Bridge MT4 / MT5

with RMS

Ultimate bridging & aggregation technology is now available at a simple flat fee. Our MT4 / MT5 Bridge and Liquidity Aggregator can work seamlessly with many Liquidity Providers, giving you complete flexibility in directly connecting to desired liquidity pools

Key Features

Ultimate bridging & aggregation technology

Multiple LP connection

Our bridging solution provides a broad connection to well-known LPs, and Brokers can aggregate multiple price streams and manage hedge settings in real-time

Risk Management

Bridge by Match-Trade is a solution that allows Brokers to customize risk management settings at the account or group level

Advanced Reporting

With an integrated web reporting module, Forex Brokers can generate detailed reports for all trades processed by the bridge and control how much they earn

Hedge Monitor

Control your hedged exposure on MT4 / MT5 versus the Liquidity provider’s accounts and B-Book exposure with our flexible routing system

Connecting your Liquidity Provider

- Low Cost

You can use our MT4/MT5 Bridge for free if connected to recommended Liquidity Providers. Most importantly we charge only a simple flat fee, no turnover-based fees! - Easy to connect

Moreover, we guarantee seamless connectivity to multiple FIX-compliant Liquidity Providers: LMAX, CFH, Currenex and many more. No plugin installation on MT4 Server needed - Intuitive to manage

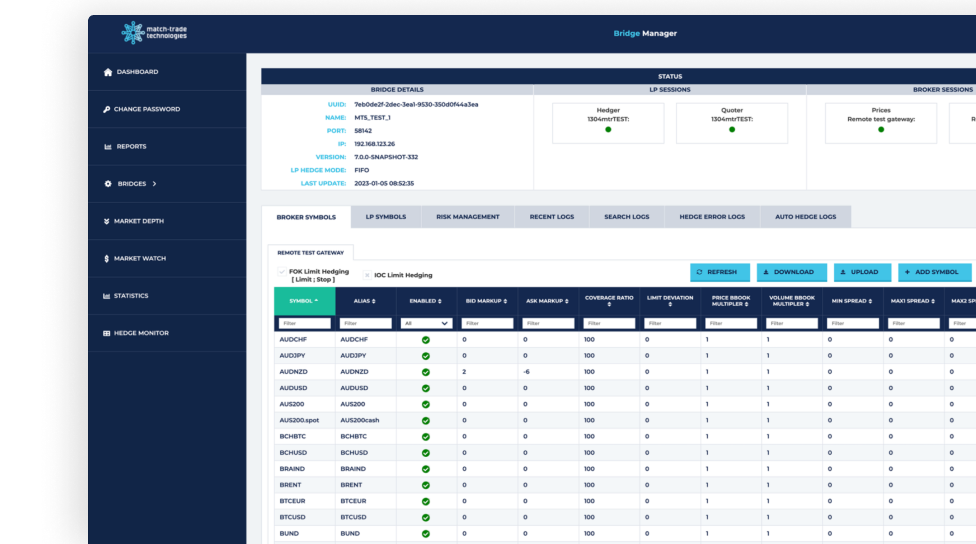

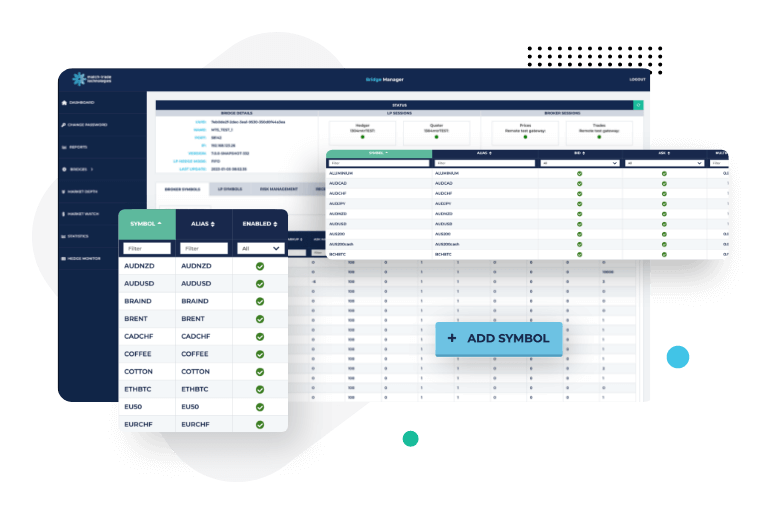

Use our web-based application – Bridge Manager for easy handling of A-Book and B-Book groups and clients. Manage data feeds with min/max spreads, price multipliers and order book modifications

MT4/MT5 Bridge & Aggregator

- Robust risk management system

Firstly keep your profits under control with advanced order routing rules adjusted to your risk management strategy - Wide range of instruments available

Offer your clients extensive investment possibilities with a complete feed for Forex, Indices, Commodities, equity CFDs, Bitcoin, Litecoin, Dash, Ethereum, Ripple, Cardano, Terra, Solana, Avalanche and other popular cryptocurrencies - Transparency

Live view of LP price streams and markups. Order book streaming to MT5 Server - Superb Execution

Get the best prices with the best bid/offer aggregation. Rely on our finest VWAP execution for B-Book trades – fully automated

Know-how

Frequently asked questions

Can I hedge a particular group/offer?

Our Bridge allows you to hedge specific groups, accounts, or instruments, giving you greater flexibility in managing your risk

Is there a setting to execute stop-loss and take-profit orders without price slippage?

Brokers can set a rule for price execution with an exact desired price, avoiding any potential client complaints related to price slippage

Can I set a percentage value of my clients’ trades to be hedged?

Our solution allows brokers to modify the scale on which they want to hedge a group, instrument, or account, giving you more control over your risk management strategy

Contact us

Please fill out the contact form below if you would like to learn more about our technology and services