Are Robin Hood‐inspired trading apps a threat to the CFD Brokers? Michael Nichols, our chief of sales, has analysed traders’ behaviour and expectations based on the way they navigate in the digital world. During his presentation at the iFX Expo Dubai, he shares the must-dos to prevent the outflow of traders from the Forex Broker. So, how to adopt a new GenZ-driven trend in an FX Broker to retain more traders?

Watch Michael’s presentation or read the transcript below.

Gen Z forex traders – who are they?

Let’s start with who is this Gen Z, and why, at this point, should we even consider their needs and behaviours while planning business strategy. People labelled as Gen Z are born within an elusive date range, some saying it starts after 2001, others said after 1995. They are defined as the Digital Natives. They are the first generation born into a world where the immersive experience, the Internet of Things, bitcoin economics, and Instagram are as natural as the rising sun. They have never known the joys of dial-up modems, landlines, or Polaroid; they don’t get the saying ‘hang up’ when asked to finish the call. They live and breathe the Internet.

Why should forex business even consider their needs?

Gen Z’ers are now in their early to mid-twenties. They’ve just begun their adult life, starting a professional career and making money. According to the different researches (our data from the Altitude consulting firm), Gen Z accounts for 40% of consumers and will only grow from there. This generation will be the leading consumers of technology for many years to come. So failing at attracting this group would mean losing nearly half of clients in the near future and being completely left behind.

How do they approach online investing

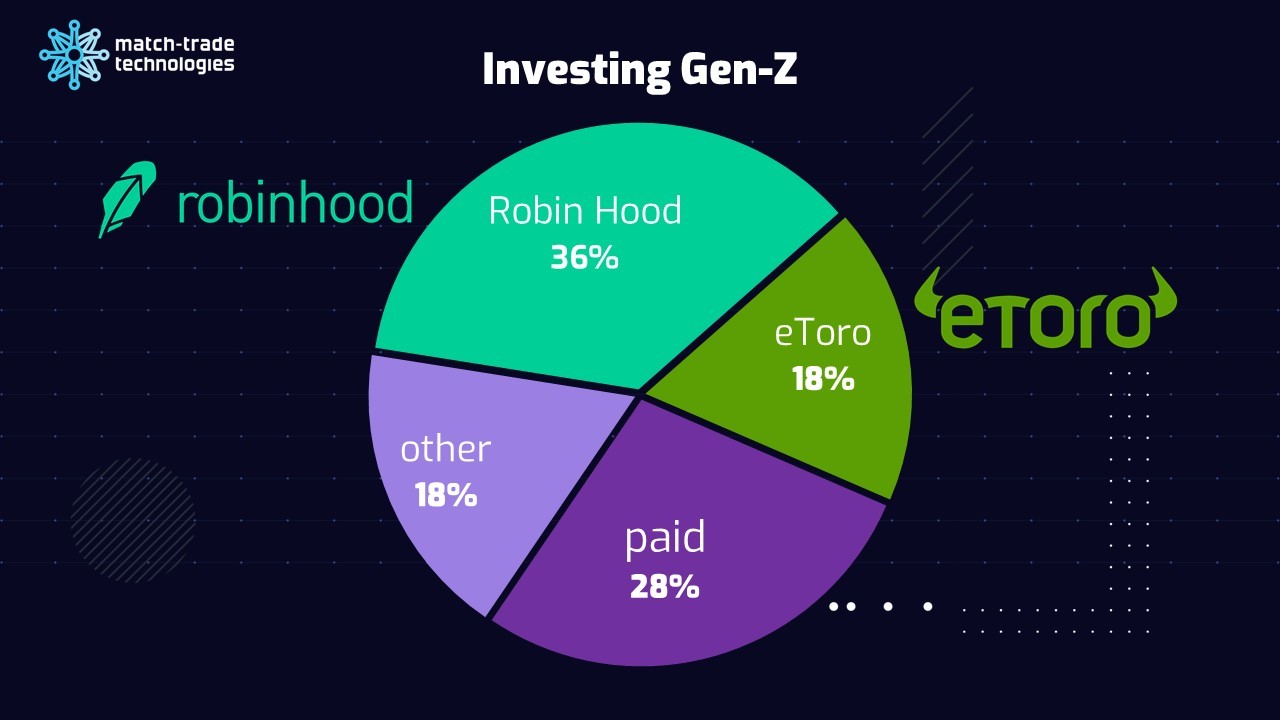

Studies show that 36% of Gen Z’ers currently have investments in stocks, mutual funds, or cryptocurrencies. Their investment platforms of choice are RobinHood – 32% and eToro – 18%.

This can be, of course, explained by their obvious preference to use platforms that do not charge account fees or trade commissions (39% responses) though the same survey shows that slightly more than a quarter (28%) use one that does. So if the abolition of fees is not all it takes to attract Gen Z investors, then what’s more to that?

Just 8 seconds to keep traders on your trading platform

The information needs to be digestible in 8 seconds or less. According to a Forbes report, the attention span for Gen Z is 8 seconds, compared to 12 seconds for millennials. In addition, they juggle between a minimum of 5 screens at a time.

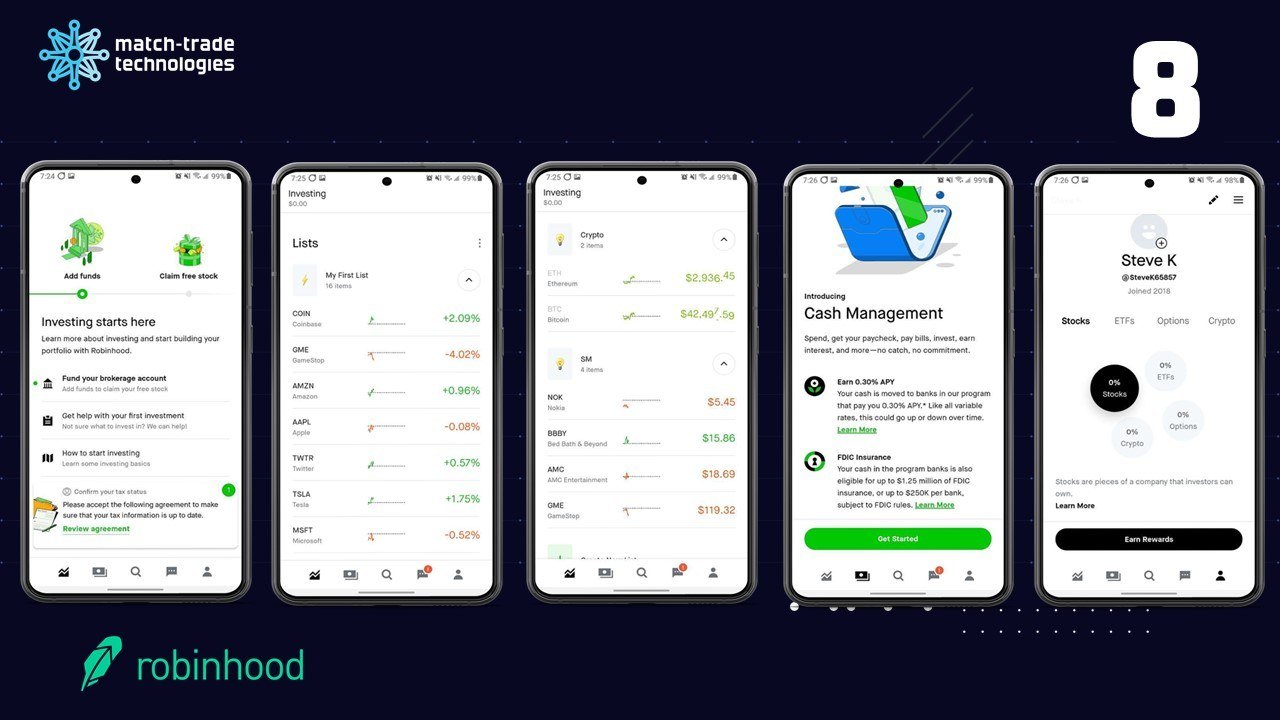

Robin Hood and eToro are proper apps with a mobile-first focus. Apps that Gen Z’ers are used to operate as they do daily. They’re always by hand, easily accessible, simple and intuitive, requiring minimal engagement. So how do they choose their platform?

How to attract more traders with your trading app?

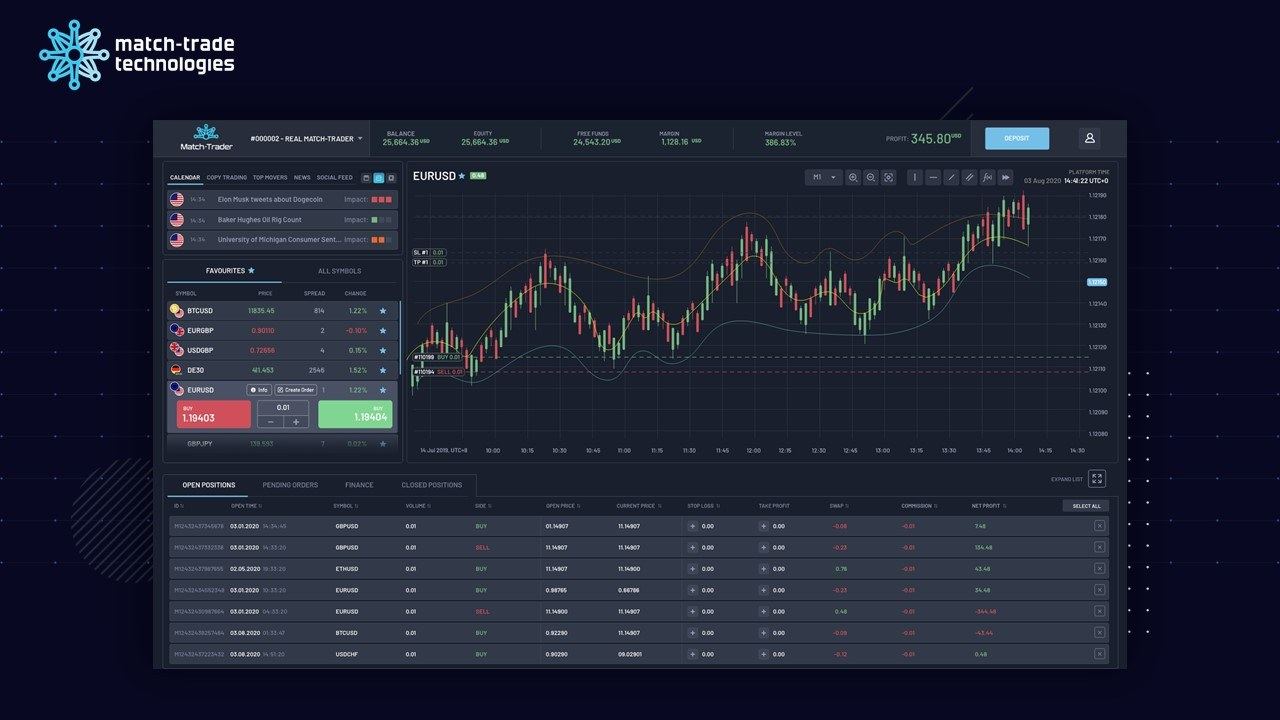

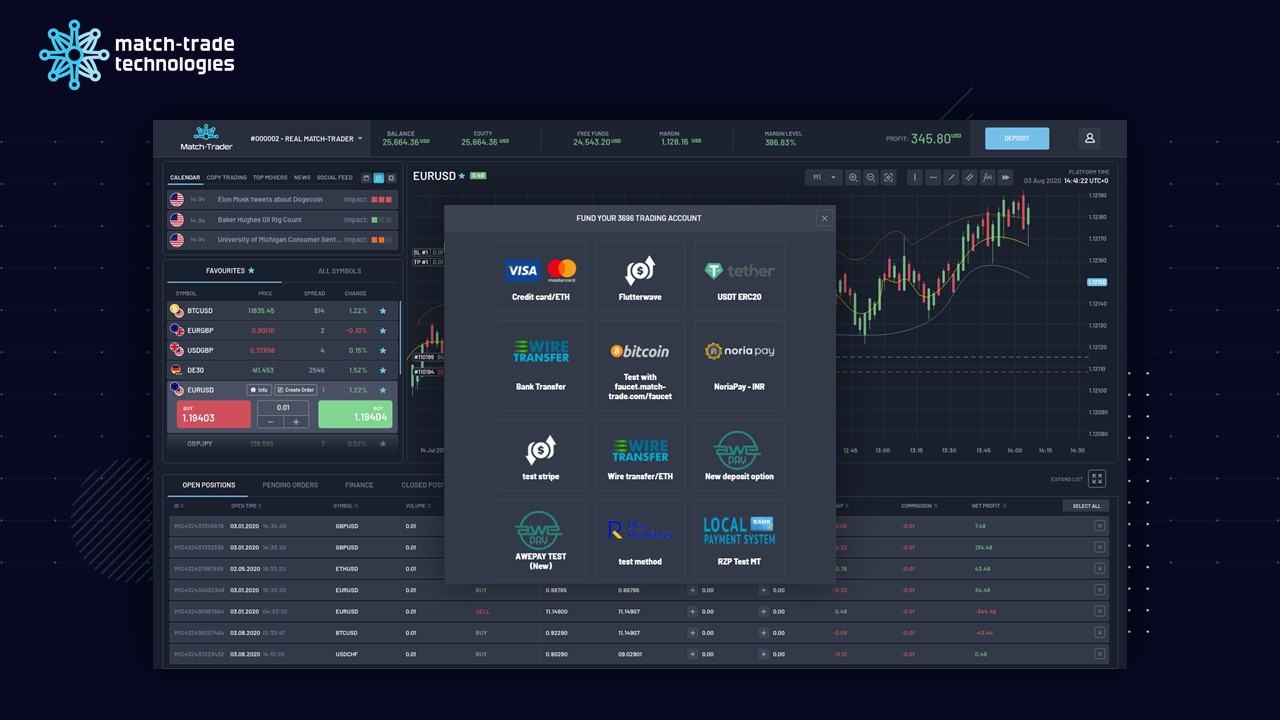

Showing you those most popular apps, I can now, with full confidence, move to Match-Trader, the platform that can provide the same level of attractiveness as RH or eToro to forex brokers and help them attract this growing number of new traders entering the market. As you can see, it’s not a bulk app, and the icon will obviously show the broker’s brand and name.

First of all, the platform needs to be eye-pleasing. This may sound shallow and irrelevant considering forex trading but remember that Gen Z’ers used glossy touch screens from day one, watching fairy tales on YouTube. They’re raised on highly visual, colourful, and short-form content. Aesthetics matter a lot as Gen Z considers it an indication of good taste, and the looks of the trading platform represent Broker’s brand.

The information on the platform is well-organised, which makes it very intuitive and easy to operate.

Gen Z’ers value efficiency and convenience. They already have a wide array of options to choose from, and according to a study by American Express, 23% of Gen Z’ers will drop a brand if its mobile features are poorly designed.

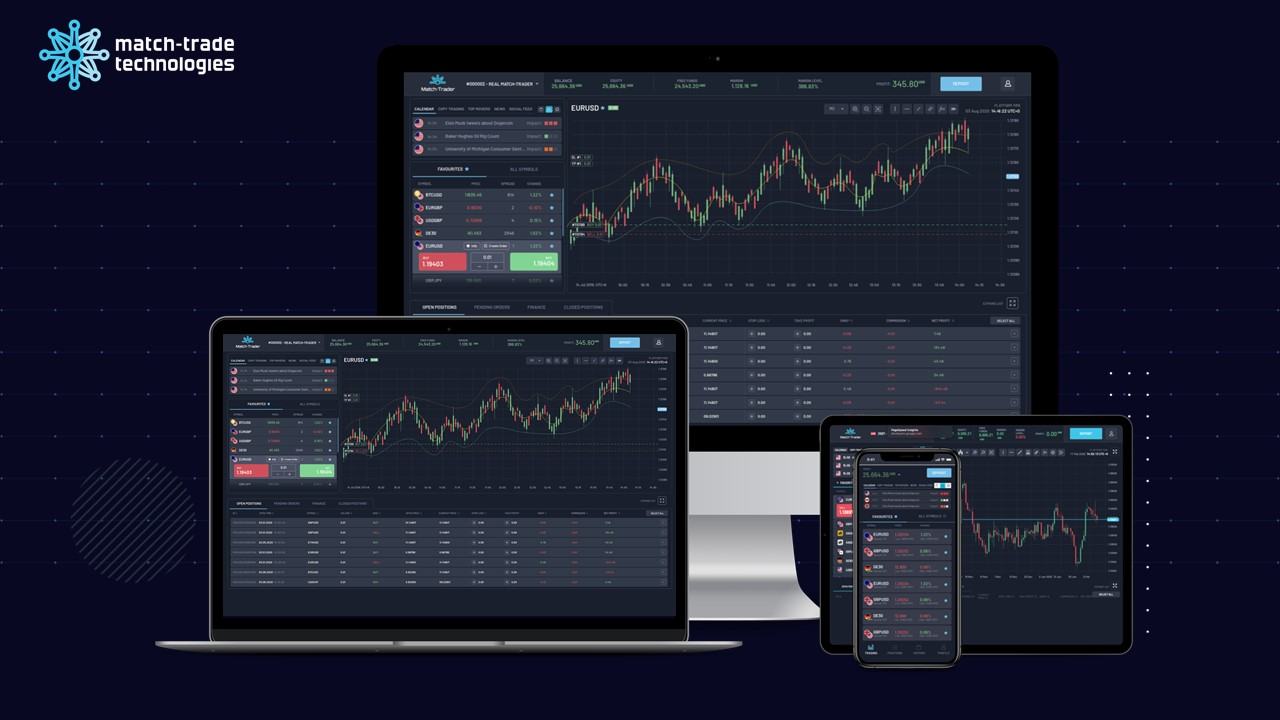

Due to their diverse array of device choices, Gen Z’ers expect tech to work on-demand across multiple platforms. Match-Trader’s UI design offers a seamless experience and responsiveness across multiple platforms. Thanks to the Progressive Web App technology we used to design the platform, the app adapts its interface and features to the device, so all user’s settings are synchronised across web, mobile and desktop in real-time. It can be launched from an icon on the device’s home screen and doesn’t take up storage space therefore, it offers high performance even on old-generation devices.

Increase your clients’ retention by optimising flow on your platform

When developing Match-Trader, the aim was to create a better overall experience for customers, not only platform UX for when they execute trades. Gen Z consumers expect a holistic experience package which is also the key to increasing retention. They’re used to instant gratification. Today you enter a search term on Google, you get 2 million in 0.3 seconds reply. Thanks to on-demand platforms like Netflix, you watch whatever, whenever and wherever you want.

That’s why we have embedded on the platform the client office features and our proprietary crypto payment solution that enables instant deposits without ever leaving the platform. Traders can truly start opening trades within no time from opening the account. (Possible because of the Back Office/Brokers CRM that is included in the platform package). So convenience is pretty much key to developing a lasting impression on your target audience and making them loyal to your brand.

Mobile trading platform – a key to Broker’s success

On average, only around 43% of customers use desktop apps compared to 57% choosing a mobile channel. Robinhood itself nearly doubled the number of users, reaching 22,5 mln in 2021 (compared to 13 mln in 2020).

The number of Match-Trader mobile users nearly doubled compared to 2020, reaching over 40k users, which make up around 60% of overall platform users.

So are mobile trading apps like RH or eToro a threat to the CFD Brokers?

The answer, unfortunately, has to be – yes. There’s a new generation of traders coming, and they are shifting towards modern and less requiring apps, so the legacy platforms will soon start to become a thing of the past. Even EA bots won’t stop it as copy trading solutions are taking their place. Tho there are solutions like the Match-Trader platform that can, and I believe, will also modernise the CFD trading industry to keep up with the trends.