiring a license means fewer formalities and the ability to become a crypto broker within days. If you want to consult this decision with a team of experts, contact us.

Acquire the right trading platform

Choosing the trading platform is an essential part of becoming a crypto broker. To do that, you need to know what kinds of clients you want to target. There are a few possibilities.

Beginners

If you want to attract novice traders, choose a platform that will be user-friendly and intuitive. That means all processes are streamlined, and the information available on the platform will assist users in making trading decisions. Our Match-Trader platform has Economic Calendar & News Feed built-in, meaning Traders do not have to look for information elsewhere.

As mentioned above, their display in the app is equally important as the access to tools and information. Hassle-free trading experience will allow less-experienced Traders to learn the ropes and grow their capabilities.

Another important feature the platform needs to offer is a Social Trading tool. Such a widget embedded into the app allows novice traders to follow experienced Money Managers or copy trades from them. They do not need to possess extensive knowledge or experience. Other examples include PAMM/MAM services.

Another critical aspect that will attract beginner traders is effortless money management. Making deposits and withdrawals straight from the app, without logging into a separate payment processor, is a massive benefit for them.

Experienced traders

If you want to work with experienced traders, there is a different set of components your chosen platform needs to contain. Of course, the features mentioned above, such as intuitive display of information or Social Trading, are also important. To attract professional traders, you also need to offer them a platform with a modern mobile version and the ability to trade “on the go”. The app needs to be available as web and desktop applications as well. What’s more, all the information needs to synchronise in real-time, no matter the version traders choose to use.

Another important aspect of the trading platform for professional traders is the possibility to manage it by themselves. Automatic registration links and KYC, creating new accounts and transferring funds between existing accounts are just some of many examples of features that experienced traders will expect.

Introducing Brokers

If you want to create a program customised to Introducing Brokers (Traders that refer other Traders to work with you), you will need to acquire a trading platform with a dedicated IB portal. What does it need to comprise? Multi-level commission structures, automatic generation of referral links, a feature that allows for internal transfers between different accounts on the platform, and easy management of IBs and sub-IBs.

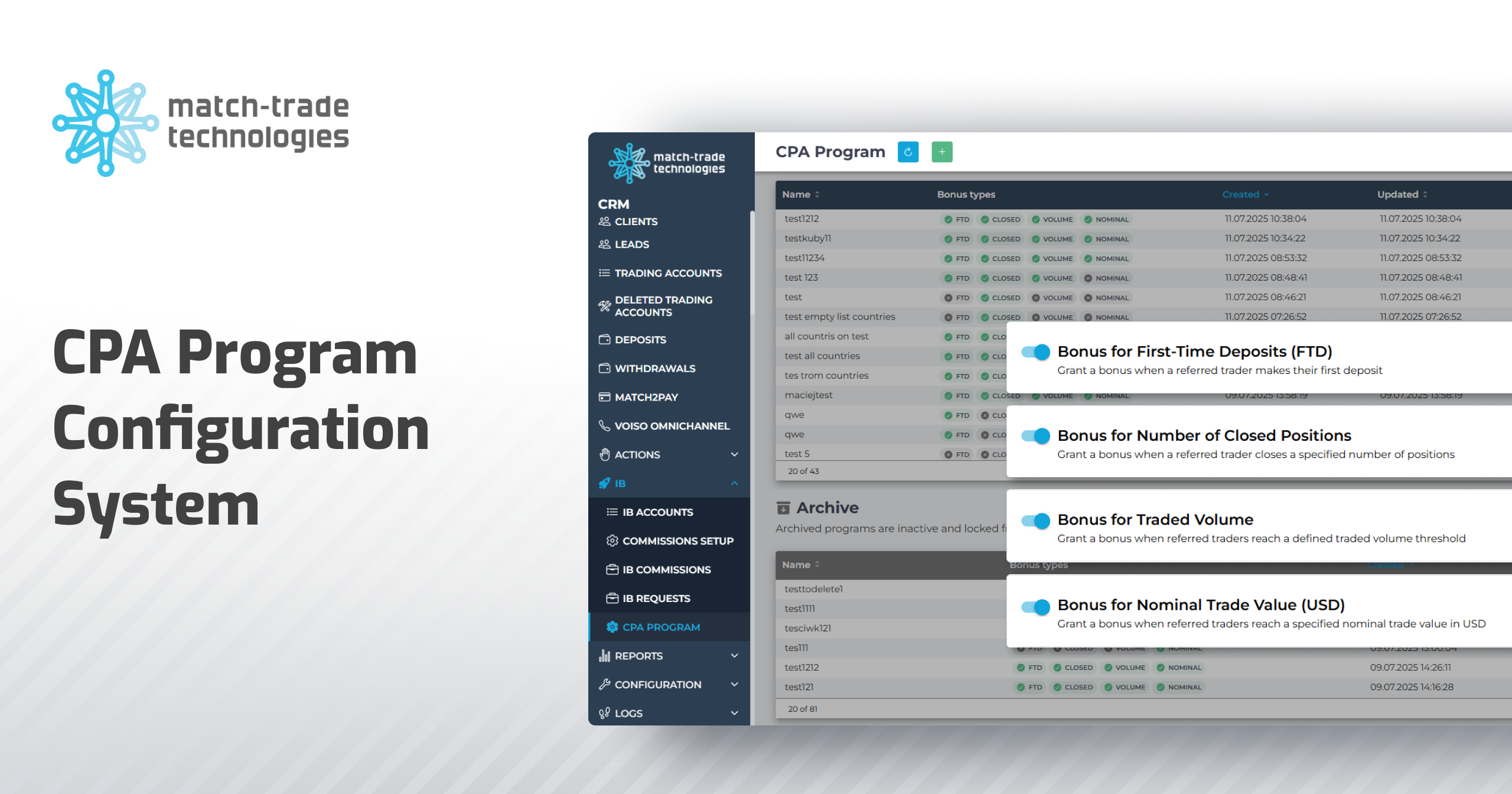

Choose a Crypto Broker Management System

Another technology you must obtain to manage your crypto brokerage is a CRM system designed for brokers. Such software allows you to manage all of the brokerage’s processes and people on your team. If you want to learn more about choosing the right CRM for your business, read this article.

Offer your clients optimal and secure crypto payments

To be a crypto broker, you also need a way to settle all your clients’ payments. The best tool for that is a Crypto Payment Gateway integrated with different exchangers.

Such a solution allows you to collect, store and exchange cryptocurrencies in a convenient, cost-effective, and safe way. To buy crypto, your clients can use credit cards or wire transfers, which is extremely important when it comes to offshore brokers.

Another advantage of such solutions is that they allow brokers to eliminate the risk of crypto volatility. Once bought using the gateway, cryptocurrencies can be converted into FIAT currencies or stablecoins

To learn more about how we ensure the full security of our Match2Pay processing technology, watch the video below:

Connect to a Crypto Liquidity pool

Connecting to crypto liquidity pools gives you the possibility to operate optimally and effectively. Perhaps the most important aspect of liquidity is that it allows brokers to optimise risk correlated with providing cryptocurrency trading.

How to choose the best liquidity provider? Consider your target audience and their specific requirements before making a decision. Low commissions and spreads, ultra-fast execution, easy integration, and a simple onboarding procedure are all important factors to consider. You must also choose between working with a regulated and unregulated company. Put simply, offshore brokers may partner with unregulated liquidity providers, and regulated brokers tend to partner with regulated providers.

What’s worth mentioning, liquidity from a trusted partner, and a bridge solution should be included when you’re acquiring a trading platform.

Set up a crypto broker website

Providing cryptocurrency trading services starts with attracting clients. What better way to do that than by creating a professional broker website? Becoming a crypto broker in today’s landscape demands promoting your business online.

The website needs to be branded with your name and logo, detail your crypto services, and offer registration forms integrated with a branded Client Office and Forex CRM.

Additionally, you should create profiles on your chosen social media.

How to become a crypto broker using our Crypto Broker Turnkey?

At Match-Trade, we offer you a complete solution allowing you to become a crypto broker. All you have to do is acquire this one tool: Crypto Broker Turnkey. What does it entail? Our proprietary trading platform, Match-Trader, a Forex CRM, our processing technology Match2Pay, and access to preferential ECN liquidity in the package. Moreover, Match-Trade’s expert team takes care of the company registration process and sets up a broker website with integrated registration forms. The only thing a new crypto broker needs to do is gain clients.

You can start with a low monthly fee of $2750-3500. If you want to learn more about the offer, contact us.