Starting an FX broker and choosing the appropriate White Label Forex Trading Platform may initially seem overwhelming. There are many technology providers on the market and many aspects to consider. That’s why we created a guide on how to choose the best WL Forex trading platform for your business. Firstly, however, we should learn what a White Label is.

What is the White Label solution?

Everybody knows what a trading platform is; therefore, explaining it would be redundant. Not everyone knows what a White Label Trading Platform is, though.

A White Label platform grants the company the possibility to start and run a brokerage under its name. Using technology from a Forex provider comes with vast branding possibilities. In short, when starting a forex broker, the company can present itself as a sovereign entity. In Forex, such a solution is called White Label Forex Trading Platform.

What components does such an agreement comprise?

We created a list based on what we offer our clients in a Standard package. It may differ from other providers’ offers.

- A branded mobile, web, and desktop trading app,

- LP connection via our Bridge with RMS,

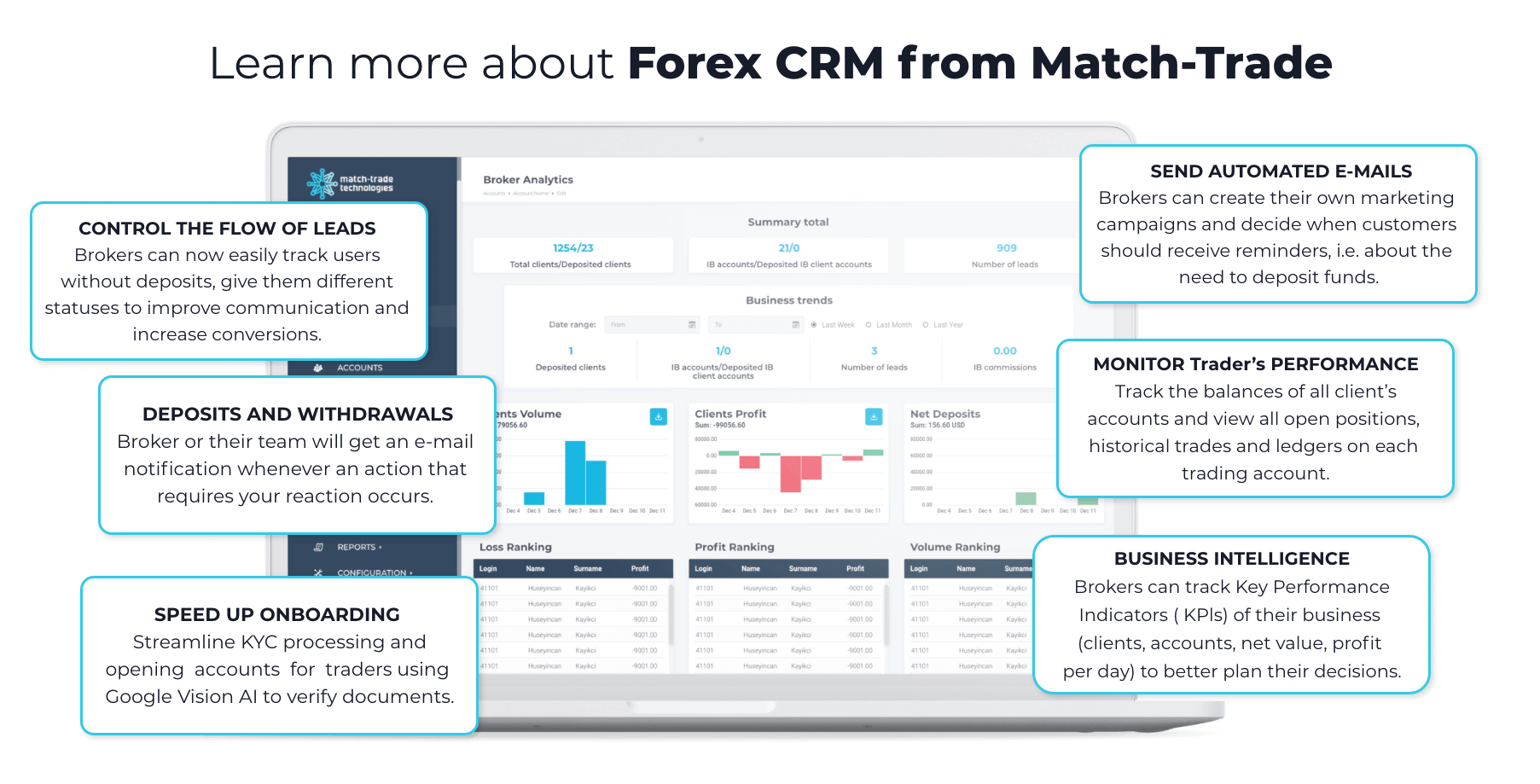

- Client Office with Forex CRM, Match2Pay crypto payment gateway, MAM, PAMM, and other solutions,

- technical and business support 24/7,

- 0$ turnover fee on B-Book,

- bonus system

- and many others.

You can find more information by clicking on the following link: Match-Trader White Label – Complete Trading Solution.

What is the best White Label Forex Trading Platform for startup brokers?

Consider your needs if you intend to launch a brokerage and are currently trying to decide which White Label Forex trading platform is best.

It is recommended that startup brokers choose the support of a technology provider. In short, the best WL trading platform would be the one acquired from a provider with a set of supporting apps and services needed to start a brokerage. Novice brokers usually have little to no experience; therefore, assistance from a professional partner will be of the essence.

At Match-Trade, we suggest novice or wannabe brokers choose a one-stop shop Technology Provider that will meet all their needs by providing a White Label trading platform, 24/7 support, as well as all necessary tools and services.

Choose the right white label trading platform in 5 easy steps

Consider your capabilities first

Before you take any other step, consider your possibilities, strengths, and weaknesses. Your professional background, forex industry experience and knowledge, your budget, and other resources you possess. All of these factors will hugely influence your entire FX business. The good news is that they will also help you choose the right White Label Forex Trading Platform.

Research your target audience

Choose a platform catered to the needs of today’s traders. How to do that? You must delve deep into the audience you will target as a forex broker.

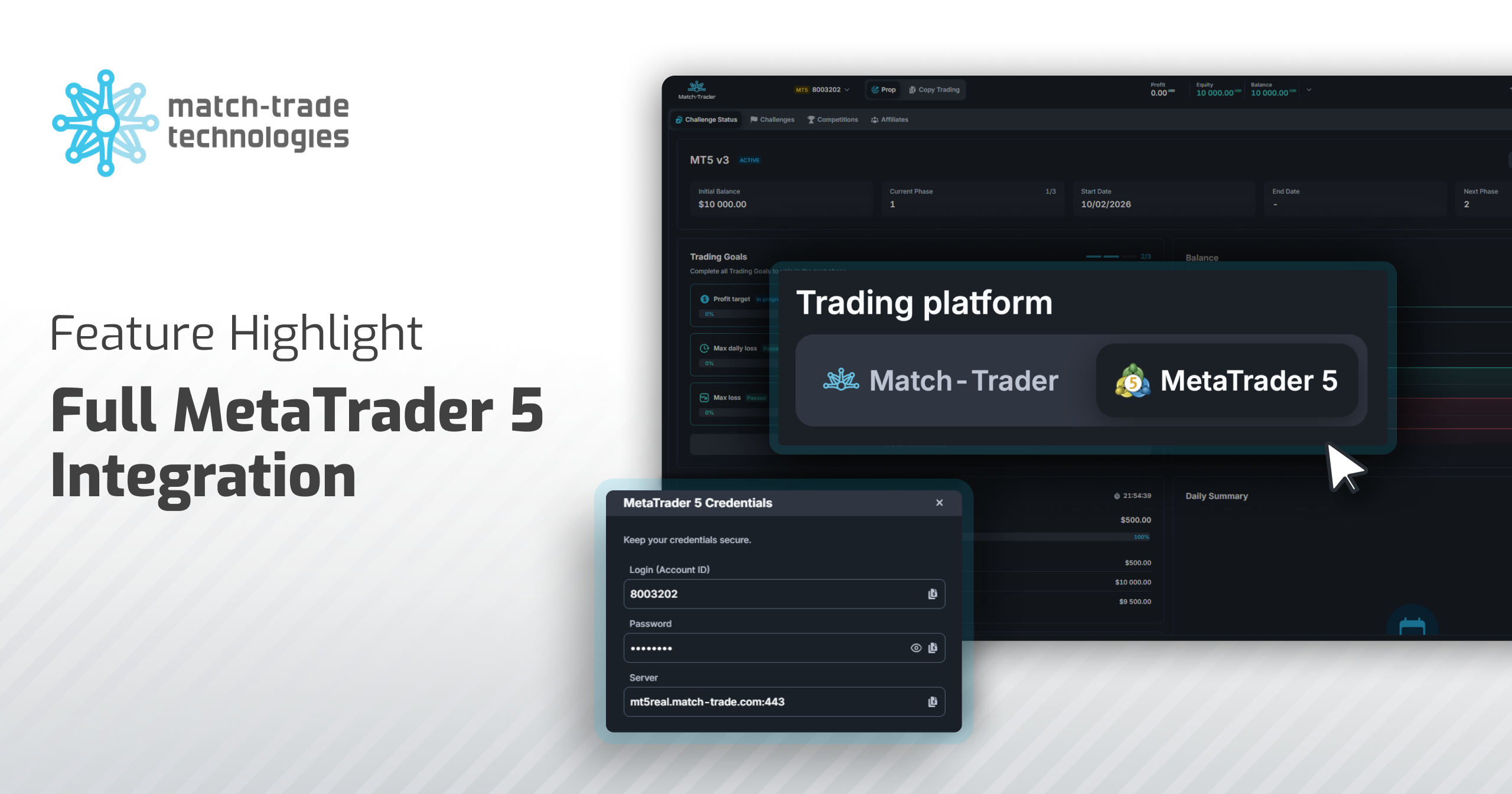

If you want to offer automated trading applications: for example, trading robots (Expert Advisor bots) and indicators, it would be recommended to consider MT5 or Match-Trader platform. However, it’s worth noting that recently, the MetaTrader platform became virtually unavailable for startup brokers. Formerly believed to be a staple trading platform, today MetaTrader is hard to acquire for new brokerages, as the requirements have changed drastically.

If, on the other hand, your audience values the modern design, Social & Copy Trading possibilities, and working simultaneously on mobile & web apps, you should choose newer platforms, like cTrader, Utip, and Match-Trader. These platforms offer a user-friendly and mobile-first approach.

A thorough look into the targeted group will allow you to choose the platform that will meet the specific needs of your future clients.

Research the market offer

There are many different forex technology providers existing on the market. The point is to do thorough research before deciding on any of them. Things to look out for include:

- If the technology provider offers a payments processor embedded, different Copy/Social Trading solutions, etc.,

- If there are Branding options included,

- If the provider has a ready-made package of solutions and services needed for Startup Brokers,

- What is White Label Forex broker cost (MT4 white label cost, MT5 white label cost, etc.)

- If the company provides 24/7 technical support for the novice broker,

- If there is an LP connection available free of charge.

Choose the White Label Forex Trading Platform with the necessary built-in apps

White Label Forex Trading Platform – what other tools do you need when starting? There are apps that your clients are going to look for when choosing a trading platform. They are an essential part of any brokerage business. We compiled a list of them that you can find below:

- Client Office (known as Trader’s Room),

- Payment gateway,

- Copy/Social Trading,

- Advanced charts.

These are catered to the traders’ needs, and therefore, it is crucial that you choose a platform with these tools embedded.

Apps necessary for Brokers

There is also a set of tools for brokers that you need to consider while starting a white label business. It includes:

- A Forex CRM,

- An IB portal,

- A bridge connecting the broker with a Liquidity Provider,

- PAMM/MAM application,

- Reporting tools,

- And many others.

Some tools may seem non-obligatory to acquire at first.

What are they? Some examples include in-app notifications, an Economic Calendar, and a News feed. Some might argue that these are not necessary at first, but any experienced broker will tell you that they make trading far easier. That results in an increase in traders’ engagement, which is your primary goal.

The cost of White Label Forex Trading Platform

The MT4 white label cost significantly differs from the MT5 white label cost. The same is true for other platforms on the market, such as the one created by Match-Trade Technologies – Match-Trader. After analysing your future clients’ needs and what is available on the market, you must consider the cost and your financial possibilities. A few questions will help you effectively analyse the white label forex broker cost. They are as follows:

- What fits your budget?

Starting a forex broker from start to finish is not as pricey as it may seem. Some solutions require only a few thousand dollars (including creating a brand, brokerage website, etc.). When choosing a White Label forex trading platform, you should consider which one fits your budget the best.

- Should you buy a complete package of tools from one provider or different solutions from different providers to save money?

Depending on your plans and chosen provider, it may seem cost-effective to work with different providers. For startup brokers, however, selecting a package deal from one company is recommended. Why? If you choose the right provider, you can actually cut costs that way. Moreover, working with a few different providers may result in a lack of accountability. For example, in case of any issues, there will be no easy way to tell which one is responsible for the current situation.

If you want to learn more about the costs startup brokers may expect while creating a forex broker, read our article “What are the costs you should expect when starting your forex business?”.

As you can see, choosing a White Label Forex Trading Platform may take a while. If you need help in making a decision, contact us. We offer WL options with our platform Match-Trader and the MT4/MT5 platform from MetaQuotes.