Our January release delivers upgrades across trader experience, prop infrastructure, and operational efficiency – strengthening your competitive edge. Traders get more visual flexibility, as well as advanced prop trading and analytical capabilities, while brokers gain new revenue levers and reduced operational friction without sacrificing enterprise-level control. Key updates include:

- Prop Challenge Boost Add-On – increase Max Loss and Max Daily Loss limits during challenges

- Self-Service Webhooks Management Interface – configure and monitor real-time integrations

- Advanced Chart and Candle Customization – personalize trading interface appearance

- Percentage-Based Y-Axis Display – assess relative market movements and compare instruments

- New Area and Bar Chart Visualizations – use additional chart types for different trading styles

- Dynamic Widget Positioning in Fullscreen Chart Mode – optimize workspace ergonomics

- Horizontal Chart Screen View – maximize screen space by changing device orientation

- Translation Mechanism (i18n) & Global Language Packages – access multilanguage support across 15 languages

- Max Trailing Drawdown for Prop Trading – offer dynamic risk management options for challenges

- Consistency Rule for Profit Targets and Withdrawals – enforce consistent performance for withdrawals

- Promo Code and Add-On Management for Existing Accounts – assign or remove codes pre-payment

- Prop Withdrawals via CRM Bank Transfer Gateway – process funded prop accounts through the CRM

- Equity Value Recorded Before Financial Operations – get accurate data for ROI calculations and reporting

- Balance Push After Leverage Change on Trading Account – ensure margin calculations and account balances remain accurate

- Additional Validation to GTD Orders – prevent erroneous or unintended order placements

- MIFID Request Management Module – handle MIFID requests within the CRM

- Virtual Scroll for Money Manager Leaderboard – improve responsiveness by rendering visible elements

Prop Challenge Boost Add-On

A Challenge Boost add-on has been developed, letting traders dynamically increase their Max Loss and Max Daily Loss limits during prop challenges. Now, a critical moment pop-up notifies the trader at loss threshold proximity, a dedicated info interface explains the add-on’s benefits and conditions, and a simplified purchase section offers immediate access. In the CRM, a complete configuration tab gives brokers and prop firms the ability to define, administer, and monitor Challenge Boost parameters for each challenge, including dynamic fee structures and CSV export of all applied boosts. This prop infrastructure enhancement delivers bilateral value: trader flexibility and centralized visibility and control for brokers.

Benefits:

- Direct revenue stream: Monetizing risk tolerance through paid boosts creates a new source of income for brokers.

- Stronger retention: Traders can avoid automatic disqualification at critical thresholds, which keeps them engaged longer.

- Upsell automation: The “critical moment” popup acts as a proactive sales tool, precisely when it’s most relevant.

- Centralized governance: CRM-based configuration, fee control, and CSV reporting make oversight simple and auditable.

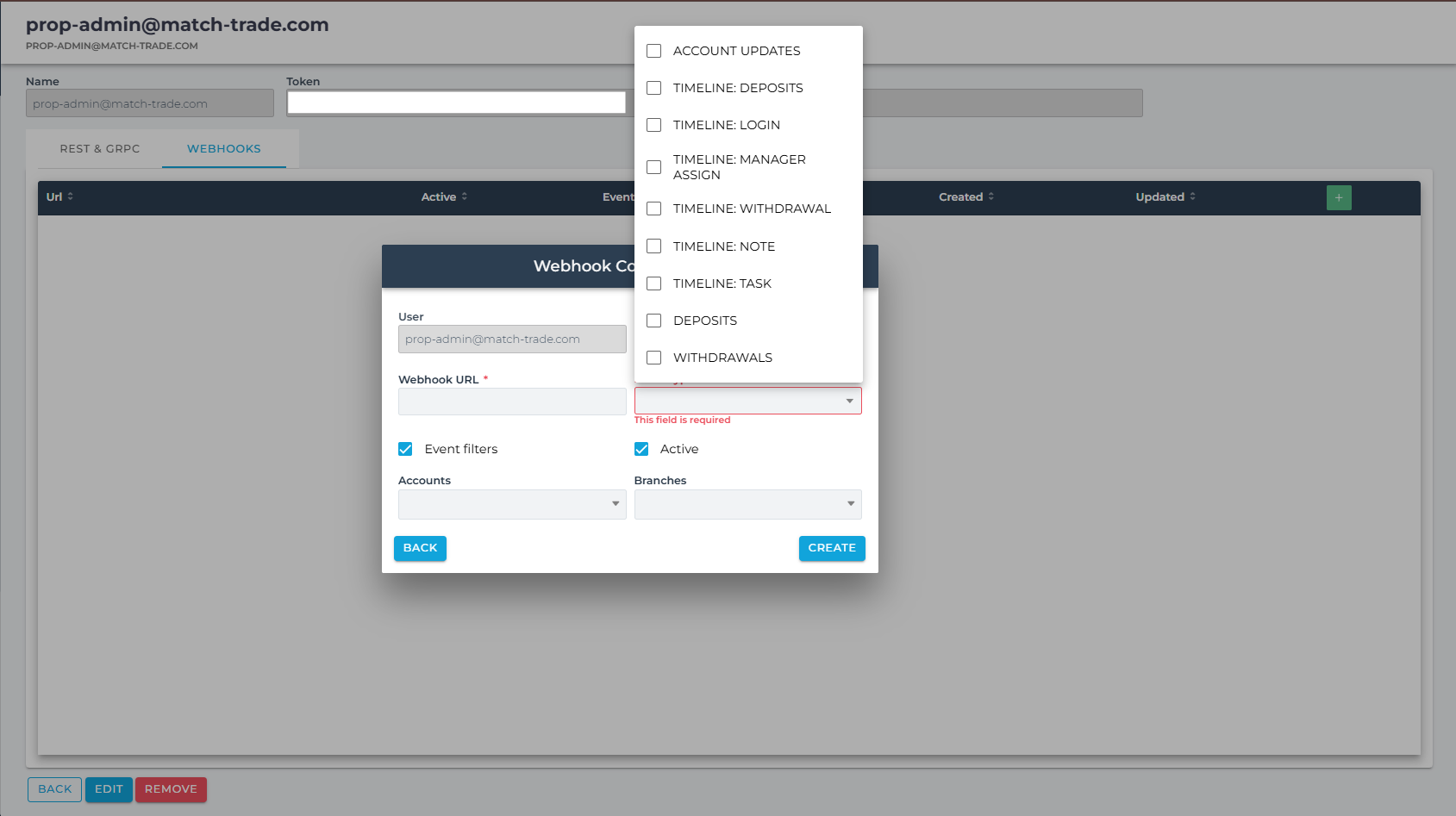

Self-Service Webhooks Management Interface

A new Webhooks management interface is now available in the CRM’s API Access section, allowing brokers and partners to set up, test, and monitor real-time integrations for event-driven workflows. Authorized users can independently create and maintain webhook configurations, select trigger events, and apply precise account- or branch-level filters.

The interface includes built-in connectivity testing for instant validation feedback and automatically disables failing webhooks to protect system integrity. This self-service tool streamlines integration with external systems – such as marketing automation or reporting platforms – while keeping data delivery transparent, controlled, and dependable.

Supported Events:

- Accounts and Trading: Account creation, updates, and login events.

- Financial Operations: Deposits and withdrawals.

- Management & CRM: Manager assignments, tasks, notes, and their corresponding timeline events.

Benefits:

- Operational automation: Business processes are streamlined by providing instant, real-time notifications for critical platform events.

- Targeted integrations: Granular filters send only the necessary data to external systems, improving security and efficiency.

- System reliability: Built-in testing and automatic error handling reduce integration downtime and manual troubleshooting.

- Enterprise readiness: Enterprise-grade webhooks infrastructure signals platform maturity and delivers scalable third-party connectivity.

Advanced Chart and Candle Customization

A comprehensive chart customization feature has been introduced, allowing traders to personalize the appearance of their trading interface. Users can now adjust colors and visibility for various elements, including backgrounds, grids, axes, crosshairs, and candlestick components. The new settings panel allows for live previews and an instant reset to default values. All customizations are synchronized via the backend across all devices, ensuring a consistent trading environment regardless of the platform used.

Benefits:

- Strategic value: Tailored visuals reduce cognitive friction and enhance analytical precision during critical decision-making.

- Multi-device consistency: Cloud-saved settings ensure a seamless transition between desktop and mobile.

- Reduced friction: Preview and reset options allow for risk-free experimentation with chart styles.

Percentage-Based Y-Axis Display

Traders can now visualize the Y-axis on charts as a percentage change from a base value, rather than absolute price. This allows traders to quickly assess relative market movements and compare instruments more effectively. All relevant chart elements, such as bid, ask, take profit, stop loss, and pending orders, now reflect percentage changes, providing a clearer view of market dynamics. The calculation engine operates continuously with incoming data, ensuring analytical relevance in real time.

Benefits:

- Faster interpretation: Traders can make faster, more informed decisions by visualizing relative price movements.

- Cross-instrument analysis: Direct comparison across different instruments appeals to professional-grade user segments.

- Competitive signal: Enhanced analytical capabilities improve market positioning and broaden user appeal.

New Area and Bar Chart Visualizations

We’ve expanded the platform’s toolkit with two chart visualization types – Area and Bar. These options provide traders with additional ways to analyze market data, catering to different trading styles and preferences. The update ensures smooth transition between chart types, maintaining consistent performance across devices.

Benefits:

- Analytical flexibility: More visualization options support diverse strategies and analytical approaches.

- Market attraction: Added depth attracts advanced traders and professional operations.

- Broker differentiation: Expanded charting capabilities strengthen competitive positioning in broker evaluations.

Dynamic Widget Positioning in Fullscreen Chart Mode

The Quick Trade and Advanced Order widgets now feature enhanced repositioning capabilities within fullscreen chart mode, supporting both native and TradingView chart integrations. Widget positioning resets to default upon fullscreen exit or re-entry to maintain interface consistency, while the added visual drag indicator makes desktop manipulation intuitive. This upgrade allows traders to customize their workspace for greater comfort and efficiency during trading sessions.

Benefits:

- Execution optimization: Customizable workspace architecture improves execution efficiency and reduces operational friction.

- Professional signaling: Enhanced flexibility supports advanced trading strategies and multitasking.

- Retention mechanics: Workspace customization drives client acquisition, habit formation, and long-term platform retention.

Horizontal Chart Screen View

Automatic horizontal chart mode activation is now supported upon device orientation change, allowing users to analyze charts more comfortably. This feature ensures that the chart occupies a larger portion of the screen, maximizing screen utilization for immersive analytical experiences. The horizontal mode is activated automatically upon device rotation, while vertical orientation automatically restores standard display mode without manual intervention.

Benefits:

- More usable space: Expanded screen space improves pattern recognition and chart readability.

- Effortless adaptation: The intuitive orientation-based switch delivers a seamless user experience without explicit configuration.

- Mobile elevation: A responsive chart experience raises the quality of mobile trading.

Translation Mechanism (i18n) & Global Language Packages

We’ve deployed a comprehensive translation engine, supporting dynamic language delivery across 15 languages: Arabic, Portuguese, Czech, German, Spanish, Persian, French, Italian, Japanese, Korean, Russian, Thai, Turkish, Vietnamese, and Chinese.

Benefits:

- Broader market reach: Multi-language support expands accessibility for global traders and investors.

- Faster broker expansion: Brokers can pursue international growth without added engineering work or complex deployments.

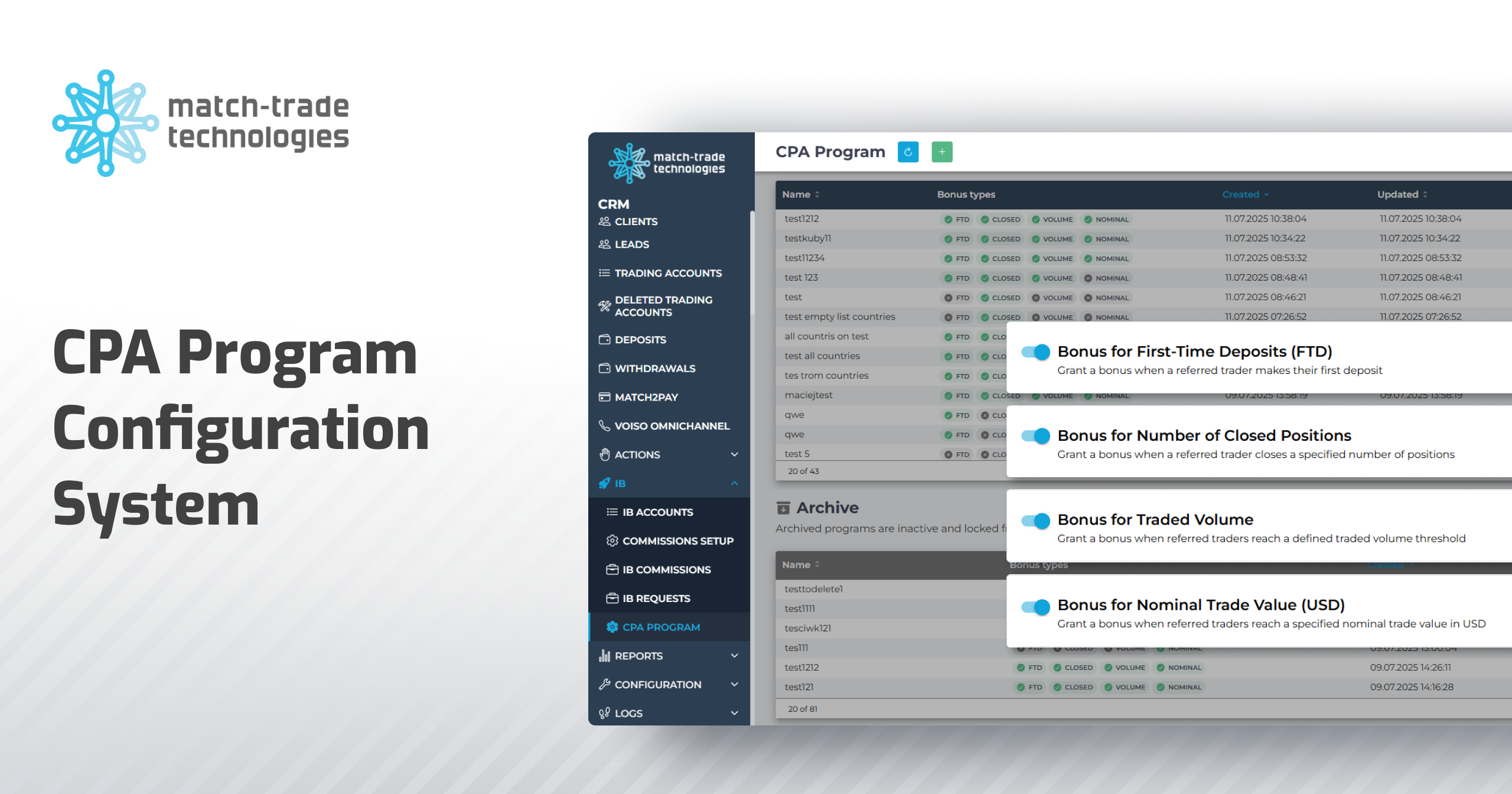

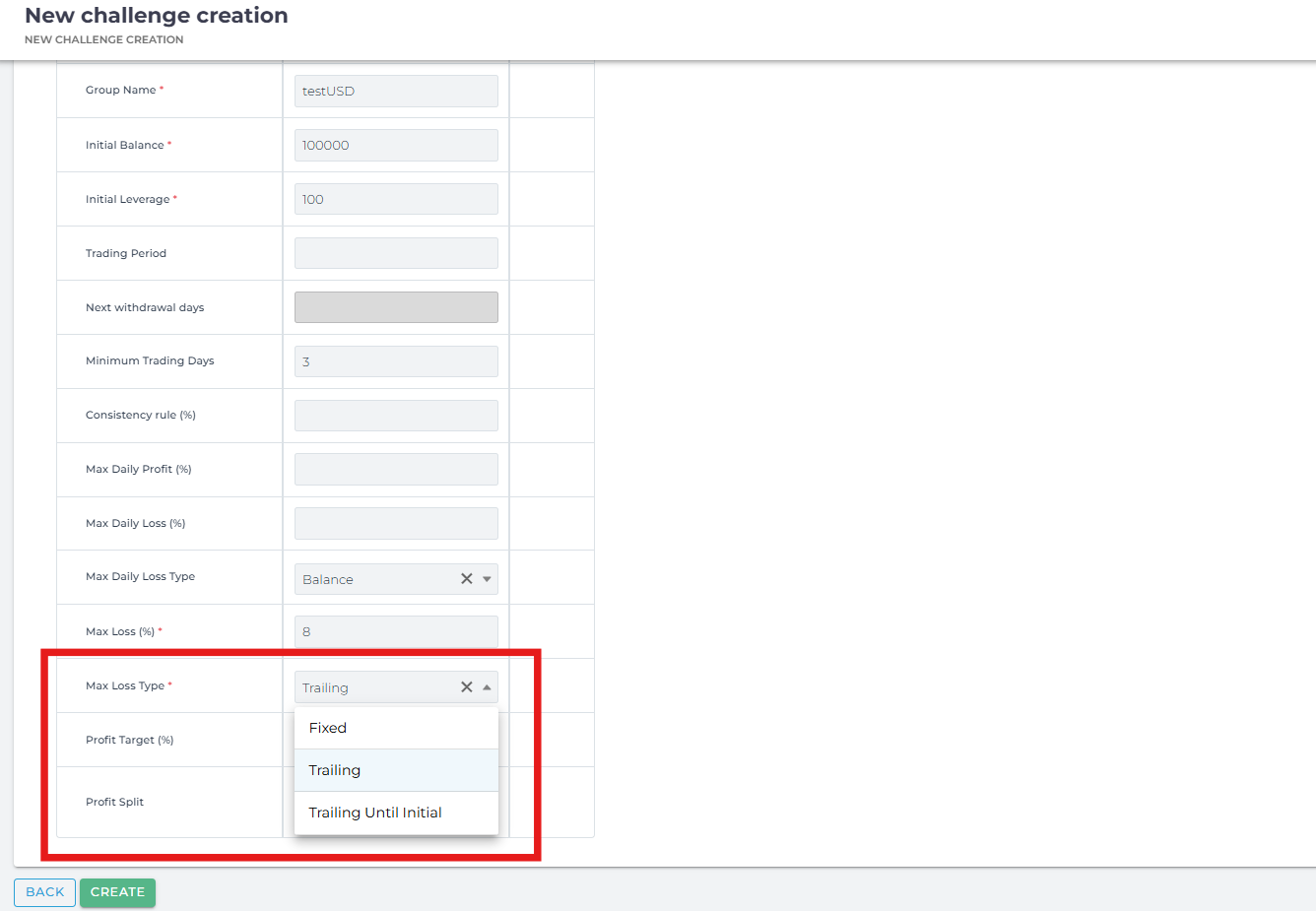

Max Trailing Drawdown for Prop Trading

The introduction of the Max Trailing Drawdown feature allows brokers to offer a dynamic risk management option for prop trading challenges. Instead of remaining fixed, the new capability enables the maximum allowable loss to adjust in real time based on the trader’s highest achieved equity. This performance-tied approach creates more compelling offerings for prop firms while keeping risk limits aligned with actual trading results. Max Trailing Drawdown also ensures that all calculations and resets are handled automatically during phase transitions and withdrawals, maintaining transparency and fairness for both traders and brokers.

Benefits:

- Competitive differentiation: Dynamic risk parameters enable prop firms to differentiate their challenge offerings with advanced risk management options.

- Higher engagement: Flexible, performance-based loss limits support trader psychology, improving engagement and challenge completion rates.

- Operational automation: Automated drawdown calculations and resets reduce manual intervention requirements for brokers.

Consistency Rule for Profit Targets and Withdrawals

The Consistency Rule has been implemented across both demo and funded phases of prop trading challenges, introducing a new standard for evaluating trader performance and managing withdrawals. In the demo phase, the system recalculates profit targets based on a configurable consistency threshold, ensuring that only traders with stable results can progress. In the funded phase, withdrawals are automatically blocked if a trader’s daily profits are not consistent with overall performance, and the ability to withdraw is restored only when the consistency rule is met. Brokers set the consistency rule percentage for each challenge phase directly through the CRM, and all updates are instantly reflected in both the CRM and trading dashboards. This unified approach provides transparent, real-time oversight and enforces more rigorous challenge integrity conditions for every participant.

Benefits:

- Risk control: Brokers gain precise control over challenge progression and payout eligibility, reducing the risk of one-off high-profit trades distorting results.

- Performance clarity: Real-time feedback on consistency status ensures fair evaluation and clear withdrawal eligibility for all traders.

- Operational efficiency: Automated recalculation and enforcement of rules streamline operations and minimize manual intervention for brokers and prop firms.

- Flexible standards: Configurable consistency rules enhance the platform’s competitiveness by enabling tailored challenge requirements and transparent risk management.

Promo Code and Add-On Management for Existing Accounts

Brokers can now assign or remove promo codes and add-ons for trading accounts that have been created but not yet paid for. This configuration flexibility enables targeted incentive deployment and feature adjustment prior to payment completion, with immediate synchronization across CRM and statistical dashboards. The update also ensures that affiliate and referral commissions are calculated accurately, supporting marketing and partnership strategies.

Benefits:

- Conversion optimization: Brokers can tailor offers and incentives for traders before payment, increasing conversion rates.

- Campaign agility: Dynamic marketing campaigns and affiliate programs are supported with accurate commission tracking.

- Operational flexibility: Account features can be adjusted in response to trader needs.

Prop Withdrawals via CRM Bank Transfer Gateway

Withdrawals from funded prop accounts can now be processed through the CRM using the Bank Transfer gateway, in addition to the existing manual method. The system automatically calculates profit splits and updates account balances, providing a seamless experience for both brokers and traders. This enhancement expands payout options while lowering administrative workload.

Benefits:

- More payout options: Additional withdrawal methods increase broker flexibility.

- Reduced errors: Automated profit split calculation cuts manual effort and mistakes.

- Elevated trader experience: Faster, more convenient payout options compound trader trust and satisfaction.

Equity Value Recorded Before Financial Operations

The ledger system now captures the equity value immediately before every financial operation – deposits, withdrawals, and credit adjustments. This creates complete audit trails that support ROI analysis, performance attribution, and regulatory compliance workflows.

Benefits:

- Analytical accuracy: Precise historical equity data improves performance attribution for brokers and analysts.

- Regulatory readiness: Accuracy in ROI calculations and financial audits is improved.

- Enhanced compliance: Transparent visibility into all account types and changes builds credibility.

Balance Push After Leverage Change on Trading Account

A new mechanism has been introduced to automatically send a balance update after leverage changes on trading accounts. This ensures that margin calculations and account balances remain accurate and up-to-date following any leverage adjustments. The automation prevents discrepancies and maintains information reliability across trader and broker touchpoints.

Benefits:

- Trust maintenance: Real-time balance accuracy reduces confusion and related ticket volume.

- Account clarity: Immediate updates improve transparency and trust in account data.

- Lower risk: Accurate margin data mitigates risk of margin-related issues and disputes.

Additional Validation to GTD Orders

Additional validation has been implemented for GTD (Good-Till-Date) orders, ensuring that orders can’t be placed more than 100 days in advance or less than 10 seconds ahead. This reduces accidental or erroneous submissions, lowers operational risk, and aligns with industry best practices.

Benefits:

- Mistake prevention: Validation rules eliminate error vectors before order submissions.

- Reliable experience: Fewer invalid orders make the platform more professional and reliable.

- Regulatory foundation: Compliance with industry standards supports regulatory expectations.

MIFID Request Management Module

A dedicated MIFID tab within the Actions group lets brokers manage centralized regulatory requests from traders directly within the CRM. The module allows for manual acceptance or rejection, detailed request reviews, and role-based access controls.

Benefits:

- Regulatory efficiency: All regulatory requirements can be managed without leaving the CRM, reducing context-switching.

- Operational flexibility: Auto-accept configuration suits high-volume brokers with automated onboarding workflows.

Virtual Scroll for Money Manager Leaderboard

To support growing communities, the Money Manager list within the Match-Trader UI now employs virtual scrolling technology. It significantly improves responsiveness by only rendering the elements currently visible on the screen. This ensures a lag-free experience, even when browsing through thousands of entries in the list.

Benefits:

- High-performance experience: Interface remains lag-free during scrolling, searching, and sorting.

- Business scaling: Brokers can host an unlimited number of Money Managers without degrading UI performance.

- Deeper engagement: Smooth, efficient navigation encourages deeper exploration of the leaderboard.