Our October release brings several practical improvements for both traders and brokers, with Trailing Stop Loss as the standout feature. This tool automatically protects profits by adjusting the stop loss level as the market moves in the trader’s favor, while also helping to limit losses in the event of a reversal. The update also includes Risk Mode, which revolutionizes position sizing through intelligent, automated, risk-based volume calculations, as well as standalone Management apps that make broker operations faster and simpler. We’ve refreshed the Copy Trading module with a cleaner look and added bulk tools for faster account management. New features like an alternative phone field and better CRM exports round out an update that makes trading and account handling easier across desktop and mobile platforms.

Trailing Stop Loss

The Trailing Stop Loss feature has been introduced, enabling traders to set and manage dynamic stop loss orders that automatically adjust as the market price moves in their favor. This helps secure profits while protecting against sudden market reversals. The stop loss level follows the market price at a specified distance, reducing the need for constant manual monitoring.

Traders can activate a trailing stop when opening a new position or add it to an existing one, with full availability on both desktop and mobile platforms. The feature is seamlessly integrated into the trading workflow through the advanced order form and can be managed directly on the trading charts with intuitive drag-and-drop functionality.

For more comprehensive control, the trailing stop loss can be combined with other tools, including Take Profit and Risk Mode. Clear visual indicators and helpful tooltips have been added to guide users, while the interface now provides real-time updates to reflect changes instantly.

Benefits:

- Profit protection working automatically to secure your gains and limit losses, enhancing overall risk management capabilities without requiring constant manual adjustments

- Trading efficiency increased significantly with an intuitive interface featuring real-time updates and direct chart management that makes advanced strategies more accessible through a streamlined experience

- Position management that remains flexible and convenient from any location with full functionality across both desktop and mobile platforms

Please note: the Trailing Stop Loss feature is not available for pending orders.

MTR Broker Management App

The new Broker Manager application has introduced a significant improvement in accessibility by allowing users to launch the Admin and Manager apps directly as standalone executable files. By eliminating Java-based launcher dependencies, we’ve greatly simplified installation and startup, making it easier and faster for Broker Managers to access their tools.

This architectural upgrade transforms the user experience with single-click application access, removing technical complexities that previously hindered daily operations. The straightforward deployment process not only accelerates onboarding but also effectively reduces compatibility concerns, resulting in fewer support requests related to application access.

Benefits:

- Faster, more intuitive application access, supporting Broker Managers in boosting daily workflows and reducing technical hurdles

- Simplified deployment and maintenance, providing brokers with fewer support issues and a more reliable user experience

- Greater operational efficiency achieved by minimizing software dependencies and streamlining application rollout across the organization

Risk Calculator Tool (Risk Mode)

The Risk Calculator Tool, also known as Risk Mode, was introduced to help traders manage their risk more precisely when opening new positions or pending orders. With this feature, traders can activate Risk Mode in the advanced order form, allowing them to specify both their desired stop loss and the amount of risk they are willing to take, either as a fixed value or a percentage of their account balance. Based on these inputs, the system automatically calculates the optimal position size, ensuring that each trade aligns with the trader’s risk profile. All related calculations and order details update in real time, and the feature integrates seamlessly with other order parameters, such as take profit.

Benefits:

- Enhanced risk management allowing traders to automate position sizing according to their individual risk tolerance

- Simplified trading process facilitated by an intuitive interface and real-time calculations, reducing the likelihood of manual errors

- Improved client risk management providing brokers with support for more responsible trading behaviors on the platform

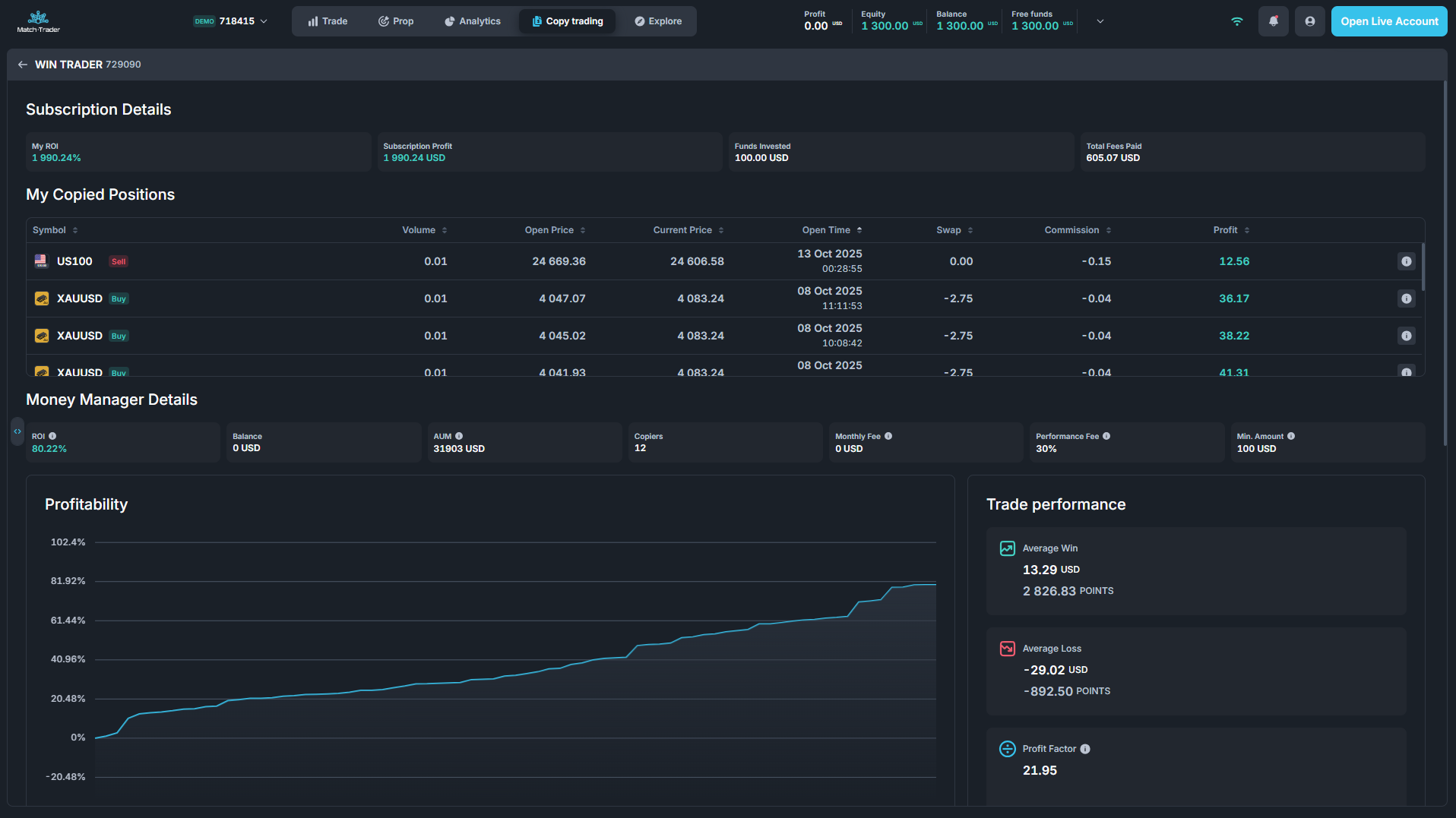

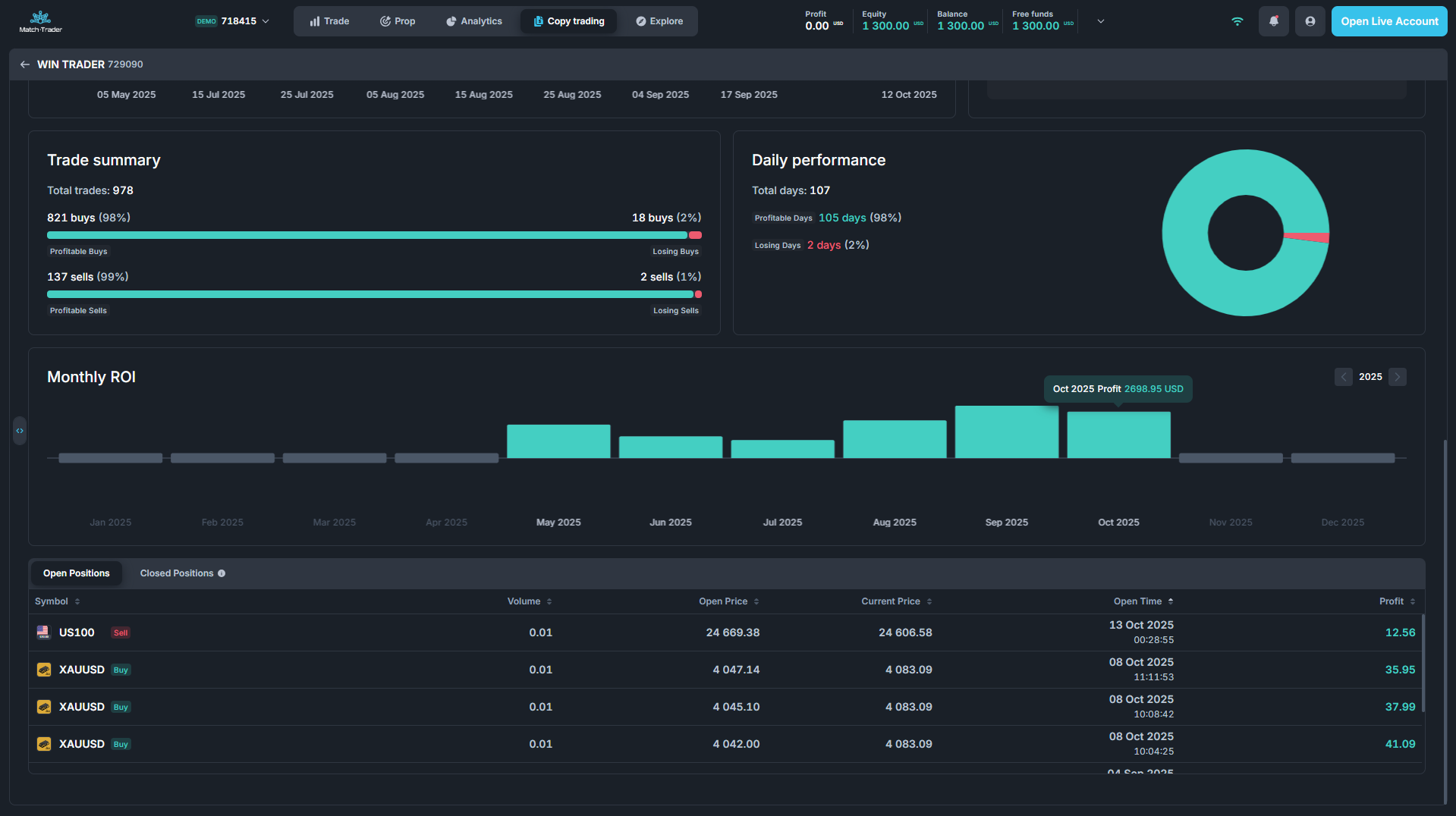

Copy Trading Module in New Match-Trader

A new Copy Trading module has been launched within the Match-Trader platform, delivering a modernized and fully optimized user interface as part of the Social Trading suite. The new UI preserves all functionalities from the previous version while introducing a refreshed design and improved usability. To ensure a smooth transition for users, the interface has been thoroughly tested for compatibility across various screen resolutions, browsers, and mobile devices. This comprehensive testing, along with the implementation of all essential features, guarantees a production-ready Copy Trading experience for all platform users.

Benefits:

- Increased user engagement and satisfaction through a modern, intuitive, and visually appealing Copy Trading experience

- Minimized learning curve and migration risk by ensuring full functional parity with the legacy UI

- Strengthened operational efficiency delivered through optimized workflows and seamless integration with backend services

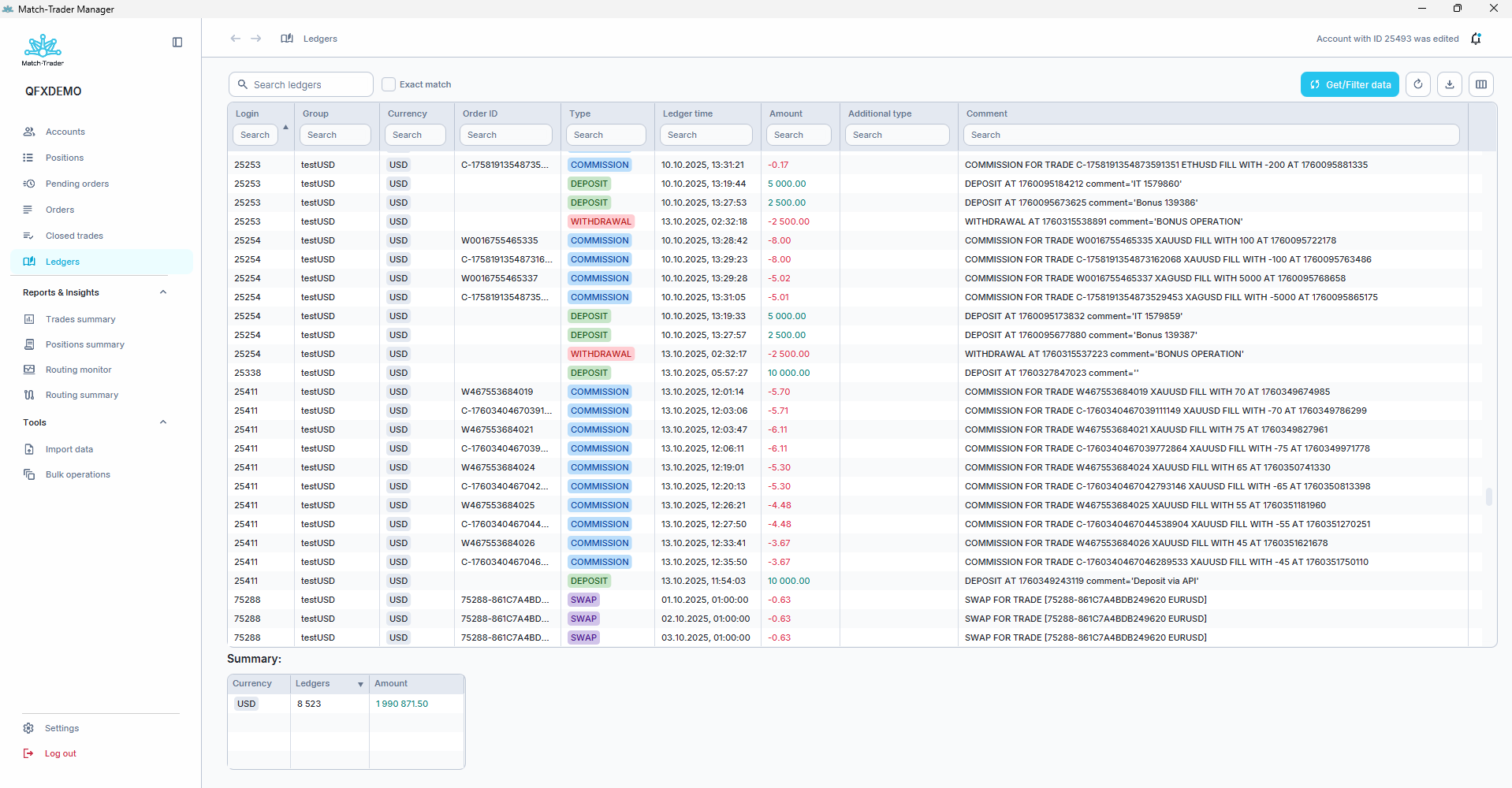

Manager App’s UI/UX Upgrade

The Manager App now showcases a sophisticated visual identity with the implementation of comprehensive UI/UX upgrades aligned with contemporary design standards. This release completes the entire visual refactor for Manager 2.0 App, delivering a cohesive aesthetic experience across all screens and interface elements. The update includes final adjustments, minor improvements, and bug fixes to guarantee a seamless and visually coherent user experience across the application.

Benefits:

- Elevated user satisfaction through a sleek, modern, and consistent interface that enhances engagement and usability

- Streamlined daily operations with intuitive design that empowers Broker Managers and administrators to work more efficiently

- Reinforced brand credibility with contemporary design standards that reflect your company’s commitment to excellence and professionalism

- Minimized user friction and support overhead through clear, well-structured, and easy-to-navigate interface

“Change MTR Pro Setting” Bulk Operation

The Manager App now includes a powerful new bulk operation designed to streamline MTR Pro configuration management. MTR Pro displays order book depth on the Match-Trader platform, aggregates positions, and shows prices as Volume-Weighted Average Price (VWAP).

Thanks to the update, users can enable or disable MTR Pro settings across multiple trading accounts simultaneously, eliminating the need for individual account updates. To access this feature, users simply choose “Change MTR Pro setting” from the Bulk Operations context menu. The system then presents an intuitive dialog with a toggle switch, allowing users to apply their desired MTR Pro status to all selected accounts with a single action. Once executed, the configuration updates are automatically reflected across both the user interface and exported reports, ensuring data consistency throughout the platform.

Benefits:

- Streamlined management of MTR Pro settings across multiple accounts, saving significant time for administrators

- Reduced risk of manual errors through consistent, bulk-update capabilities that ensure accuracy

- Boosted operational efficiency for brokers managing large portfolios of trading accounts

- Improved reporting clarity with MTR Pro status clearly visible and sortable in both the UI and exported data

Bulk Symbol Deletion in Admin 2.0

Admin 2.0 now supports bulk deletion of symbols, speeding up instrument management.

Benefits:

- Valuable time savings with faster instrument management when editing and organizing the symbol list

- Greater precision by working exclusively on selected elements

Margin Call Email Controls in QFX Admin

QFX Admin 2.0 now offers enhanced flexibility with group-specific Margin Call email management. Administrators can selectively enable or disable these critical notifications for individual user groups through an intuitive toggle switch located in Groups → Group Details → SMTP tab.

This granular control empowers admins to tailor communication strategies based on group requirements while maintaining operational consistency. By default, notifications are enabled for both new and existing groups, ensuring continuity. When deactivated, traders within the designated group no longer receive Margin Call email alerts.

Benefits:

- Precise control over Margin Call notifications, enabling tailored communication strategies for different client groups

- Reduced email traffic for groups where Margin Call notifications aren’t required, creating a better client experience

- Supported compliance and operational flexibility through quick notification setting adjustments as business needs evolve

Customizable Indicator Chart Height

Traders can now adjust indicator chart heights directly within the platform across both desktop and mobile interfaces. This feature includes an intuitive resize handle and on-hover highlighting that make it simple for users to customize their technical indicator displays to suit their preferences. The scaling mechanism ensures that all indicator charts remain readable and visually consistent, even when multiple indicators are displayed.

Benefits:

- Optimized workspace personalization enhancing analytical clarity and trading comfort

- Intuitive chart flexibility creating a more responsive and user-centric experience

- Streamlined technical analysis supporting more confident and effective trading decisions

Price Info in Toast Notifications

Toast notifications for trading events deliver comprehensive price information directly to traders, offering instant, detailed feedback on opening, closing, or updating positions and pending orders. Updated notification titles and messages ensure clear, consistent communication across both desktop and mobile platforms.

Benefits:

- Faster, more confident trader decisions, enabled by richer notifications that surface the right details at the right moment

- A more transparent, professional user experience across the platform

- A stronger broker value proposition by highlighting improved notification capabilities

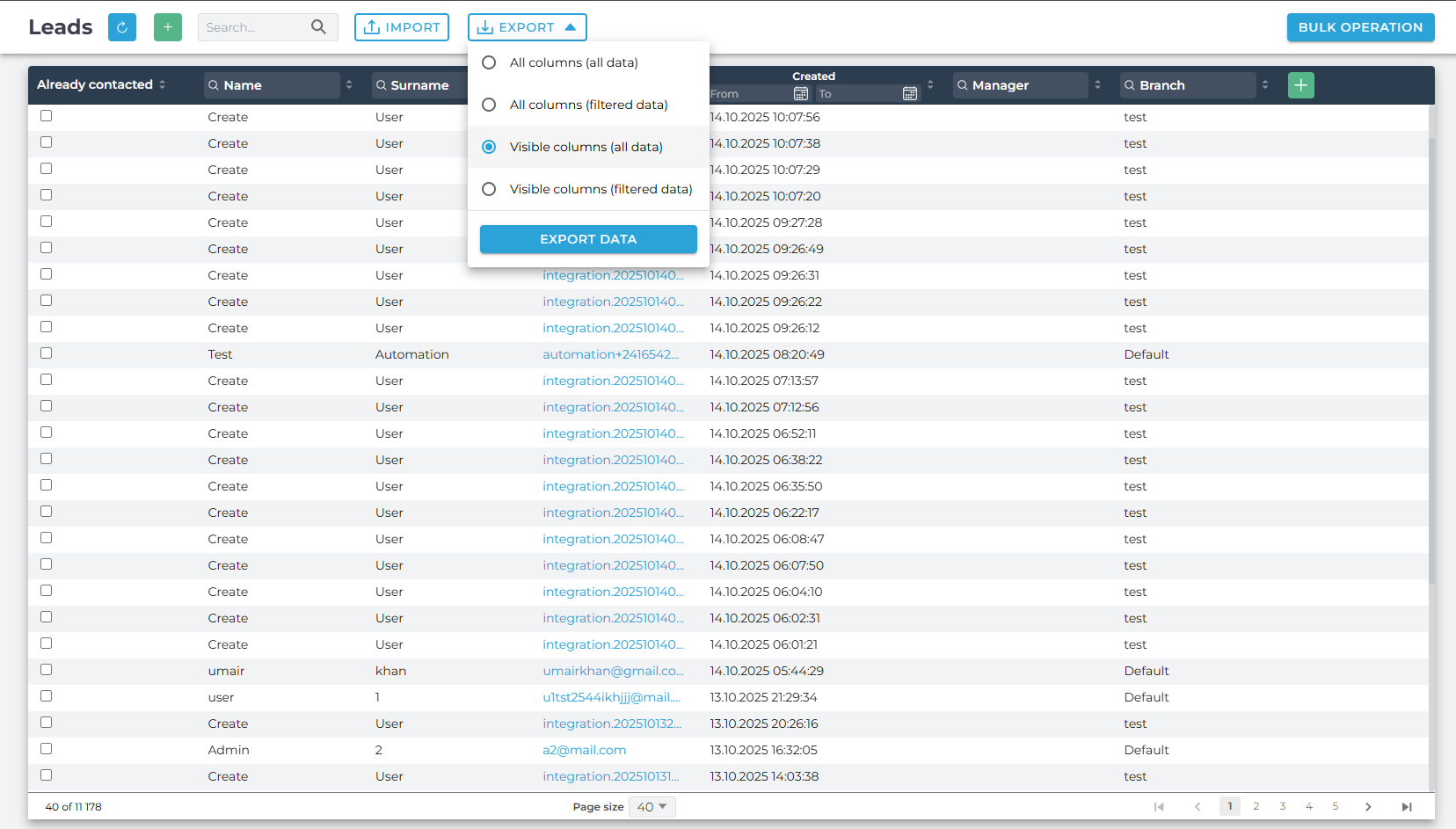

Export Options for Clients, Leads, Deposits, and Withdrawals Tabs

The export functionality across CRM tabs including Clients, Leads, Deposits, and Withdrawals has been expanded. Users now have exact control over their exports with four options: all columns with all data, all columns with filtered data, visible columns with all data, and visible columns with filtered data. The dropdown intelligently reflects any active filters and column settings in the export menu, ensuring that exported files match the user’s specific requirements. The redesigned import/export buttons now follow the latest design guidelines, creating a more cohesive and user-friendly experience.

All implemented improvements allow CRM users to export precisely the data they need for reporting and analysis, whether they require comprehensive datasets or only the information currently visible on their screens. The changes also ensure that essential system columns are always included in exports, even if they are hidden in the table view.

Benefits:

- Increased time efficiency, with CRM users being able to customize data exports to match their exact reporting needs, eliminating unnecessary manual data processing

- Data integrity improved with automatic inclusion of essential system information in all exports, supporting compliance requirements

Prop Trading Restrictions

The Prop Trading Restrictions module is used to define and monitor trading rules on prop accounts. It enables brokers to introduce various types of restrictions related to risk, position size, or transaction opening time. Thanks to centralization in the CRM, all rules and violations are easily accessible, ensuring consistent and transparent management of prop accounts. All notifications related to violations of the set rules appear in the trading restrictions tab and in the Evaluation Requests tab for each account, allowing brokers to perform detailed analysis and monitoring of traders’ behavior. Four types of trading restrictions can be configured.

News Trading Restriction

This functionality controls whether traders open transactions within a specific time window before or after key economic calendar events. It applies to all instruments related to the event’s currency (e.g., publication from the USA affects all USD pairs and instruments). The time window can be configured separately for before and after the event and tailored by its impact (low, medium, high).

Benefits:

- Effective limitation of risk associated with sudden market volatility

- Better control of trader behavior during major releases

- Support in creating a consistent policy aligned with macroeconomic events

Setting Stop Loss Restriction

A new functionality in the prop trading restrictions module checks if each trader sets a Stop Loss level for their transactions within a specified time. The system analyses all cases – both setting SL at the moment of opening the transaction, its later modification, as well as removal and re-setting. If the time to add or restore the Stop Loss is exceeded, the broker receives an appropriate notification.

Benefits:

- Greater control over the application of basic risk management principles

- Faster identification of traders who bypass safeguards

- Easier analysis of tickets and complaints related to account servicing

Max Risk per Trade Restriction

We’ve introduced the option to verify whether a trader hasn’t exceeded the permitted level of risk for a single transaction relative to the account’s initial balance. The system automatically calculates the allowable loss based on the defined percentage limit and compares it with the value of the potential loss resulting from the set Stop Loss. When this level is exceeded, a broker receives a notification.

Benefits:

- Consistent application of risk management principles

- Protection against excessive loss on a single order

- Greater stability and security of prop capital

Lot Size Limit Restriction

The new restriction allows brokers to limit the cumulative value of open positions (measured in lots) relative to the account’s initial balance. The system sums the volume of all open positions – regardless of direction (BUY and SELL add up). If the allowable threshold is exceeded, the broker is informed immediately.

Benefits:

- Possibility to differentiate limits depending on account value and challenge stage

- Full control over exposure relative to account size

- Prevention of excessive loads resulting from many open positions

Max Daily Profit

A new parameter – Max Daily Profit – has been introduced in the challenge configuration, allowing you to set the maximum daily profit that a trader can earn since the last snapshot. The system monitors the current equity level of the account, and when the set limit is reached it automatically closes all open transactions and blocks further trading until the next snapshot.

Benefits:

- Control over daily profit levels on a trader’s account

- Reduced risk from uncontrolled growth of exposure

- Automatic system operation without manual intervention by the broker

Account Manager Changes Displayed in Timeline

The upgraded Timeline view displays detailed information about Account Manager reassignment for a given account. The system now clearly identifies the responsible party by displaying the full name and email address of the CRM user who executed the change, with visibility controlled by user permission levels. For changes made by automated lead assignment rules, the rule name is shown instead. This improvement covers all modification types – single, bulk, and rule-based.

Benefits:

- Greater transparency into account management activities for brokers and managers

- Advanced auditability and accountability for changes made to account assignments

BCC Option for Email Notifications

The CRM’s email notification system has been enhanced with a new BCC (blind carbon copy) capability in the mailing settings. Users can now activate this feature for selected operations and choose one or multiple recipient addresses to receive duplicate copies of outgoing notifications. This upgrade facilitates automated feedback collection and strengthens communication tracking.

Benefits:

- Significant time savings and reduced manual effort, with CRM users being able to automate the entire process of sending review requests to platforms like Trustpilot

- Oversight capabilities expanded through better administrator visibility of all outgoing communications, elevating both compliance efforts and transparency

Group Column in the Platform Logs Table

A strategic improvement has been implemented to the Platform Logs table by introducing a new “Group” column, positioned between the existing “Country” and “App version” columns. This addition expands log management capabilities by enabling users to efficiently search, sort, and export logs based on group classifications. The new structure streamlines the process of analyzing user behavior patterns and conducting investigations of reported cases.

Benefits:

- Faster incident investigation and resolution possible with support and compliance teams quickly identifying and filtering user actions by group

- Optimization of administrator work through improved reporting and more comprehensive data export capabilities

Alternative Phone Number Field

An “Alternative Phone Number” field has been added to KYC and registration forms, enabling traders to provide a secondary contact number. The field can be configured as required or optional, and is available in both demo and live registration flows. It also appears in account details and is included in data exports. Access to this data is governed by user permissions.

Benefits:

- Improved client service in regions where multiple contact numbers are common

- Enhanced data collection, completeness, and communication flexibility for both clients and administrators

- Stronger alignment with local practices and smoother client onboarding

Manual Withdrawals for Demo Accounts

The manual withdrawal endpoint now supports withdrawals from demo accounts. Both CRM and Broker API users can initiate and process demo withdrawals using the same controls as live flows. All transactions are recorded in the CRM and broker systems, ensuring end-to-end visibility.

Benefits:

- Fund management flexibility expanded for CRM users and administrators managing demo accounts

- Testing and training support strengthened with brokers gaining enhanced demo account management options

Broker API: Extended Open Positions Endpoint

The POST /v1/trading-accounts/trading-data/open-positions endpoint has been extended to accept the ‘includeLocked’ and ‘includeBlocked’ parameters. This update gives users greater flexibility in data access by allowing them to specify whether to include locked or blocked trading accounts when retrieving open positions.

Benefits:

- Custom data accessibility allowing Broker API users to tailor data retrieval to specific operational requirements

- Manual filtering reduced, saving time for users managing large account sets