Liquidity and

Data Feeds

Get direct access to Liquidity from Institutional Liquidity pools – through our partnership with a regulated Liquidity Provider, and use our Data Feeds to enjoy the low latency price streams for more than 250 instruments

Key Features

Ultimate Liquidity solution

Reliable partner

Due to our strategic partnership with Match-Prime, CySEC regulated LP you have direct access to Liquidity and you only pay to one provider

Fewer formalities

To provide bespoke Liquidity for all types of Brokers, our partnership contract enables clients to gather and send documents only once

One point of contact

At Match-Trade Technologies, we make sure our clients get one consultant to take care of every matter

Easy setup

Since Match-Prime Liquidity uses our technology, we guarantee a problem-free setup

Multi-asset Liquidity

Reliable partner

Our strategic partnership with Match-Prime, Liquidity Provider regulated by CySEC, enables our clients to access deep liquidity for over 250+ instruments

Ultra-fast Matching Engine technology

Match-Trade’s matching engine is installed right next to the MT4 / MT5 servers to speed up communication and minimise execution latency

Integrated with trading platforms and aggregators

Match-Prime liquidity pool is already integrated with MT4, MT5, xStation, cTrader, Match-Trader and Utip trading platforms. Clients can access it also via OneZero, Gold-i, Your Bourse, PrimeXM aggregators and T4B, Centroid, FXCubic, Takeprofit Technology and Brokeree bridges

MT4 / MT5 Bridge in the package

If you choose Match-Prime Liquidity, you’ll get our MT4/MT5 Bridge solution without additional costs. You gain access to all the advanced features as well as our ultra-fast data feeds for B-Book execution

Low commission

Thanks to our proprietary solutions and the strategic partnership, Match-Prime Liquidity can offer lower commission and a minimum monthly fee as low as $1000

Digital currency liquidity

Match-Prime Liquidity provides access to liquidity for the 50 most popular digital currencies, including Bitcoin, Dash, Ethereum, Bitcoin Cash, Ripple, Litecoin, Terra, Solana, Avalanche and Polkadot

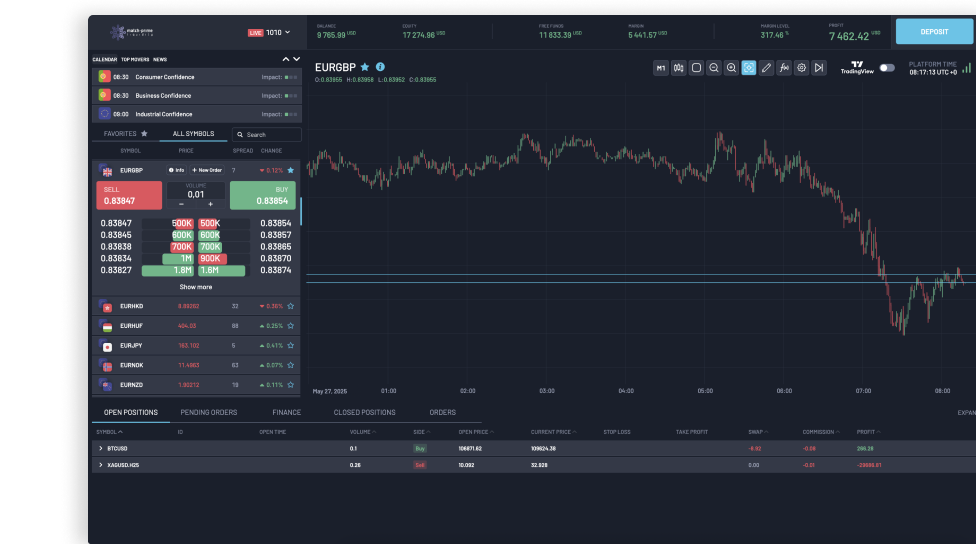

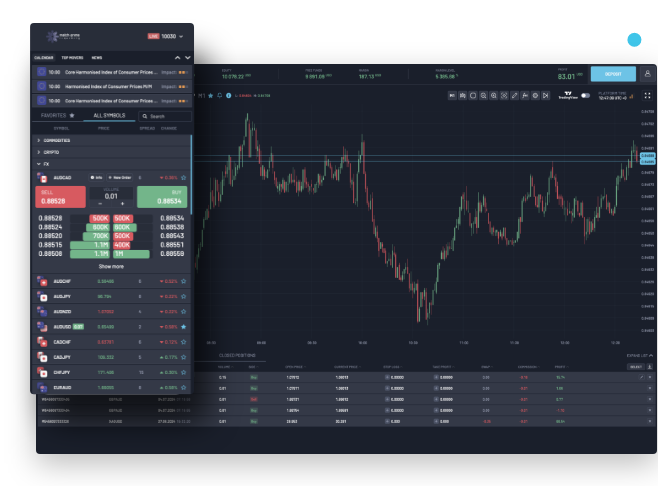

Match-Trader PRO – institutional liquidity platform

Match-Trader PRO is an advanced platform compliant for institutional clients. It guarantees operational transparency (order books), and has all the necessary functionalities to actively manage a liquidity account, such as Market Depth presentation, daily reports, FIX connectivity, click and trade buttons, market watch and a complete view of account summary. Moreover, it provides built-in deposits and a CRM system for easy management

Connectivity

Flexible connectivity to Match-Prime Liquidity

Ultra-Fast Data Feeds

Match-Trade Data Feeds provide the low latency price streams for FX, Precious Metals and Digital currencies. In total, we have more than 250 instruments in the offer!

Unique matching engine technology

All price streams are generated in the ultra-fast Matching Engine designed and developed in-house by an experienced team of industry professionals. Our Data Feeds allow all Forex market participants to access reliable sources of FX, CFD and other instruments in the fastest possible way. We also cover multiple equity markets from Europe, USA and Asia

Ultra-fast Data Feeds to ensure low latency

Our Data Feed streams prices directly from both internal market, and various institutional and retail market participants therefore our customers are not dependent on big banks’ pricing policies only

All available prices streamed without delay

Match-Trade’s price streams are not subject to price filtration, therefore our customers will receive all prices available without any delay. This feature is crucial, especially for the market makers or B-Book brokers, as it allows them to provide reliable execution based on the low latency price feeds

Feeds and Liquidity for digital currencies

Match-Trade provides an aggregated feed from different exchanges adjusted to Forex Brokers needs. The liquidity for digital currencies is based on real volumes from selected and trusted exchanges such as Kraken, Gemini, Bitfinex, Bitstamp, CoinbasePro, and LMAX Digital

Key benefits of our Data Feeds

- Data feeds available via FIX or MT4 / MT5 unfired protocol

- Reliable B-Book execution based on Exchange-based Market Depth (VWAP)

- FIX Data Feeds with 5 levels of Market Depth

- Latency arbitrage resistant

- Unique source of prices from the internal market

- A broad range of instruments

- Feeds are integrated with OneZero Hub, PrimeXM, FX Cubic, Tools4Brokers, FTT, Your Bourse, Brokeree and other bridge providers

- Our Feeds are also available in xStation, cTrader, UTIP, Protrader, DXtrade platforms

Know-How

Frequently asked questions

How many instruments do you offer?

We provide liquidity access to 250+ trading instruments on a single account, giving your clients access to various trading opportunities

What kind of the Liquidity Providers you have in your offer?

We offer access to our aggregated liquidity pool with over 20 liquidity providers, including banks, non-banks and internal trading network to provide bespoke Liquidity for both regulated and offshore Brokers

What is the difference between A-Book and B-Book income?

A-Book income is solely based on spread and commission markups. B-Book income is based on transactions’ profit and loss balance. It’s higher risk but can be managed by certain risk management strategies

Contact us

Please fill out the contact form below if you would like to learn more about our technology and services