This month, we’ve focused entirely on giving brokers deeper insights into platform activities. The main highlight of the update is the expanded Platform Logs in Manager 2.0, which now offers unprecedented visibility into user behavior and trading actions. This means faster dispute resolution, proactive security management, and streamlined compliance. The remaining updates build on the same goal of putting more control in brokers’ hands while making daily operations both easier and more reliable.

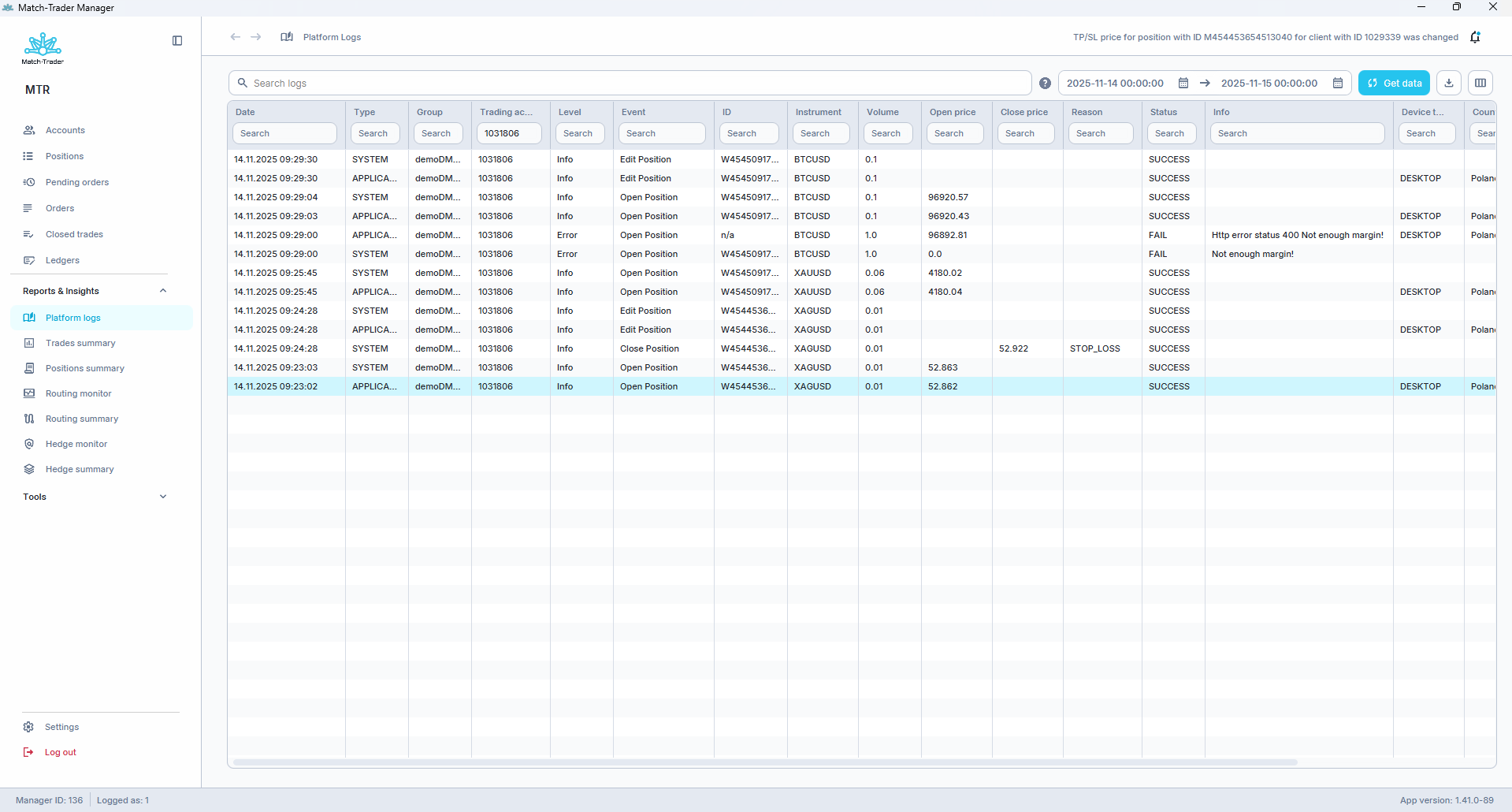

Platform Logs in Manager 2.0

Manager 2.0’s Platform Logs tab now delivers detailed records of critical trading and account operations directly to brokers. They can track logs for actions such as opening, editing, and closing positions, partial closes, creating and managing pending orders, as well as user sign-ins and sign-outs. Each log entry is packed with context – device type, browser identifiers, IP addresses, and group associations. This equals no more relying on external systems for investigations. Brokers can quickly investigate user activity, identify suspicious behavior, and resolve disputes, all within the same system. By surfacing granular operational data, the solution empowers users to proactively detect potential fraud or abuse and ensure regulatory compliance.

Benefits:

- Tracking of every trading action and account activity – from user access to order management – all within Manager 2.0

- Quick spotting of potential fraud with rich contextual data available: devices used, browser signatures, and precise IP addresses

- Enhanced operational transparency and auditability, helping brokers resolve client disputes and meet compliance requirements effortlessly

Account Statement in Manager 2.0

We’ve added an innovative, unified account statement feature to Manager 2.0. Managers can now generate complete reports covering positions, pending orders, trades, and ledger history in one place. With intuitive data selection and flexible export options in both HTML and CSV formats, professional reporting to clients and stakeholders has never been simpler.

Benefits:

- Customized account statements that exactly match specific client or internal reporting needs

- Flexible export options that satisfy any business scenario or regulatory demand

- Stronger client relationships built through enhanced transparency and professional communication

Position Margin Information Added to Manager 2.0 UI

Critical margin details are now visible in both Positions and Closed Trades sections of Manager 2.0. These snapshots, captured when positions are opened, give brokers and managers traceable insights into margin requirements and associated trading costs. This powerful addition supports more informed decisions and clearer client discussions about margin usage.

Benefits:

- Deeper insights into real-time margin utilization patterns across your client base

- Client confidence built through transparent cost presentation

- Strengthened risk management and improved quality of advisory services

Refund Ledgers Added to Manager 2.0

A new refund capability in Manager 2.0 allows brokers to efficiently correct or reverse selected financial operations right from the Ledgers section. They can now refund deposits, withdrawals, as well as credit-in and credit-out transactions individually or in bulk. The system automatically updates account balances, providing clear notifications when refunds aren’t permitted for a specific ledger. Every refund action is properly logged for complete transparency and auditability of broker operations.

Benefits:

- Quick resolution of financial discrepancies through direct ledger operation refunds without manual intervention or support requests

- Process acceleration via bulk corrections with reduced administrative workload for operations teams

- Operational transparency through automated logging and clear notifications to maintain compliance standards

Bulk Options in Manager 2.0

Bulk-operation capabilities have arrived in Manager 2.0, enabling brokers to perform mass actions across positions, pending orders, and closed trades. This upgrade dramatically cuts the time spent on manual trade management, greatly improving responsiveness to client needs while reducing administrative overhead.

Benefits:

- Efficiency boost through simultaneous handling of multiple trades and orders

- Manual workload reduction and error risk minimization in high-volume operations

- Unlimited growth potential with scalable operations and consistent service quality

Swap Markups on Group Level

Our new feature enables percentage-based swap markups at the group level. This automation eliminates manual calculations while ensuring consistent swap application throughout specified client segments. Supporting both individual and bulk editing, it gives brokers unprecedented efficiency and flexibility in managing trading conditions.

Benefits:

- Intelligent automation of swap calculations for the elimination of tedious manual processes

- Transparency in swap structures for increased client trust and confidence

- Flexible configuration options with customizable trading conditions across different client groups

Swap Markups and Margin Call Notification Switch in WL Manager

We’ve integrated swap markup configuration and margin call notification settings into the WL Manager. Previously exclusive to the Admin interface, swap markups and margin call notifications can now be managed directly from your preferred WL environment. This eliminates platform-hopping and streamlines operational workflows significantly.

Benefits:

- Centralization of essential account settings through a single, intuitive interface

- Consistency in configuration across management tools for reduced operational risk

- Customization of trading conditions with unprecedented ease and flexibility

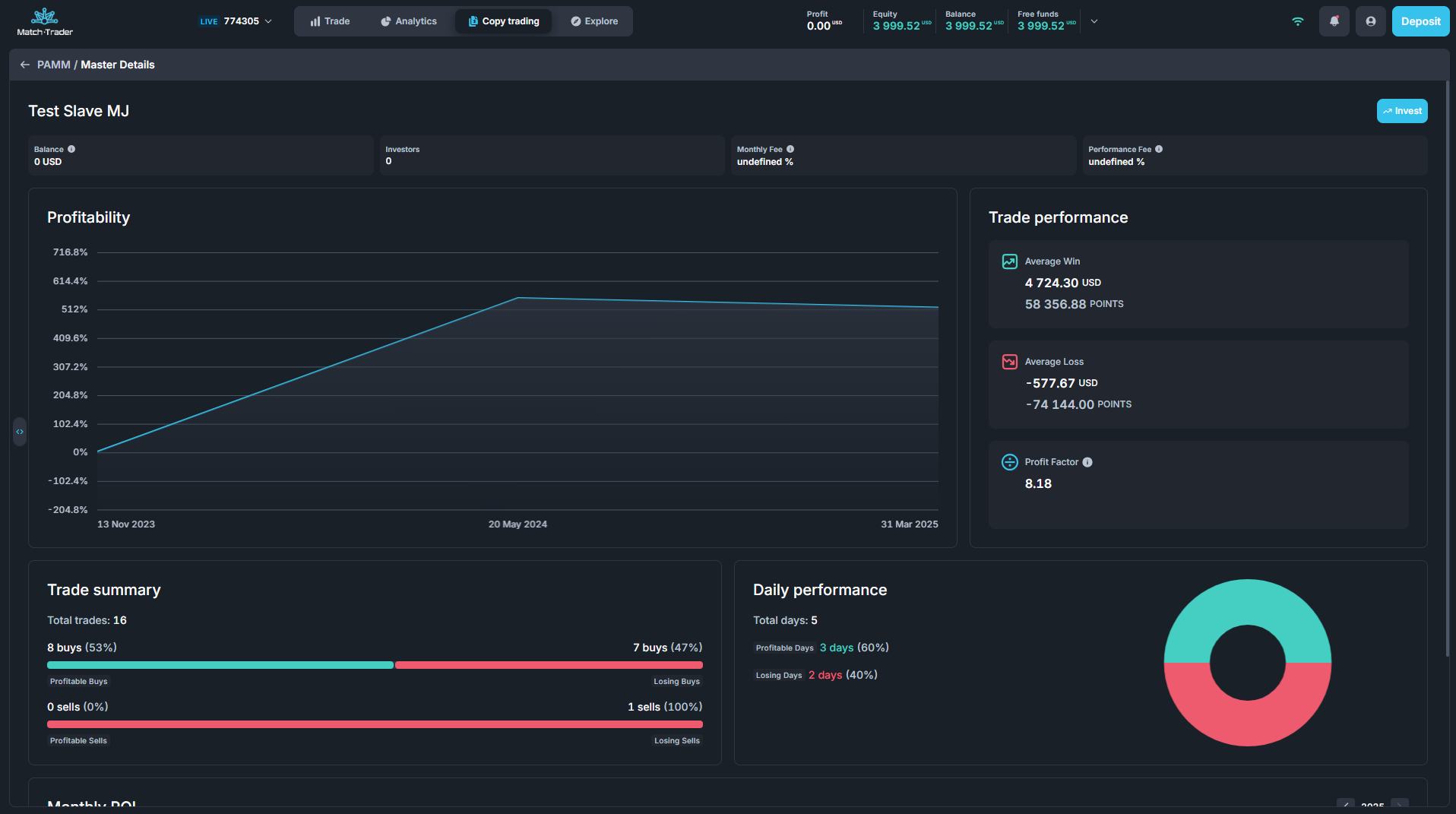

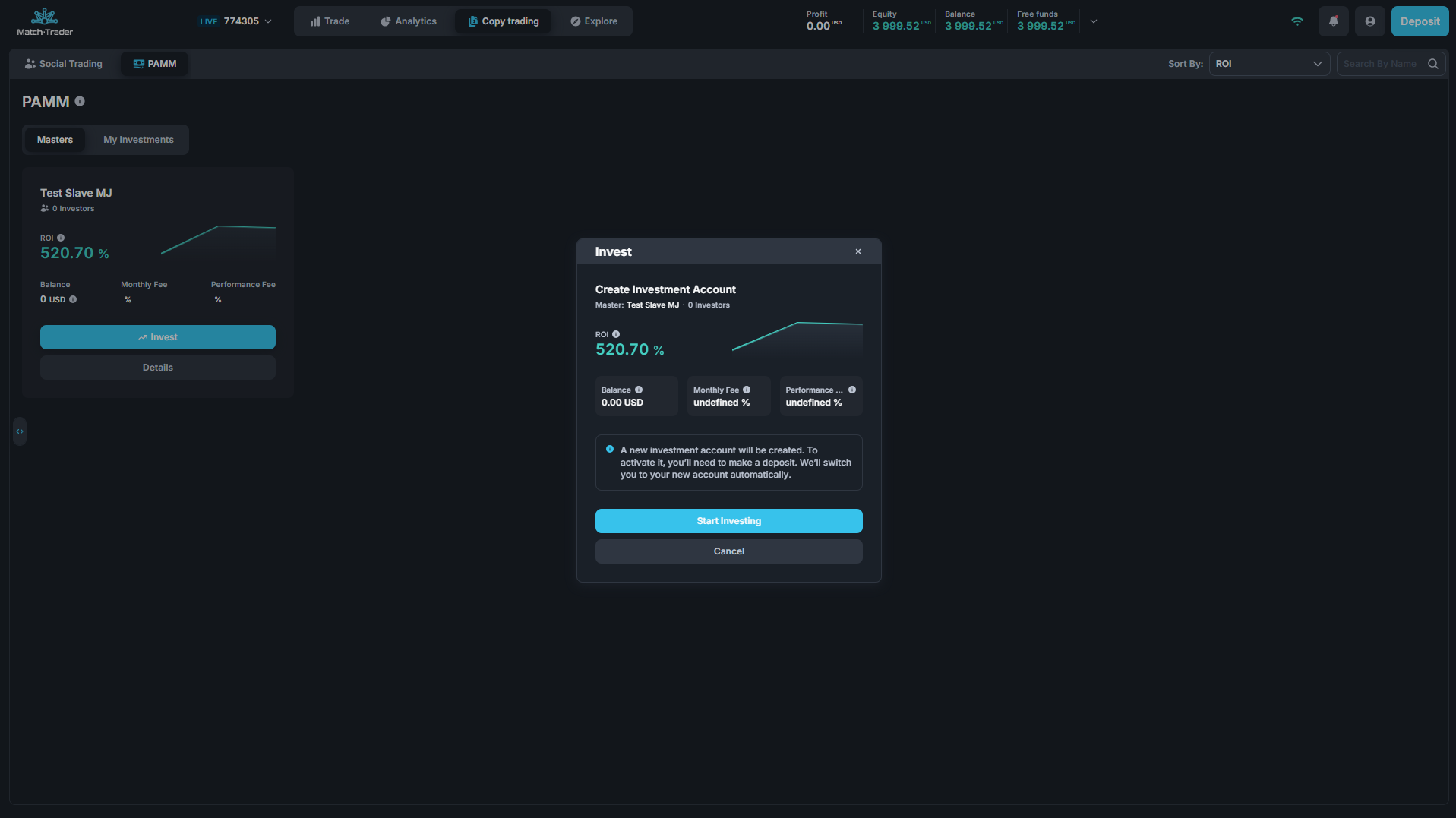

PAMM in the New Match-Trader Platform

The PAMM module (Percent Allocation Management Module) has been redesigned for the Match-Trader platform, delivering a completely modernized yet familiar user experience within our Social Trading suite. While sporting a sleek, contemporary look, it preserves all existing functionality from the legacy system. All essential tabs and features for production-ready PAMM operations are fully implemented, with exhaustive cross-platform testing ensuring a flawless user transition and strong performance across various resolutions and mobile devices.

Benefits:

- Intuitive interface for Copy Trading, with a modern design for increased user engagement

- Risk-free transition with complete functional parity with the legacy UI, with no retraining required

- Internal performance enhancement through optimized workflows and seamless backend integration

Option to Hide the Ask Line on Charts

Traders can now choose to hide the ask line on charts, gaining greater control over their technical analysis environment. This user-driven feature allows for personalized market data presentation tailored to individual trading styles and preferences. It creates a more focused trading experience and demonstrates our commitment to creating a platform that adapts to users’ needs.

Benefits:

- Chart customization for better clarity and reduced visual clutter during analysis

- Higher appeal to professional users through greater flexibility and control over their trading environment

Performance Optimization for Large Data Lists

We’ve revolutionized how the platform handles large data lists, including open positions and orders. By rendering only visible items, the system markedly increases performance and responsiveness for users managing extensive portfolios. Load times are now lightning-fast and navigation remains smooth regardless of data volume. This creates a more scalable and robust trading environment for growing brokerages.

Benefits:

- Accelerated speed and responsiveness during active trading

- Improved support for demanding clients with large and complex portfolios

- Reduction of technical barriers to platform scalability and growth

Enhanced Update Mechanism for Application Versions

Our redesigned update system puts traders in control, offering the option to install updates immediately or defer them until their next session. This solution eliminates unwanted disruptions during crucial active trading periods and allows users to manage their experience. For critical updates, an enforced installation ensures platform security is never compromised.

Benefits:

- Minimized interruptions during trading sessions and enhanced overall user satisfaction

- Control over updates, aligned with individual trading timeframes and operational preferences

- Security assurance with continuous maintenance of critical protective features

Registration via URL with Hidden Feature Enabled

Traders can now register through direct URLs even when the registration feature is hidden on the platform. This lets brokers control visibility of public registration while still supporting targeted onboarding campaigns or partner-driven registrations. It’s a flexible approach that adapts to various business needs.

Benefits:

- Exclusivity through invitation-only registration opportunities for targeted campaigns

- Precise control over user onboarding processes and granular access and privilege management

- Partnership opportunities with customized growth initiatives and specialized collaboration frameworks

Totals Row for Swaps, Commissions, and Profits in Exported Statements

Now, exported CSV and HTML statements include a totals row for both open and closed positions, automatically summarizing swaps, commissions, and profits. This simple yet powerful addition offers instant performance insights without manual calculations, streamlining reporting capabilities and facilitating more effective financial analysis for all users, whether traders or brokers.

Benefits:

- Immediate insight into overall performance metrics with access to critical trading data

- Elimination of calculation errors through automated financial summaries

- Enhanced value of exported statements for compliance requirements and comprehensive reviews

Expanded Trading Account Update Capabilities

Trading account management now allows leverage adjustments alongside changes to other parameters in a single operation. This eliminates multiple API calls for account modifications and streamlines account administration. By consolidating multiple changes into one seamless action, the solution cuts operational friction and saves valuable time for brokers and administrators.

Benefits:

- Improved efficiency in account management, with reduced manual effort and operational delays

- Workflow enhancement for API users, enabling more responsive client service delivery

- Competitive advantage through technical complexity reduction and streamlined operational processes

‘additionalType’ Added to All Ledger Data Models

The ‘additionalType’ attribute now spans all ledger-related REST endpoints and gRPC streams. This update enables precise filtering based on transaction types, perfectly aligning with QFX standards. It substantially raises data consistency while providing brokers and partners with unprecedented flexibility for financial record access.

Benefits:

- Granular control over financial data extraction, analysis, and compliance with expanded parameter options

- Full compatibility with industry requirements for institutional clients and regulatory frameworks

- Enhanced filtering for improved operational efficiency within finance and back-office teams

Reopened Closed Position Endpoint

A new API endpoint enables instant reopening of previously closed trading positions, without the tedious manual recreation. Brokers and administrators can now restore closed positions quickly with complete accuracy, maintaining all original parameters. The feature promotes operational agility, enabling trading teams to respond decisively to client requests or market developments.

Benefits:

- Speed optimization in position restoration for enhanced client service without errors or delays

- Elimination of risks and costly mistakes during manual position recreation

- Operational flexibility in trading activities for competitive advantage and increased responsiveness